Battery Material Shifts in the Li-ion Market

The lithium-ion (Li-ion) battery industry is undergoing significant shifts in material usage, driven by the growing demand for electric vehicles (EVs) and stationary battery storage applications. Despite some short-term concerns over EV adoption, the long-term outlook for Li-ion battery demand remains positive due to improving battery technology and prices, increasing renewable penetration, and broadly supportive policies. IDTechEx forecasts the global Li-ion market to reach over US$400 billion by 2035.

This article explores the key material trends shaping the Li-ion battery market, particularly the rise of lithium iron phosphate (LFP) and shifts in graphite material. For more in-depth analysis and discussion on the trends in Li-ion materials, technologies, players, and markets, see the IDTechEx report "Li-ion Battery Market 2025-2035: Technologies, Players, Applications, Outlooks and Forecasts".

Shift toward LFP batteries

As the EV industry moves beyond early adopters and into the mass market, the focus needs to shift toward affordability. In this context, lithium iron phosphate (LFP) has emerged as a compelling option for EV batteries due to its lower cost compared to alternatives like nickel- manganese-cobalt (NMC) and nickel-cobalt-aluminium (NCA) chemistries. LFP is a highly attractive choice as automakers seek to produce more affordable electric models, with multiple manufacturers outside of China planning to adopt more LFP, including Hyundai, Volkswagen, Renault, Stellantis, and Ford.

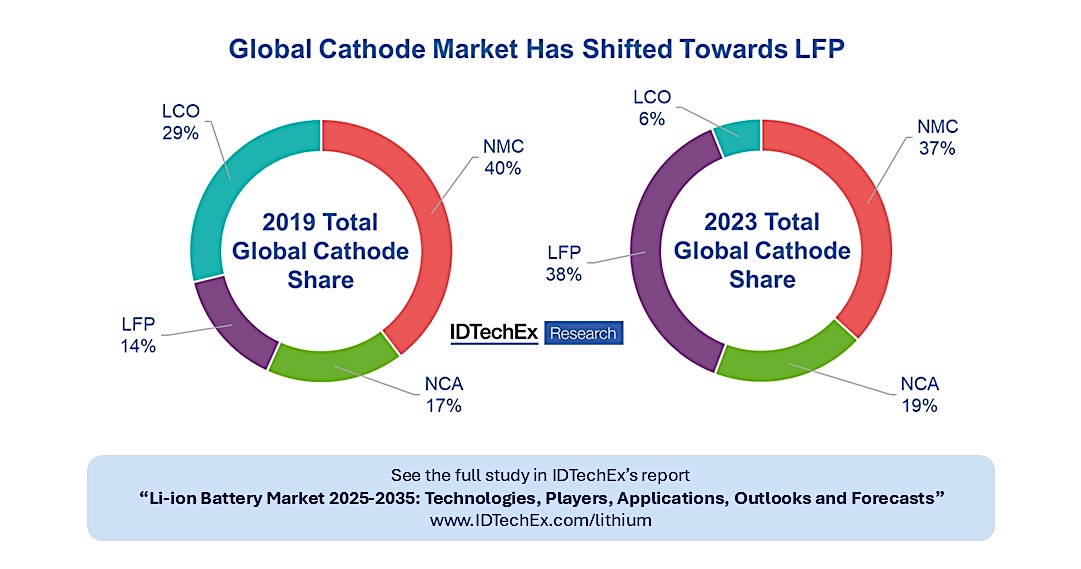

LFP's share in the global battery market has steadily risen, largely driven by China's re-adoption of LFP cathodes for EVs. The influence of LFP is now spreading beyond China, with early adoption in Europe and the U.S., as well as a growing preference in the stationary energy storage sector, where price and levelized cost are crucial. However, while there are efforts to start producing LFP outside of China, almost all LFP cathode active material and battery cells are currently manufactured in China, raising concerns about supply chain security and geopolitical risks for manufacturers relying on LFP, especially in the US.

Global Li-ion cathode share has shifted away from LCO and toward LFP. Source: IDTechEx

Global Li-ion cathode share has shifted away from LCO and toward LFP. Source: IDTechEx

LMFP as a response to LFP's energy density limitations

While LFP offers significant cost benefits and advantages related to cycle life and thermal stability, it does have a notable disadvantage - it has lower energy density compared to NMC or NCA chemistries. Despite improvements to battery pack designs, this limits the range of EVs powered by LFP batteries, a key consideration for automakers and consumers alike. Lithium manganese iron phosphate (LMFP) has emerged as a potential solution. LMFP retains the cost advantages of LFP while improving energy density by including manganese in the cathode composition. This development could help bridge the performance gap between LFP and NMC-based batteries while maintaining the low-cost structure of LFP. Plans are now emerging for developing and expanding LMFP production capacity from key cathode manufacturers such as Dynanonic and Ronbay, through to newer entrants such as Lithium Australia/VSPC or Mitra Chem. IDTechEx's report "Li-ion Battery Market 2025-2035: Technologies, Players, Applications, Outlooks and Forecasts" provides production outlooks for cathode active material and forecasts GWh battery demand by cathode through to 2035.

Artificial graphite gaining share over natural graphite

Another notable shift in battery material trends is occurring in the anode market, where artificial graphite is gaining ground over natural graphite. IDTechEx estimates that artificial graphite made up approximately 73% of the Li-ion battery graphite anode market in 2023, from approximately 60% in 2020. The primary driver behind this shift is cost. Historically, artificial graphite has been more expensive than natural due to the energy requirements of graphitization, but it offered greater reliability in material production and some performance benefits related to rate capability and cycle life. However, low energy prices in China and extensive competition have driven artificial graphite prices down, with prices as low as US$6/kg reported for high-quality anodes. This has made artificial graphite a more attractive option for battery manufacturers aiming to optimize cost and performance, leading to greater usage. Importantly, this also creates a barrier to adopting alternative anode materials for cost-sensitive applications, such as silicon-based materials, whose prices can be an order of magnitude higher on a US$/kg basis.

Battery market being driven by cost

The commonality between current anode and cathode material choice trends is cost. The use of LFP and the development of other low-cost cathodes, such as LMFP, are a primary example of the increased focus on cost and price from the Li-ion industry. The recent shift toward artificial graphite over natural graphite has also been due to falling prices. Substantial competition and overcapacity throughout the battery value chain further drive prices down. This will be highly beneficial for battery purchasers and consumers but creates considerable hurdles to players aiming to enter the market, particularly Europe and North America, where less developed supply chains and industries create an additional barrier to competing with established Asian players and manufacturers.

A diverse range of materials and technologies are emerging to meet the demands of a rapidly growing Li-ion battery industry, but key to the successful adoption of any material and technology will be cost, with the recent shifts toward LFP and artificial graphite testament to this. Innovations and developments that can drive forward performance, safety, and environmental benefits while retaining low and competitive prices will be key to the continued growth of the battery industry and the decarbonization projects relying on it.

To find out more about the latest trends in Li-ion battery materials, technologies, players, and markets, as well as other battery and energy storage technologies, visit Energy Market Intelligence Subscription (idtechex.com).

IDTechEx | www.idtechex.com