4 Factors that Make Behind-the-Meter Battery Storage Financeable

Financing behind-the-meter (demand-side) battery projects has always been challenging for commercial and industrial customers. Projects are capital-intensive, which creates a very high hurdle for companies and facility owners to clear. Strategic investors like independent power producers and infrastructure funds can bridge the gap, but many are more likely to put funding towards front-of-the-meter (utility-side) battery storage projects, due to their larger size and their similarity to solar and wind projects.

The climate crisis has a massive effect on the sources and amount of electricity we use. Demand is growing as manufacturing and transportation move towards full electrification. There's an urgent need for these electricity resources to be clean, but low-emission renewables are unpredictable in their output compared to fossil fuels. Energy storage can fill in the gap on both the utility and demand side, with demand-side storage enabling consumers to strengthen resiliency through grid services. Companies that provide these services earn benefits in on-bill savings, and potentially earn revenue from grid services.

There's been a marked increase in companies that want a battery energy storage project on their site. Many battery developers have attempted to make behind-the-meter (BTM) projects work. Despite the offer of a financed solution, many developers struggle to generate the returns required to pay for the project. Instead, these companies end up pivoting to relatively less complex front-of-the-meter (FTM) or solar projects.

Following are four factors that need to be in place to make these projects financeable and profitable.

- Favorable market conditions - regional incentives, programs, and policies

- Suitable site host specifications - required energy usage profile, creditworthiness, and physical criteria

- Development and permitting expertise - ability to navigate bureaucracy

- Scalable battery operation capabilities - consistent delivery of returns

With an estimate of $100B worth of deployable CAPEX for these projects, the key is to de-risk the investments as much as possible.

Favorable market conditions

Commercial and industrial BTM installations in the U.S. are expected to grow from 1 GW to 3.5 GW between 2024-28. The forecast for Canada is ~0.3 GW by 2028 in Ontario, the biggest market.

While battery prices are decreasing, these projects can still run into the low millions. Federal incentives like the Inflation Reduction Act provide tax credits that reduce some costs. State and grid-level programs provide even better profitability. These can be found in Ontario (Canada), Massachusetts, New York, Connecticut, California, Illinois, and New Jersey. Location is the most crucial consideration.

Suitable site host conditions

Not all facilities are suitable for large-scale battery projects. Sites that qualify have heavy and consistent load demand with high peak usage, like large commercial and industrial buildings. A BTM battery changes the timing of a facility’s consumption on the electricity grid, often adjusting for the high peaks while keeping the overall load consistent. This consistency needs to be present for the run of the project, usually 15-20 years. For this reason, it's vital to build consistent load demand into the contract. This can be a big ask, but it's made up for by the fact that the projects can come at no cost to the site host. The strategic investors finance construction and operation, taking a share of the on-bill savings and revenue generated through grid services.

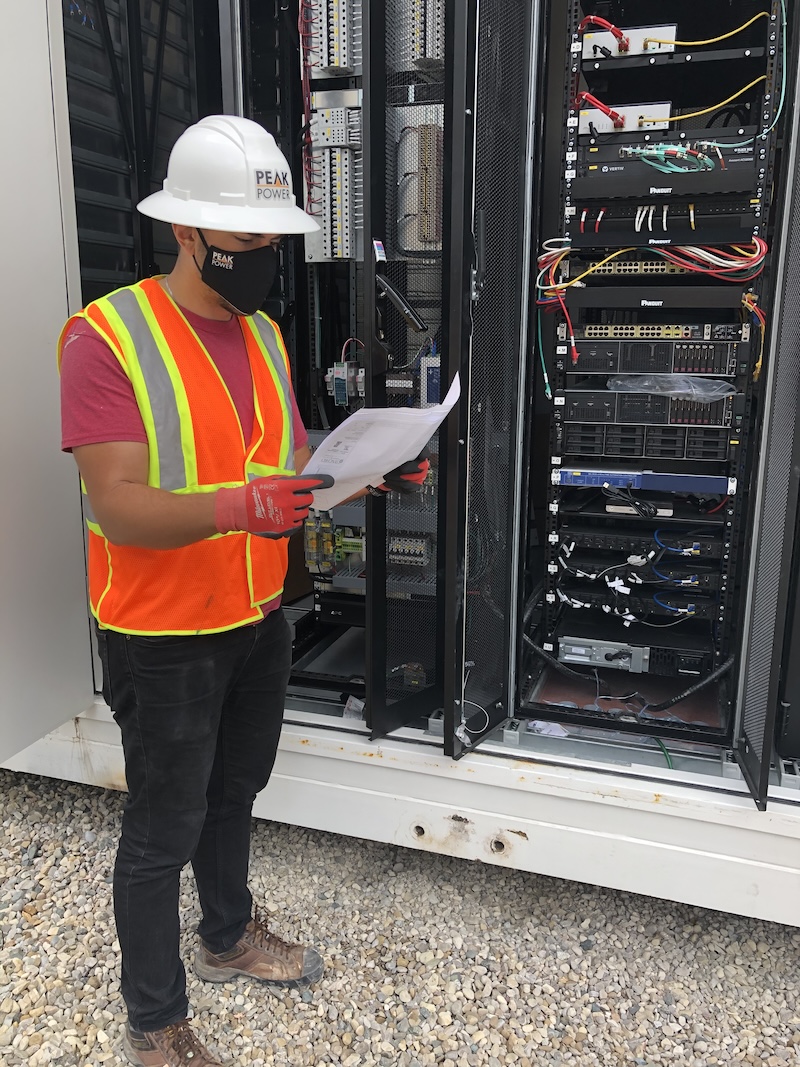

Site assessment – Peak Power

Development and permitting expertise

Anyone who has any experience or done any research into battery energy storage systems will have encountered the concept of interconnection queues. In most places in North America, the critical path runs through getting connected to the grid. The risk of a project taking months or years to break ground is a very real prospect. Companies that have access to development and permitting expertise can cut through red tape quicker and optimize project planning. This means the project can start generating value sooner.

Conversely, the construction risk is quite low compared to other typical infrastructure projects. A battery storage system is a containerized solution that's connected to the facility and utility meter. While there are physical site requirements (having space around the battery for fire safety) or limiting environmental factors (proximity to water), it's relatively straight forward.

Scalable and intelligent battery operation capabilities

The value that a battery generates relies on operating it for grid services, primarily demand response. Success in demand response requires the ability to predict peak demand on the grid. This isn't the only service that generates revenue. To capture these returns, the battery must be ready to operate for the most profitable value stream at any time. It's not good enough to have automated software that responds to grid signals because the grid patterns are volatile due to climate change, electrification, and the proliferation of demand-side systems. Human intelligence is required to complement machine learning with superior forecasting abilities.

Financiers need to source companies that can deliver expert forecasting with high accuracy and optimization performance to maximize energy savings and incentive program revenues, to generate strong investment returns.

Reduce risk and optimize returns

The ability to finance any project boils down to reducing risk at the outset and ensuring profitability for its lifetime. This requires a strong ecosystem of specialists working together. Energy markets experts can identify and provide forecasts on the favorability of regions to site a project. Engineers assess the facility’s physical and electrical conditions and energy load usage for suitability. Permitting and development professionals ensure the project can be implemented within a reasonable timeframe. A battery operator with a good track record of optimizing for value streams and forecasting peak loads/grid events can secure the profitability of the project for its lifetime. Combining expertise across the value-chain, from origination to operations, can provide the maximum value and lowest risk to financiers looking to diversify their portfolios with BTM energy storage asset class.

Asad Ahmed is leading strategic transactions at Peak Power, a Canadian cleantech company making it profitable for large energy users to pursue net zero by integrating battery energy storage systems. Asad is a seasoned financing and corporate development professional, with a passion for clean energy technology. He has spent the past years driving strategic growth, optimizing global operations, and championing decarbonization initiatives in the renewables space. Asad has spearheaded funding transactions totaling $250M+, including an IPO, and led various acquisitions from origination to close. He employs a holistic approach, combining robust analysis and problem-solving to advance sustainable financial solutions. Asad holds a bachelor’s degree in mechanical engineering and an MBA from Ivey Business School.

Peak Power | peakpowerenergy.com

Author: Asad Ahmed

Volume: 2024 November/December