Energy Storage

Schaltbau North America

Wind

Ole Binderup

Solar

Sun Ballast

The "USA Wind Farms Database" has been added to ResearchAndMarkets.com's offering. Introducing an extensive and authoritative database of wind farms across the United States, offering vital insights for professionals in the renewable energy sector. This robust database features 2,323 entries, intricately documenting both onshore and offshore wind energy projects, showcasing a substantial cumulative capacity of 159.7 GW onshore and 71.07 GW offshore.

Onshore Wind Market Overview:

Offshore Wind Market Overview:

The database is meticulously crafted, providing a wide array of detailed data points that include:

Location Details:

Turbine Specifications:

Stakeholder Information:

Status and Timeline Data:

ResearchAndMarkets.com | https://www.researchandmarkets.com/r/tc2hw.

The Solar Energy Industries Association (SEIA), Illinois Solar Energy and Storage Association (ISEA), the Coalition for Community Solar Access (CCSA), and Advanced Energy United applauded the Illinois Commerce Commission (ICC) for approving key updates to the 2024 – 2026 Illinois Power Agency’s Long-Term Renewable Resources Procurement Plan (LTRRPP) to expand solar capacity and protect Illinois consumers from rising energy costs.

The ICC’s decision authorizes an immediate expansion of the Adjustable Block Program by 100 percent — doubling community, commercial, and small-scale solar categories — and advancing new competitive procurements for utility-scale ahead of the federal Investment Tax Credit (ITC) phase-out. The ruling enables developers to bring hundreds of additional megawatts of affordable, clean power online while securing lower costs for ratepayers through efficient use of existing funds.

“This decision is a major win for Illinois’ clean energy future,” said Andrew Linhares, Senior Manager for the Central Region at SEIA. “By expanding solar capacity now, the Commission is helping ensure that Illinoisans benefit from lower costs, greater reliability, and good-paying local jobs. It’s exactly the kind of forward-thinking action we need to keep Illinois on track as a national leader in renewable energy.”

Illinois’ approach stands out nationally. While many states have slowed procurement in response to federal uncertainty, Governor Pritzker’s administration and the ICC have moved swiftly to accelerate renewable energy investments that create local jobs, stabilize bills, and strengthen grid reliability. The expanded capacity will also prioritize projects that can begin construction before the ITC sunset, ensuring maximum economic value for Illinois consumers and workers.

“This is decisive, forward-looking leadership from the Illinois Commerce Commission,” said Stephanie Burgos-Veras, Senior Manager of Equity Programs at CCSA. “By acting now, Illinois is ensuring that residents and businesses benefit from the lowest-cost solar projects while federal incentives remain available — cementing the state’s position as a national model for smart, affordable clean energy growth.”

“With this action, Illinois is showing how smart, proactive policy can turn clean energy goals into real economic value,” said Lesley McCain, Executive Director of ISEA. “By expanding solar capacity now, the Commission is helping capture remaining federal incentives, lower long-term energy costs, and strengthen the grid for Illinois families and businesses.”

“This decision positions Illinois at the forefront of smart energy planning,” said John Albers, Director at Advanced Energy United. “By accelerating renewable procurement now, the Commission is helping avoid future price shocks, create a more reliable grid, and attract private investment that keeps energy dollars working here in Illinois. It’s a clear example of how policy leadership can translate into lower costs and stronger energy security for everyone.”

Illinois currently ranks among the top five states nationwide for community solar deployment, with more than 700 MW of installed capacity and hundreds more in development. Today’s ICC ruling will allow the state to continue to set the pace for the Midwest and beyond.

Coalition for Community Solar Access | https://communitysolaraccess.org/

EverLine, a national leader in remote operations, cybersecurity, and compliance for critical and energy infrastructure, announced that it has achieved certification as a NERC Transmission Operator (TOP). The milestone marks EverLine’s continued expansion into the electric transmission market and strengthens its position as one of the few independent operators serving the U.S. power grid.

The NERC TOP certification validates that EverLine has demonstrated that its systems, personnel, and CIP high-impact compliance adhere to the North American Electric Reliability Corporation (NERC) standards for operating transmission assets. It also authorizes EverLine to carry out essential real-time tasks, such as continuous monitoring, operational planning, and emergency response, within SERC’s regional jurisdiction. By expanding its 24/7 Remote Operations Control Center (ROCC), Network Operations Center (NOC), and Security Operations Center (SOC), EverLine now offers electric transmission owners and operators a unified, secure, and compliant platform serving power, pipeline, and renewable assets.

“As the nation races to expand transmission capacity to meet surging demand, the bottleneck isn’t technology, it’s the lack of qualified, independent operating partners,” said Brandon Ware, EverLine’s Vice President of Power O&M Services. “Few organizations are equipped to provide true best in class compliance out of the gate. With this certification, EverLine delivers immediate readiness, eliminating long registration delays and giving developers a partner who can operate with full NERC authority from day one.”

The certification process requires rigorous documentation, readiness evaluations, and validation by the regional authority to verify operational control capabilities, trained staff, and secure data systems. This certification places EverLine under the same strict regulatory requirements that govern the nation’s electric grid operators, including adherence to standards such as TOP-001 (Transmission Operations) and TOP-003 (Operational Data Exchange). Each standard involves significant financial and operational risks, with potential penalties exceeding $1.5 million daily per violation for noncompliance.

EverLine’s expansion in electric transmission services allows the company to address a growing market gap. Developers and grid owners are bringing new assets online faster than the industry can staff compliant operations centers. By combining a NERC-registered control environment with advanced cybersecurity, real-time situational awareness, and audit-ready evidence management, EverLine helps clients reduce time-to-market, capital costs, and ongoing O&M expenses, while also lowering their overall risk profile.

Continued Ware, “Power infrastructure owners and developers face nearly 100 NERC standards to comply with, and penalties exceeding $1.5M per instance per day for non-compliance. We’re here to help mitigate that. This certification is just the first of several in our plans to add more choice and capacity to this market, and we aim to be the leading operating partner in this space.”

The NERC TOP certification highlights EverLine’s dedication to operational excellence and its broader goal to modernize the management, monitoring, and protection of critical infrastructure across North America.

EverLine | www.everlineus.com

Hingham Public Schools will host a groundbreaking ceremony to celebrate construction of the district's first electric school bus project. The switch from three diesel school buses to three electric school buses is projected to save the district $10,000–$20,000 each year and deliver quieter, cleaner rides for students.

In partnership with Highland Electric Fleets, North America's leading provider of Electrification-as-a-Service (EaaS), the project will introduce three IC Type C electric school buses supplied by local dealer DeVivo and three Zerova 30kW chargers. Each bus is expected to travel roughly 11,000 miles per year once the fleet begins service in February 2026.

"Hingham is proud to take this important step forward in modernizing our school transportation," said Kathryn Roberts, Superintendent of Hingham Schools. "This project reflects our commitment to fiscal responsibility and improving the daily experience for our students and drivers."

The project is supported through a combined $1.1 million in funding, including $500,000 from the Massachusetts Clean Energy Center's Accelerating Clean Transportation (ACT) Program and $600,000 from the third round of the EPA's Clean School Bus Program.

"Projects like this demonstrate how public-private partnerships can make electrification both practical and affordable," said Matt Stanberry, SVP Market Development at Highland. "Together, we're helping Hingham cut costs, improve air quality, and give students a quieter, more comfortable ride to school."

Hingham Municipal Lighting Plant (HMLP) will serve as the local utility partner, and NECGroup will lead electrical construction for the project.

Highland Electric Fleets | www.highlandfleets.com

The N.C. Clean Energy Technology Center (NCCETC) released its Q3 2025 edition of The 50 States of Solar. The quarterly series provides insights on state regulatory and legislative discussions and actions on distributed solar policy, with a focus on net metering, distributed solar valuation, interconnection rules, community solar, residential fixed charges, residential demand and solar charges, financial incentives, and third-party ownership.

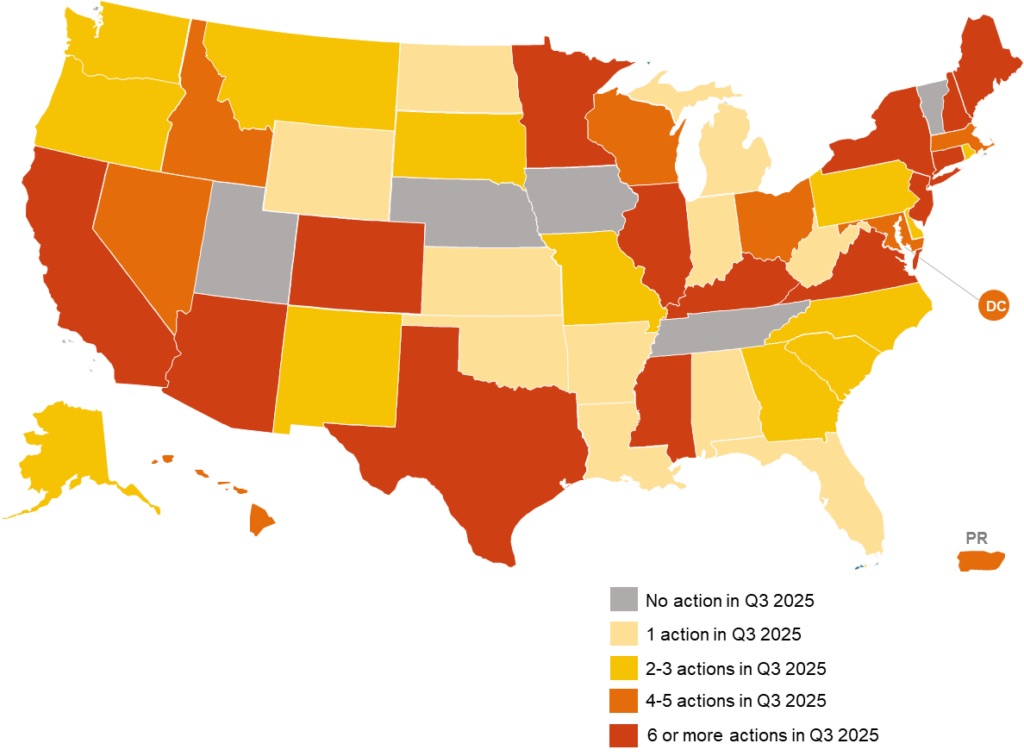

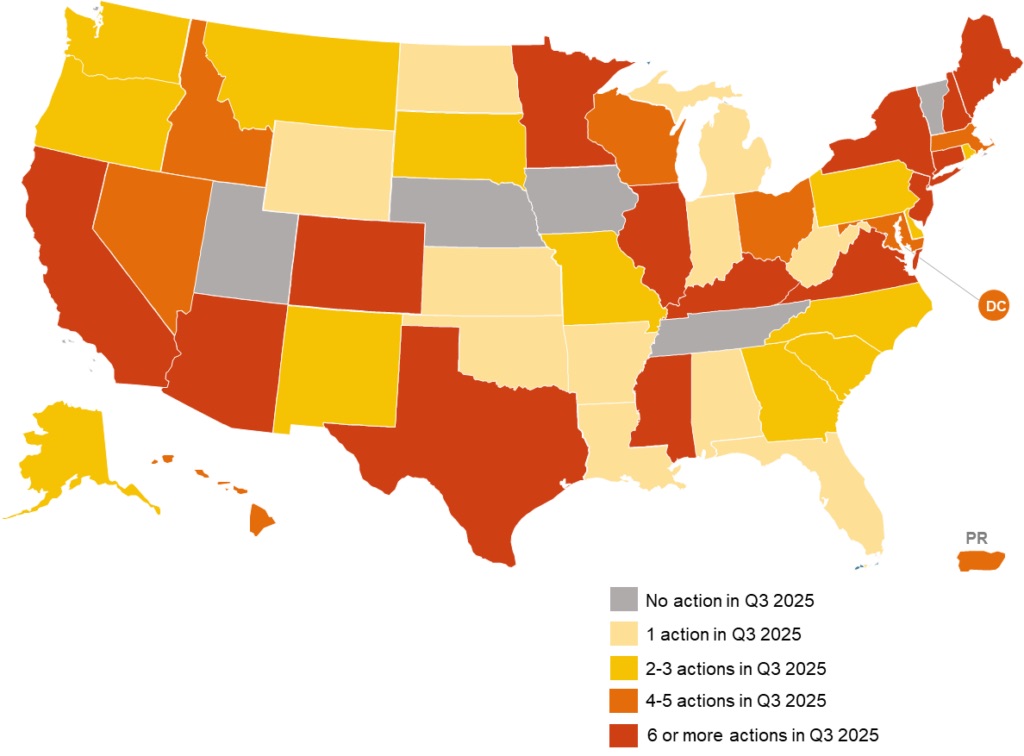

The report finds that 45 states, plus the District of Columbia and Puerto Rico, took some type of distributed solar policy action during Q3 2025 (see figure below), with the greatest number of actions continuing to address net metering policies (57), residential fixed charge or minimum bill increases (43), and community solar policies (40). A total of 217 distributed solar policy actions were taken during Q3 2025, with the most actions taken in Connecticut, Colorado, Minnesota, New York, Arizona, and California.

Q3 2025 Policy Action on Net Metering, Rate Design, and Solar Ownership

The report identifies three trends in solar policy activity taken in Q3 2025: (1) utilities continuing to transition to net billing tariffs, (2) states and utilities pursuing supporting mechanisms for community solar, and (3) states responding to the loss of federal incentives.

“After the federal government passed H.R. 1 in July, states are revising programs and guidelines to maximize use of the existing investment and production credits,” observed Rebekah de la Mora, Senior Policy Analyst at NCCETC. “Regulators are revising interconnection rules to help projects connect to the grid before the federal deadline for operating, implementing extensions and exceptions for projects under incentive programs, and considering program expansions to ‘make up’ for the loss of the credits.”

The report notes the top five distributed solar policy actions of Q3 2025:

“States and utilities continue grappling with the proper compensation structures for distributed generation. In Q3 2025, multiple utilities proposed and received approval for new net billing tariffs,” noted Brian Lips, Senior Project Manager at NCCETC. “Utilities’ netting billing tariff intervals typically range from instantaneous netting to hourly netting, in comparison to the standard monthly interval for net metering.”

View the 50 States of Solar Q3 2025 Quarterly Report Executive Summary

View and Purchase the 50 States of Solar Q3 2025 Quarterly Report

NC Clean Energy Technology Center | http://www.nccleantech.

Yokogawa Corporation of America is pleased to confirm the dates for the next Yokogawa Users Conference and Exhibition, YNOW2026, taking place in New Orleans, Louisiana, September 1–3, 2026.

Building on the tremendous success of YNOW2024: Impact Your World in Houston, YNOW2026 will bring together hundreds of industry leaders, visionaries, and innovators as we continue shaping the future of industrial automation, digital transformation, and sustainability.

Over three transformational days, attendees will discover bold ideas, practical solutions, and visionary strategies designed to accelerate their digital journey. From expert-led sessions to valuable networking opportunities, YNOW is more than a conference, it is where the next chapter of industry innovation begins.

Registration will open in early 2026. In the meantime, customers and partners can join our Early Access List to be the first to receive event updates and announcements.

We look forward to welcoming you to New Orleans in 2026 for another inspiring YNOW experience.

Yokogawa Corporation of America | https://www.yokogawa.com/

GE Vernova Inc. (NYSE: GEV) announced that it has entered into an agreement with Greenvolt International Power to supply, install and commission 42 of its 6.1 MW–158m* onshore wind turbines to power the Ialomiţa wind farm in Ialomiţa, Romania. The wind farm will be capable of producing approximately 252 MW, supporting Romania’s goal of adding significantly more renewable energy by 2030.

The Ialomiţa deal was booked in the third quarter of 2025, and deliveries of the wind turbines for the project are scheduled to begin in 2026. The wind farms will generate enough electricity to power the equivalent of more than 110,000 homes and business annually in Romania.

Gilan Sabatier, Chief Commercial Officer for GE Vernova’s Onshore Wind business in International Markets, said “We appreciate the confidence that Greenvolt has shown in GE Vernova’s teams and our technology. This project reinforces the value of our workhorse product strategy and demonstrates our ability to add value for customers in Romania and across Europe.”

GE Vernova's Onshore Wind has a total installed base of approximately 57,000 turbines and nearly 120 GW of installed capacity worldwide. Committed to its customers' success for more than two decades, its product portfolio offers next-generation high-powered turbines at scale that drives decarbonization through high-quality, affordable, and sustainable renewable energy.

GE Vernova | https://www.gevernova.com/

Solar Oct 10, 2025

Solar is safe when it’s maintained — and risky when basics slip. Across sites, the pattern behind many PV fires is consistent: soiling and shading create hot spots; loose or corroded DC joints run hot; wildlife and litter add fuel; and moisture i....

Solar is safe when it’s maintained — and risky when basics slip. Across sites, the pattern behind many PV fires is consistent: soiling and shading create hot spots; loose or corroded DC joints run hot; wildlife and litter add fuel; and moisture i....

As utility-scale hybrid solar and battery energy storage projects become standard across North America, operators are facing increasing complexity. These systems are no longer passive generators, but dynamic assets that must respond in real time to g....

It didn’t start with a robot. It started with a problem. Clean energy is one of the hottest commodities today, and the world is rushing to meet this increasing demand. However, the typical financial barrier isn’t a problem for the industry; it....

Wind power has been a highly successful ....

As wind turbines keep growing taller and....

As energy needs grow more complex and grid instability becomes a regular concern, mobile microgrids are gaining attention as a flexible, lower-emission energy solution. Their emergence is timely. From wildfire-related outages in the West to hurricane....

A next generation of Virtual Power Plants has emerged in 2025, embodying trends which will require more efficient integration with utility grids. These trends span a wide range: VPPs that integrate EV charging and other new resources; building manage....

The confluence of several energy challenges has presented itself within the North American market. Rising electricity demands, grid reliability concerns, affordability and bottlenecks have reached an inflection point. Microgrids are emerging as a sol....

After months of debate in Congress, the One Big Beautiful Bill Act (OBBBA) was finally signed into law. With the goal of restructuring and simplifying federal incentive programs while reducing long-term costs, the OBBBA comes with several updates and....

Helium, once known primarily for its niche industrial uses, has emerged as a strategic political asset amid rising geopolitical tensions and trade uncertainties. Its critical role in next-generation technologies such as semiconductors, space explorat....

The need for reliable, high-quality electricity has never been greater now the grid is highly dependent on getting its supply from multiple sources. Power grid quality monitoring increasingly plays a significant role in ensuring that electricity arri....