PEMFCs and SOFCs are Leading the Way for Stationary Fuel Cells

Hydrogen fuel cells are a renewable energy technology that is receiving increasing commercial interest, with growing pressures for companies to improve their green credentials, alongside a global target to reach Net-Zero by 2050, driving this attraction. Traditional renewable technologies such as solar and wind have garnered significant attention; however, due to their intermittent nature, additional technologies that can provide on-demand and continuous power are required, leading to the growing attention into hydrogen fuel cells for stationary power generation.

In their new report "Stationary Fuel Cell Markets 2025-2035: Technologies, Players & Forecasts", IDTechEx comprehensively covers the stationary fuel cell market, including the key application areas, breakdown of fuel cell (FC) power generation modes, and assessment of the main trends anticipated within each sector. This analysis is carried out alongside an in-depth evaluation of the varying fuel cell technologies and benchmarking of their key specifications. Granular market analysis sees IDTechEx forecast the stationary fuel cell market to exceed US$8 billion by 2035.

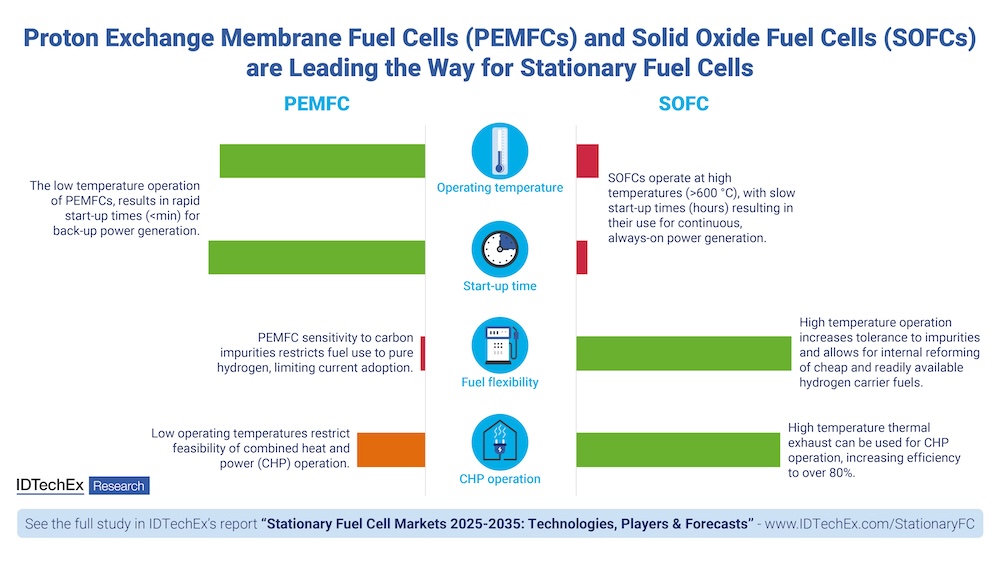

The different operating specifications of PEMFCs and SOFCs. Source: IDTechE

Uninterruptable power supplies are essential for many mission-critical applications, including data centers, hospitals, airports, and telecommunications. Power outages or interruption of power to these sectors can have widespread and devastating effects on the safety of the compromised people, along with economical and operational impacts. The US DOE estimates that power outages cost the US economy US$150 billion annually. This, compounded by the growth of electricity demand, which is predicted by the International Energy Agency (IEA) to rise at a faster rate over the next three years, growing by an average of 3.4% annually through 2026, means there are growing concerns over energy security. By leveraging both long-established and newer power generation technologies, grid operators can hope to meet the rises in demands and deal with unprecedented challenges.

Of the various types of fuel cell technologies, proton exchange membrane fuel cells (PEMFCs) have received the greatest commercial attention due to growing interest in their integration within automotive applications. PEMFCs operate at temperatures below 100°C, combining hydrogen fuel and oxygen to generate electricity, and water and heat as by-products. The low operating temperature allows for quick response times to changes in power demand. IDTechEx finds that backup power applications present a significant opportunity for PEMFCs, with key players such as Ballard and Plug Power exploring FC use within data centers for the replacement of diesel generators.

PEMFCs, however, can only operate using pure hydrogen, a fuel that is currently costly compared to traditional non-renewable fuels like natural gas and diesel. PEM fuel cells are highly susceptible to carbon monoxide (CO) poisoning, due to sensitivity of the catalyst to carbon impurities, which leads to cell degradation. Unfortunately, limited access to green hydrogen, and a lack of supply infrastructure, currently hinders the growth of the PEMFC stationary power market. However, it is likely that development of the hydrogen economy will coincide with growth of the PEM stationary fuel cell market.

To overcome the current restrictions to the stationary fuel cell market, mainly the cost and availability of hydrogen fuel, it is worth considering the viability of fuel cells that can operate on a variety of fuel types, in particular solid oxide fuel cells (SOFCs). SOFCs are a high-temperature alternative to PEMFCs. By operating at temperatures above 600°C, SOFCs have an increased tolerance to fuel impurities and can internally reform cheaper and readily available carbon-based hydrogen carrier fuels, for example natural gas. Limitations due to slow start-up times as a result of the high operating temperature mean SOFCs are restricted to continuous power generation applications. However, the wide availability of natural gas, with existing production and supply infrastructure, helps to drive current adoption of SOFCs. IDTechEx finds that SOFCs present a unique opportunity for the stationary fuel cell market, helping to establish a secure installation base while the hydrogen economy develops, with the technology largely dominating the market growth.

Due to the varying operating conditions of PEMFCs and SOFCs, each is suited to a particular power generation mode. The high-temperature operation of SOFCs results in a slow ramp-up time, hindering their ability to respond quickly to power demand changes. SOFCs are, therefore, better suited to continual operation. Continuous power generation refers to systems that are operating 24/7, typically powering large-scale applications and systems. Traditionally, continuous power generation technologies include natural gas or coal-powered systems like steam or gas turbines. These systems are used for global grid power supplies. As global energy demands increase, so do the strains placed upon these existing technologies to meet higher energy outputs. SOFCs are well aligned to operate continuously, in parallel with existing power generation technologies.

Conversely, the low-temperature operation of PEMFCs leads to rapid start-up times and an ability to quickly respond to power demand changes, meaning they are better suited for backup power operation. Typically, diesel and petrol generators are installed as backup power generation technologies; however, with growing environmental concerns and commitments from governments to reach decarbonization goals, the long-term replacement of these generators is required. Stationary fuel cells, in particular PEMFCs, can meet these power generation demands; however, as previously stated, leveraging the hydrogen economy is required for widespread market adoption to be seen. In the latest report, IDTechEx explores the market potential of PEMFCs and alternative fuel cell technologies as backup power generation devices for a range of application areas.

Overall, the growth of the stationary fuel cell market is anticipated to be dominated by SOFC technology, attributed to their fuel flexibility and large MW scale power outputs. PEMFCs will see growth amongst small-scale backup power applications. However, this will be dependent upon the development of the hydrogen economy. For more information on the different types of fuel cell technologies, their application areas, and emerging trends within the market, see the IDTechEx report "Stationary Fuel Cell Markets 2025-2035: Technologies, Players & Forecasts".

Upcoming free-to-attend webinar

Evolving Stationary Fuel Cell Market Set for Significant Growth

Maia Benstead, Technology Analyst at IDTechEx and author of this article, will be presenting a free-to-attend webinar on Tuesday 5 November 2024 - Evolving Stationary Fuel Cell Market Set for Significant Growth.

This webinar will:

- Discuss the different types of fuel cell technologies, including proton exchange membrane fuel cells (PEMFCs), solid oxide fuel cells (SOFC), phosphoric acid fuel cells (PAFC), alkaline fuel cells (AFC), molten carbonate fuel cells (MCFC) and direct methanol fuel cells (DMFC) alongside benchmarking of their key specifications

- Highlight the various power generation modes for fuel cells and identify the optimum operation for each fuel cell type

- Outline the main stationary power generation application areas and the key considerations required for the technologies

- Overview of the key stationary fuel cell market trends anticipated for the next decade

We will be holding exactly the same webinar three times in one day. Please click here to register for the session most convenient for you.

If you are unable to make the date, please register anyway to receive the links to the on-demand recording (available for a limited time) and webinar slides as soon as they are available.

IDTechEx | www.idtechex.com