Energy Storage

Brian Cashion

Energy Storage

Accure Battery Intelligence

Energy Storage

Jim Brown

Governor Kathy Hochul announced $11.6 million in funding to support clean energy industry workforce development initiatives in New York State. The funding, which was approved by the New York Power Authority Board of Trustees, stems from a NYPA commitment in the 2023-24 Enacted State Budget and will largely support the efforts of the state Office of Just Energy Transition (OJET), which was established within the New York State Department of Labor last year to connect workers to opportunities for jobs in the clean energy economy through up-skilling and training with a focus on serving those who are traditionally underrepresented, especially within disadvantaged communities.

“As we develop a clean energy economy in New York State, we're ensuring that we have a workforce ready and able to fill the needed jobs of tomorrow,” Governor Hochul said. “This funding will support critical programs for New Yorkers looking to develop skills in the emerging energy sector so that everyone can participate in our green energy future.”

Four new workforce training programs will be launched with this initial funding: two administered through NYSDOL and two administered by NYPA. The programs will incorporate wraparound services that include assistance with transportation, childcare, stable housing, food and other support. Wraparound services are essential to overcome obstacles that make it difficult for participants to attend and successfully complete such programs.

NYPA and NYSDOL will collaborate on programs related to workforce training, retraining and apprenticeships related to preparing workers for employment and work in the renewable energy field, as well as programs to train or retrain utility workers.

In this first tranche of spending, NYPA will provide NYSDOL with $5 million to expand or create clean energy training programs and pre-apprenticeship opportunities and provide wraparound services for individuals participating in them. Projects supported must provide training or pre-apprenticeship programs in building electrification, renewable energy, electric vehicle charging, or energy intensive industries. To learn more, visit the OJET webpage.

NYSDOL also will receive $4 million to create opportunities for local workforce development boards to support transitioning and residential workers. The funds will support transitioning workers in either up-skilling or re-skilling for the renewable energy field from fossil fuel jobs, as well as provide residential worker support in the areas of weatherization and building performance. The funds will include wrap around services that will aid with childcare, transportation, housing stability, food, mental health services, substance use treatment and life-skills training.

In addition, the Power Authority, as part of its workforce development priorities, has plans to invest $2.6 million to launch two workforce development initiatives.

With the first initiative, NYPA will collaborate with training providers to develop technical training opportunities, hands-on experience, paid internships and full-time jobs for people entering the workforce and advance training opportunities for those traditional utility workers to ensure that both new and current employees have the requisite skills and qualifications to participate in New York’s clean energy field. The first phase of the initiative, which will cost $2 million, will be regionally focused, providing employment training and employment opportunities for residents in disadvantaged communities located in the vicinity of NYPA power projects. NYPA will issue an RFP to seek potential partnership opportunities with interested parties.

The second NYPA workforce development initiative will be in collaboration with the Say Yes Buffalo. NYPA will be providing $600,000 to the firm’s Youth Apprenticeship Program, which will place recent public high school graduates in one-to-three-year structured work-based learning apprenticeships at committed industry partners in high demand sectors. It combines paid on-the-job learning, professional mentorship and aligned educational training and credentialing to ensure historically underserved youth have equitable access to and retention in secure, mid-wage, mid-skill jobs with room to grow. The expectation is that this program will grow to serve as many as 200 high school students as it matures.

Each of the initiatives advance the Power Authority’s and New York State’s goals of supporting workforce training and retraining to prepare workers for employment in renewable energy fields, and provide benefits to residents of disadvantaged communities, including communities in the vicinity of the Power Authority’s power projects. NYPA has extensive experience providing training to workers in energy-related fields and working with organized labor to help implement training programs for current and future employees.

NYSDOL oversees hundreds of millions of dollars annually and has extensive experience connecting hundreds of thousands of people annually to job training, supportive services, job search and career development services and ultimately to employment.

In addition to its new workforce training commitments, the 2023-24 Enacted State Budget provided NYPA with enhanced authority to plan, design, develop, finance, construct, own, operate, maintain and improve renewable energy generation and storage projects—either alone or in collaboration with other entities—to help support the state's renewable energy goals in the Climate Leadership and Community Protection Act, maintain an adequate and reliable supply of electric power and energy in the state, and support the new REACH program, which will enable low-income and moderate-income electricity customers to receive bill credits through the production of renewable energy by NYPA. NYPA will publish its first biennial strategic plan for renewable energy development in January 2025.

New York Power Authority | www.nypa.gov

The Department of the Treasury has released final guidance implementing the 30D New Clean Vehicle Tax Credit. Concurrently, the Department of Energy released its final interpretation of the term “Foreign Entity of Concern,” or FEOC, which establishes the framework for automakers to reorient their supply chains away from adversarial nations—one of the key eligibility requirements tied to the 30D credit. Taken together, these actions seek to balance the U.S. goals of deploying electric vehicles (EVs) while developing a robust, domestic supply chain disentangled from FEOCs.

Fast Facts on the 30D Tax Credit

Critical Minerals Requirement

A new clean vehicle is eligible for a $3,750 credit if a certain percentage, by value, of the critical minerals in its battery has been a) extracted or processed in the United States or a country with which the U.S. has a Free Trade Agreement (FTA), or b) recycled in North America. The percentage requirement began in 2023 and has become increasingly stringent over time. Automaker compliance with the critical minerals requirement can be determined in one of two ways:

Battery Component Requirement

A new clean vehicle is eligible for a $3,750 credit if a certain percentage, by value, of the battery components are manufactured or assembled in North America, with increased stringency over time. The percentage is calculated as the proportion of incremental value of battery components that were either manufactured or assembled in North America. Incremental value refers to the value of a component subtracted by the value of any of its subcomponents, if any, and is roughly equivalent to a measure of value added by each component.

“Foreign Entity of Concern” Requirement

New clean vehicles are disqualified from any portion of the 30D credit if they contain a) battery components manufactured by a FEOC, beginning in 2024, or b) critical minerals extracted, processed, or recycled by a FEOC, starting in 2025. These requirements apply to all battery components and critical minerals contained in the battery except those identified as “impracticable-to-trace ” due to their origination from multiple sources and commingling during the refining process. Identified materials include critical minerals contained in electrolyte salts, electrode binders, and electrolyte additives, as well as synthetic and natural graphite used in anode materials. The impracticable-to-trace exemption expires in 2027; in order to qualify for 30D in the interim, vehicle manufacturers must submit reports identifying steps taken to reach FEOC compliance after the exemption period ends.

“Foreign Entity of Concern” Definition

An entity is determined to be a FEOC if it meets the definition of a foreign entity and is either subject to the jurisdiction of the government of a covered nation (China, Iran, North Korea, and Russia) or is owned by, controlled by, or subject to the direction of a covered nation’s government.

A foreign entity is defined as either:

An entity is subject to the jurisdiction of a covered nation government if:

An entity is owned by, controlled by, or subject to the direction of a covered nation government if:

Conclusion

The 30D New Clean Vehicle Tax Credit is a key component of the U.S. industrial and decarbonization strategies. Together with the other pro-manufacturing tax credits in the Inflation Reduction Act, incentives are in place to deploy clean energy technologies while weakening foreign influence over their supply chains. While both goals are central to U.S. federal policy, incentives must be balanced to achieve both goals. Final rules like the ones covered in this post provide the regulatory certainty needed throughout the supply chain to help derisk private investment in domestic production.

Zero Emission Transportation Association | https://www.zeta2030.org/

In a landmark collaboration aimed at revolutionizing the construction industry's approach to off-grid electric equipment charging, Volvo Construction Equipment (Volvo CE) and Portable Electric are proud to introduce the PU130. This groundbreaking mobile charging unit, designed, engineered, and built by Portable Electric, enables rapid recharging of electrified construction equipment, which significantly reduces downtime and increases job site productivity.

With Portable Electric’s proprietary 48-Volt Direct Current Fast Charging (DCFC) technology integrated, the PU130 offers unparalleled advantages for construction sites by providing the ability to rapidly recharge equipment over a lunch break, which enables users to service a full workday and beyond. In addition to recharging electrified construction equipment at a 20 kW charge rate, the PU130 can simultaneously provide 40 kW of job site power to support tools, lighting, office trailers, and more. Moreover, the PU130 seamlessly hybridizes with other power generation systems for extended power, ensuring continuous operation with minimal environmental impact. As with all power and charging solutions from Portable Electric, the PU130 offers seamless connectivity with Neuron OS for remote monitoring. With real-time data, analytics, and GPS tracking, users can remotely monitor the PU130's performance, optimize charging schedules, and ensure maximum efficiency. This connectivity feature further enhances job site productivity and allows for proactive maintenance, maximizing uptime.

Volvo PU130 Quick Specs:

Ray Gallant, Vice President of Volvo Construction Equipment, expressed his enthusiasm for adding the PU130 to Volvo's product offerings, stating, "The PU130 represents a significant milestone in our journey towards sustainable construction practices. By partnering with Portable Electric, we are delivering cutting-edge solutions that exceed our customers' expectations."

Keith Marett, CEO of Portable Electric, echoed Gallant's sentiments, remarking, "We are incredibly proud to partner with Volvo Construction Equipment in bringing the PU130 to market. This first-of-its-kind unit is a testament to our team's dedication in helping reduce the use of carbon-intensive fuels at construction sites worldwide. By removing a key barrier of adoption, electrified equipment users can now reduce their downtime and increase their productivity through our rapid recharging technology.”

Experience the future of off-grid power solutions firsthand at the Volvo booth at ACT Expo 2929. Learn how the PU130 is reshaping the construction industry and discover the possibilities of sustainable, efficient charging solutions.

Volvo Construction Equipment | volvoce.com

Portable Electric | portable-electric.com

The Bechtel-built Cutlass Solar 2 project in Fort Bend, Texas, is complete and generating electricity at full capacity for the first time, sending enough clean, renewable energy to the grid to power 40,000 homes—a milestone that comes ahead of the 13-month delivery schedule.

The 218 Megawatt (MW) solar facility delivered for Sabanci Climate Technologies comprises almost half a million solar panels spanning 1,100 acres.

“We’re delighted to get Cutlass Solar 2 to maximum capacity to provide more renewable power for Texans, support America’s energy transition, and help achieve the Lone Star State's goal to become the nation’s largest producer of solar power,” said Scott Austin, Bechtel General Manager of Renewables & Clean Power. “Bechtel is proud to partner with Sabanci Climate Technologies in their pursuit to make clean, renewable energy more accessible to the people of Texas.”

“We partnered with Bechtel for our first solar venture because they are experts in delivering projects better and faster,” said Ismail Bilgin, President, Sabanci Climate Technologies. “Sending maximum power to Texas’ grid is a fantastic milestone in this successful project and reconfirms that we were right to choose Bechtel. We’re looking forward to continuing this success on our next project, Oriana, together.”

To meet the project’s ambitious schedule, Bechtel employed data-driven automation, survey robots, machine-controlled equipment, drones, and a mindset that ‘every minute matters.’ Bechtel’s first-of-a-kind digital execution hub used at Cutlass Solar 2 enabled 100% digital delivery through software integration. The hub gathers data directly from equipment in the field and feeds the data into an interactive map-based visualization. You can watch a video about Bechtel’s smart digital delivery at Cutlass projects here.

At peak construction, more than 300 people were employed on the site. Approximately 30% of our professional staff and 15% of the project’s craft professionals were women, representing two and a half times the industry average.

Bechtel leads renewables projects from the development stage through commissioning and handover. The company will soon begin constructing the Oriana Solar facility for Sabanci Climate Technologies in Victoria County, Texas. Oriana Solar is expected to produce enough clean energy to power more than 34,000 homes.

Bechtel | www.bechtel.com

Sabanci Climate Technologies | www.sabanci.com

Avangrid, Inc. (NYSE: AGR), a leading sustainable energy company and member of the Iberdrola Group, announced it acquired a state-of-the-art mobile transformer that can be quickly deployed and enables the company to resolve outages in the event of a damaged transformer in a couple months compared to the two year lead time for a replacement transformer.

“We are thrilled to have this first mobile transformer, which is an exciting new addition to Avangrid’s toolkit and will improve the resiliency and reliability of our wind and solar operations across the United States,” said Pedro Azagra, Avangrid CEO. “When we reduce downtime at our renewable energy assets, we ensure that clean energy keeps flowing to our customers. New, innovative pieces of equipment like this are key to delivering on Avangrid’s mission to accelerate the clean energy transition.”

Utility-scale transformers are an essential piece of the electric grid and manage the flow of energy from generating facilities to the consumer. When these machines fail, power generation must stop and replacing them can take 18 months or longer.

The new 168 megavolt-ampere (MVA) mobile transformer, custom-made for Avangrid and purchased from Hitachi Energy, can be deployed and installed within a couple months to any of Avangrid’s onshore wind and solar facilities due to the transformer’s multi-voltage capabilities. The transformer’s unique technology also allows for a low profile and the ability to withstand higher-than-normal transport accelerations - perfect for quick transport to its needed location. This will bring energy production back online while replacement equipment is procured.

“The clean energy transition relies heavily on partnerships and collaboration. Working with Avangrid to design this innovative and versatile transformer solution ensures clean, reliable energy when and where it’s needed most, even if a transformer is damaged after a major storm,” said Steve McKinney, Senior VP and Head of Hitachi Energy’s Transformer Business, North America. “As part of this collaboration with Avangrid, this unique engineering solution also incorporates the skills of our expert services team to support installation and commissioning for fast relief and restoration, which is especially critical in an industry facing longer than usual lead times for new equipment.”

Consisting of three modules, the transformer will be hauled on trailers with semi-trucks to the site. One of the most versatile transformers of its kind, it shows Avangrid’s dedication to reliability by covering the needs of any of their onshore renewable energy facilities throughout the U.S.

Avangrid | www.avangrid.com

Qcells, a pioneer in complete clean energy solutions and a leader in the U.S. solar market, announced EnFin by Qcells (EnFin), its residential solar financing platform, completed its first asset-backed securities (ABS) transaction totaling $252.86 million. The transaction comprises bonds backed by thousands of consumer loans used to finance residential solar installations. RBC Capital Markets acted as the sole structuring advisor and bookrunner, and Santander served as co-manager in the transaction.

“This deal signals confidence in the Qcells brand within the solar financing sector and in the broader capital markets,” said Alex Kaplan, EnFin’s President and CEO. “EnFin is the only financing platform in the market backed by a major manufacturer, and we benefit from Qcells’ trusted reputation for high-quality equipment and its significant investment to build a sustainable solar supply chain in the U.S. With our seamless point-of-sale technology, extensive installer relationships and scalable services, EnFin is ready to support homeowners across the country who want to go solar with reliable and attainable financing.”

In addition to the recent ABS transaction, EnFin has closed two revolving warehouse transactions totaling $500 million of committed capacity. The first warehouse was closed with RBC in April 2023 and the second with Santander in January 2024, each for $250 million.

EnFin, a wholly owned subsidiary of Qcells, began pilot lending operations in the latter half of 2022 and officially launched in January of 2023. Since launch, EnFin has accumulated approximately 18,000 consumer loan contracts with an aggregate principal balance of more than $800 million. Loans under the EnFin program are made through a partnership with Hatch Bank, whose national lending charter has enabled EnFin to be active in 46 states and the District of Columbia.

The platform offers a number of unique value propositions to its customers that leverage its connection with Qcells. For instance, qualified homeowners can benefit from a 30-year performance warranty option on select Qcells modules when financed with EnFin. Additionally, EnFin enables residential customers to create further value from their solar and battery storage installations by connecting them with other Qcells incentive programs through which they can participate in grid services offerings and monetize solar renewable energy credits (SRECs) produced by their systems.

Providing competitive financing for solar and battery storage systems is part of Qcells’ long-term strategy to become a one-stop shop and offer a full suite of clean energy solutions to the market. In pursuit of this goal, in January 2024 EnFin launched a third-party-ownership (TPO) financing offering which provides power purchase agreement (PPA) and lease options to homeowners who want to use solar energy without purchasing a solar or solar + battery storage system.

With the announcement of this transaction, EnFin is proving the sustainability of its business model through its diversified sources of financing and stable, high-quality loan originations.

“It’s exciting to see Qcells grow in the residential solar financing space,” said Justin Lee, CEO of Qcells. “This first ABS transaction truly reflects investor confidence and showcases EnFin as a unique value proposition. Ultimately, our success in this area will help to accelerate the clean energy transition by making rooftop solar and battery systems more accessible.”

EnFin | https://www.enfin.com/

Qcells | https://qcells.com/us/

With 5.7 million electric vehicles (EVs) anticipated to be used in fleet applications by 2025, EV Connect, a leading EV charging business platform and bp pulse, a global leader in charging infrastructure for fleets and public charging, announced a collaboration to bring key capabilities of Omega, bp pulse's EV charge management software to the EV Connect platform. Tailored to the diverse charging requirements and duty cycles of EV fleets, Omega delivers a comprehensive managed charging solution that integrates state-of-the-art charging management technology from EV Connect and bp pulse into a new, comprehensive fleet offering.

With bp pulse and EV Connect’s Omega integration, fleet operators can focus on their core business while Omega orchestrates charging schedules, prioritizes charging based on fleet needs, and enables real-time insights for informed decision-making, whether charging at depots, on the go, or at driver homes. The collaboration between bp pulse and EV Connect gives fleet operators greater control over charging infrastructure while reducing costs associated with energy consumption and providing detailed historical data for further optimization.

"At bp pulse, we remain steadfast in our mission to simplify electrification for diverse fleets, and collaborating with EV Connect on this endeavor marks an exciting milestone, expanding our scope to deliver turnkey solutions for fleet operators industry-wide," said Sujay Sharma, CEO of bp pulse Americas. “Our shared goal is to provide fleet customers with a comprehensive solution that addresses all aspects of their charging needs—no matter the location. This collaboration allows us to combine our unique offerings into one cohesive platform."

Omega orchestrates EV charging to optimize cost-effective charging for fleets, while the EV Connect platform focuses on managing financial transactions, particularly in commercial fleet settings. This includes fleet operations in which drivers bring vehicles home, requiring private chargers with simple reimbursement options. By combining the capabilities of Omega and the EV Connect platform, fleet operators, including those in government, municipal, logistics, services, and sales sectors, can expect improved efficiency and optimization of their charging stations while empowering fleet managers with precise control over when and how their vehicles are charged, optimizing for factors like energy cost, power constraints, vehicle readiness, and operational efficiency.

"This collaboration between EV Connect and bp pulse brings unparalleled expertise in the electric vehicle charging industry, opening doors to elevate our fleet management capabilities and deliver cutting-edge solutions that set new standards for both of our customers," said Jon Leicester, Vice President and Head of Commercial at EV Connect. "By integrating our platforms, we can offer a comprehensive management solution that caters to fleet operators looking to optimize electric fleet efficiency like never before."

EV Connect | www.evconnect.com

bp pulse | bppulsefleet.com

Alternative Energies Jun 26, 2023

Unleashing trillions of dollars for a resilient energy future is within our grasp — if we can successfully navigate investment risk and project uncertainties. The money is there — so where are the projects? A cleaner and more secure energy ....

The Kincardine floating wind farm, located off the east coast of Scotland, was a landmark development: the first commercial-scale project of its kind in the UK sector. Therefore, it has been closely watched by the industry throughout its installation. With two of the turbines now having gone through heavy maintenance, it has also provided valuable lessons into the O&M processes of floating wind projects.

In late May, the second floating wind turbine from the five-turbine development arrived in the port of Massvlakte, Rotterdam, for maintenance. An Anchor Handling Tug Supply (AHTS)

vessel was used to deliver the KIN-02 turbine two weeks after a Platform Supply Vessel (PSV) and AHTS had worked to disconnect the turbine from the wind farm site. The towing vessel became the third vessel used in the operation.

This is not the first turbine disconnected from the site and towed for maintenance. In the summer of 2022, KIN-03 became the world’s first-ever floating wind turbine that required heavy maintenance (i.e. being disconnected and towed for repair). It was also towed from Scotland to Massvlakte.

Each of these operations has provided valuable lessons for the ever-watchful industry in how to navigate the complexities of heavy maintenance in floating wind as the market segment grows.

The heavy maintenance process

When one of Kincardine’s five floating 9.5 MW turbines (KIN-03) suffered a technical failure in May 2022, a major technical component needed to be replaced. The heavy maintenance strategy selected by the developer and the offshore contractors consisted in disconnecting and towing the turbine and its floater to Rotterdam for maintenance, followed by a return tow and re-connection. All of the infrastructure, such as crane and tower access, remained at the quay following the construction phase. (Note, the following analysis only covers KIN-03, as details of the second turbine operation are not yet available).

Comparing the net vessel days for both the maintenance and the installation campaigns at this project highlights how using a dedicated marine spread can positively impact operations.

For this first-ever operation, a total of 17.2 net vessel days were required during turbine reconnection—only a slight increase on the 14.6 net vessel days that were required for the first hook-up operation performed during the initial installation in 2021. However, it exceeds the average of eight net vessel days during installation. The marine spread used in the heavy maintenance operation differed from that used during installation. Due to this, it did not benefit from the learning curve and experience gained throughout the initial installation, which ultimately led to the lower average vessel days.

The array cable re-connection operation encountered a similar effect. The process was performed by one AHTS that spent 10 net vessel days on the operation. This compares to the installation campaign, where the array cable second-end pull-in lasted a maximum of 23.7 hours using a cable layer.

Overall, the turbine shutdown duration can be broken up as 14 days at the quay for maintenance, 52 days from turbine disconnection to turbine reconnection, and 94 days from disconnection to the end of post-reconnection activities.

What developers should keep in mind for heavy maintenance operations

This analysis has uncovered two main lessons developers should consider when planning a floating wind project: the need to identify an appropriate O&M port, and to guarantee that a secure fleet is available.

Floating wind O&M operations require a port with both sufficient room and a deep-water quay. The port must also be equipped with a heavy crane with sufficient tip height to accommodate large floaters and reach turbine elevation. Distance to the wind farm should also be taken into account, as shorter distances will reduce towing time and, therefore, minimize transit and non-productive turbine time.

During the heavy maintenance period for KIN-03 and KIN-02, the selected quay (which had also been utilized in the initial installation phase of the wind farm project), was already busy as a marshalling area for other North Sea projects. This complicated the schedule significantly, as the availability of the quay and its facilities had to be navigated alongside these other projects. This highlights the importance of abundant quay availability both for installation (long-term planning) and maintenance that may be needed on short notice.

At the time of the first turbine’s maintenance program (June 2022), the North Sea AHTS market was in an exceptional situation: the largest bollard pull AHTS units contracted at over $200,000 a day, the highest rate in over a decade.

During this time, the spot market was close to selling out due to medium-term commitments, alongside the demand for high bollard pull vessels for the installation phase at a Norwegian floating wind farm project. The Norwegian project required the use of four AHTS above a 200t bollard pull. With spot rates ranging from $63,000 to $210,000 for the vessels contracted for Kincardine’s maintenance, the total cost of the marine spread used in the first repair campaign was more than $4 million.

Developers should therefore consider the need to structure maintenance contracts with AHTS companies, either through frame agreements or long-term charters, to decrease their exposure to spot market day rates as the market tightens in the future.

While these lessons are relevant for floating wind developers now, new players are looking towards alternative heavy O&M maintenance options for the future. Two crane concepts are especially relevant in this instance. The first method is for a crane to be included in the turbine nacelle to be able to directly lift the component which requires repair from the floater, as is currently seen on onshore turbines. This method is already employed in onshore turbines and could be applicable for offshore. The second method is self-elevating cranes with several such solutions already in development.

The heavy maintenance operations conducted on floating turbines at the Kincardine wind farm have provided invaluable insights for industry players, especially developers. The complex process of disconnecting and towing turbines for repairs highlights the need for meticulous planning and exploration of alternative maintenance strategies, some of which are already in the pipeline. As the industry evolves, careful consideration of ports, and securing fleet contracts, will be crucial in driving efficient and cost-effective O&M practices for the floating wind market.

Sarah McLean is Market Research Analyst at Spinergie, a maritime technology company specializing in emission, vessel performance, and operation optimization.

Spinergie | www.spinergie.com

According to the Energy Information Administration (EIA), developers plan to add 54.5 gigawatts (GW) of new utility-scale electric generating capacity to the U.S. power grid in 2023. More than half of this capacity will be solar. Wind power and battery storage are expected to account for roughly 11 percent and 17 percent, respectively.

A large percentage of new installations are being developed in areas that are prone to extreme weather events and natural disasters (e.g., Texas and California), including high wind, tornadoes, hail, flooding, earthquakes, wildfires, etc. With the frequency and severity of many of these events increasing, project developers, asset owners, and tax equity partners are under growing pressure to better understand and mitigate risk.

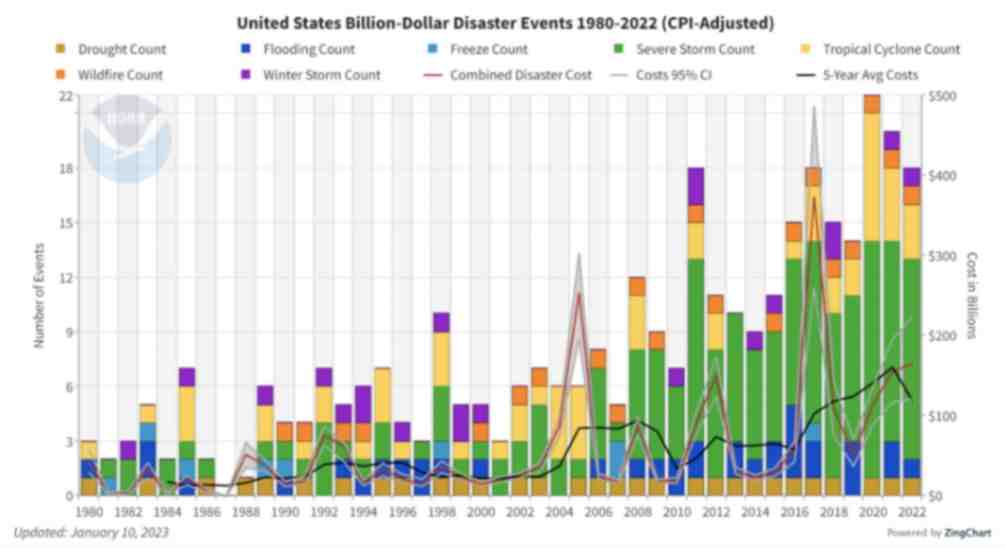

Figure 1. The history of billion-dollar disasters in the United States each year from 1980 to 2022 (source: NOAA)

In terms of loss prevention, a Catastrophe (CAT) Modeling Study is the first step to understanding the exposure and potential financial loss from natural hazards or extreme weather events. CAT studies form the foundation for wider risk management strategies, and have significant implications for insurance costs and coverage.

Despite their importance, developers often view these studies as little more than a formality required for project financing. As a result, they are often conducted late in the development cycle, typically after a site has been selected. However, a strong case can be made for engaging early with an independent third party to perform a more rigorous site-specific technical assessment. Doing so can provide several advantages over traditional assessments conducted by insurance brokerage affiliates, who may not possess the specialty expertise or technical understanding needed to properly apply models or interpret the results they generate. One notable advantage of early-stage catastrophe studies is to help ensure that the range of insurance costs, which can vary from year to year with market forces, are adequately incorporated into the project financial projections.

The evolving threat of natural disasters

Over the past decade, the financial impact of natural hazard events globally has been almost three trillion dollars. In the U.S. alone, the 10-year average annual cost of natural disaster events exceeding $1 billion increased more than fourfold between the 1980s ($18.4 billion) and the 2010s ($84.5 billion).

Investors, insurers, and financiers of renewable projects have taken notice of this trend, and are subsequently adapting their behavior and standards accordingly. In the solar market, for example, insurance premiums increased roughly four-fold from 2019 to 2021. The impetus for this increase can largely be traced back to a severe storm in Texas in 2019, which resulted in an $80 million loss on 13,000 solar panels that were damaged by hail.

The event awakened the industry to the hazards severe storms present, particularly when it comes to large-scale solar arrays. Since then, the impact of convective weather on existing and planned installations has been more thoroughly evaluated during the underwriting process. However, far less attention has been given to the potential for other natural disasters; events like floods and earthquakes have not yet resulted in large losses and/or claims on renewable projects (including wind farms). The extraordinary and widespread effect of the recent Canadian wildfires may alter this behavior moving forward.

A thorough assessment, starting with a CAT study, is key to quantifying the probability of their occurrence — and estimating potential losses — so that appropriate measures can be taken to mitigate risk.

All models are not created equal

Industrywide, certain misconceptions persist around the use of CAT models to estimate losses from an extreme weather event or natural disaster.

Often, the perception is that risk assessors only need a handful of model inputs to arrive at an accurate figure, with the geographic location being the most important variable. While it’s true that many practitioners running models will pre-specify certain project characteristics regardless of the asset’s design (for example, the use of steel moment frames without trackers for all solar arrays in a given region or state), failure to account for even minor details can lead to loss estimates that are off by multiple orders of magnitude.

The evaluation process has recently become even more complex with the addition of battery energy storage. Relative to standalone solar and wind farms, very little real-world experience and data on the impact of extreme weather events has been accrued on these large-scale storage installations. Such projects require an even greater level of granularity to help ensure that all risks are identified and addressed.

Even when the most advanced modeling software tools are used (which allow for thousands of lines of inputs), there is still a great deal that is subject to interpretation. If the practitioner does not possess the expertise or technical ability needed to understand the model, the margin for error can increase substantially. Ultimately, this can lead to overpaying for insurance. Worse, you may end up with a policy with insufficient coverage. In both cases, the profitability of the asset is impacted.

Supplementing CAT studies

In certain instances, it may be necessary to supplement CAT models with an even more detailed analysis of the individual property, equipment, policies, and procedures. In this way, an unbundled risk assessment can be developed that is tailored to the project. Supplemental information (site-specific wind speed studies and hydrological studies, structural assessment, flood maps, etc.) can be considered to adjust vulnerability models.

This provides an added layer of assurance that goes beyond the pre-defined asset descriptions in the software used by traditional studies or assessments. By leveraging expert elicitations, onsite investigations, and rigorous engineering-based methods, it is possible to discretely evaluate asset-specific components as part of the typical financial loss estimate study: this includes Normal Expected Loss (NEL), also known as Scenario Expected Loss (SEL); Probable Maximum Loss (PML), also known as Scenario Upper Loss (SUL); and Probabilistic Loss (PL).

Understanding the specific vulnerabilities and consequences can afford project stakeholders unique insights into quantifying and prioritizing risks, as well as identifying proper mitigation recommendations.

Every project is unique

The increasing frequency and severity of natural disasters and extreme weather events globally is placing an added burden on the renewable industry, especially when it comes to project risk assessment and mitigation. Insurers have signaled that insurance may no longer be the main basis for transferring risk; traditional risk management, as well as site and technology selection, must be considered by developers, purchasers, and financiers.

As one of the first steps in understanding exposure and the potential capital loss from a given event, CAT studies are becoming an increasingly important piece of the risk management puzzle. Developers should treat them as such by engaging early in the project lifecycle with an independent third-party practitioner with the specialty knowledge, tools, and expertise to properly interpret models and quantify risk.

Hazards and potential losses can vary significantly depending on the project design and the specific location. Every asset should be evaluated rigorously and thoroughly to minimize the margin for error, and maximize profitability over its life.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

ABS Group | www.abs-group.com

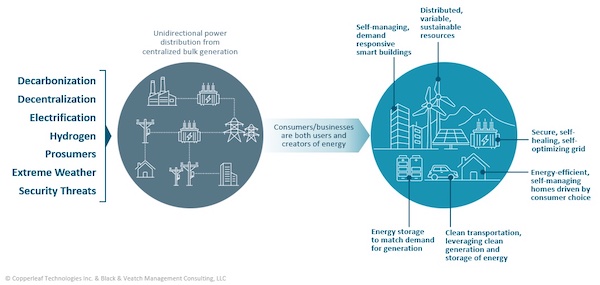

Grid modernization is having a profound impact on the nature and regulation of North American utilities. It represents a significant change to the way energy is managed, distributed, and used—today and in the future. As Environmental, Social, and Governance (ESG) targets become increasingly important to energy investors and regulators, how can organizations transform their Asset Investment Planning (AIP) processes to overcome challenges and take advantage of emerging opportunities?

Grid modernization

The energy transition refers to the global energy sector’s shift from fossil-based systems of energy production and consumption to renewable energy sources like wind and solar, as well as long-term energy storage such as batteries. The increasing penetration of renewable energy into the energy supply mix and the onset of electrification and improvements in energy storage are key drivers of the energy transition.

Grid modernization is a subset of the energy transition, and refers to changes needed in the electric transmission and distribution (T&D) systems to accommodate these rapid and innovative technological changes. Grid modernization often necessitates the increased application of sensors, computers, and communications to increase the intelligence of the grid and its ability to respond swiftly to external factors. The main goals of the grid are to provide the capacity, reliability, and flexibility needed to adapt to a whole range of new technologies (in the drive to net zero), while maintaining a comparable level of service and cost to the end customer.

Grid modernization projects are driven by both climate resilience through hardening of assets and changes to the T&D network to accommodate climate mitigation strategies. There are 3 broad categories for these types of projects:

Grid modernization is accelerating due to multiple factors, such as decarbonization, electrification, extreme weather, and security threats.

Valuing innovative projects

The changing demands dictated by grid modernization will require organizations to strike the right balance between cost-effectively managing the current business, while investing appropriately to meet future demands. Organizations are already seeing an increase in both the volume and variety of grid modernization projects. This is leading to increased planning complexity, requiring utilities to demonstrate that they are spending their limited budgets and resources to maximize value and drive their ESG and performance targets.

A value-based approach to investment decision making is key to establishing a common basis to evaluate potential investment opportunities and meet the challenges of grid modernization. The key to achieving your organization’s grid modernization goals is building a multi-year plan that breaks the work into executable chunks. This ensures adequate funding and resources are available to carry out the plan in the short-term, resulting in incremental progress toward longer-term objectives.

With a value-based decision-making approach, organizations can ensure they are making the right grid modernization investments—and justify their plans to internal and external stakeholders.

Align decisions with strategic objectives

Business leaders must develop frameworks that quantify the financial and non-financial benefits of all proposed investments on a common scale and understand how projects will contribute to their short- and long-term grid modernization initiatives and broader energy transition goals. A value framework also creates a clear line of sight from planned investments to regulatory and corporate targets, allowing organizations to provide transparency into the decision-making methodology—and demonstrate the benefits of their plans to regulators, stakeholders, and customers:

Russ is a Director of Product Management, Decision Analytics at Copperleaf. He is an innovative leader with over 20 years of comprehensive business and technical experience in high-tech product development organizations. Russ holds a B.A.Sc. in Mechanical Engineering from the University of British Columbia and a Management of Technology MBA from Simon Fraser University.

Russ is a Director of Product Management, Decision Analytics at Copperleaf. He is an innovative leader with over 20 years of comprehensive business and technical experience in high-tech product development organizations. Russ holds a B.A.Sc. in Mechanical Engineering from the University of British Columbia and a Management of Technology MBA from Simon Fraser University.

Copperleaf | www.copperleaf.com

What’s underneath the surface of the land that you plan to develop and who owns it? Identifying owners of mineral rights is critical for utility-scale solar energy projects, especially in regions where these rights are legally separable from surfac....

Since the passage of the Inflation Reduction Act nearly two years ago, U.S. solar panel makers navigate a promising market amid production, legal, and investment considerations Nearly two years after U.S. President Joe Biden signed the Inflation R....

The global shift towards clean energy — exemplified by the widespread adoption of solar power — is not only a beacon of hope for a sustainable future, but also comes with heightened expectations for responsible project execution. From the initial....

The impacts of climate change are becoming increasingly more apparent as communities around the world experience extreme weather events. From hurricanes and floods to droughts and wildfires, these types of events can have profound negatives effects o....

When thinking of renewable energy sources, you most likely picture solar panels or massive wind turbines, churning out energy to reduce the strain on electric grids and helping towns and businesses meet lofty sustainability goals. However, when an ex....

The US offshore wind sector has entered 2024 with cautious optimism as the industry shakes off negativity from last year, ready to apply learnings from a challenging 2023 to the year ahead. There are already key projects in the pipeline, including th....

As the world accelerates its transition to renewable energy sources, the deployment of energy storage solutions has surged to meet the demands of this ongoing transformation. Battery Energy Storage System (BESS) capacity is likely to quintuple betwee....

On April 19, 2019, a thermal runaway event took place in a battery energy storage unit (ESS) located within a building in Surprise, Arizona. The ESS was provided with fire detection and fire suppression, which both activated. Approximately five hours....

The summer of 2023 was the hottest in recorded history, hitting the United States with disproportionate force. A climatology report by PBS explained that the terrain in and surrounding the U.S. contributes to powerful competing air masses t....

As industrial operations look for opportunities to decrease their carbon emissions, hydrogen fuel cell vehicles and battery-electric vehicles have emerged as potential solutions. These power options generate zero carbon emissions at the tai....

In the last five years, North America has experienced a significant increase in severe weather events that have impacted power grids. In Canada, Alberta's electric system operator issued 17 provincial grid alerts since 2021, due to extreme weather co....

Now more than ever, it would be difficult to overstate the importance of the renewable energy industry. Indeed, it seems that few other industries depend as heavily on constant and rapid innovation. This industry, however, is somewhat unique in its e....