Investing in U.S.-Based Zinc Battery Manufacturing Lowers Supply Chain Risk

Diversified, safe, and domestically-produced energy storage is vital for a sustainable and secure future. North America must look beyond lithium and invest in alternate chemistries that complement existing batteries and provide alternatives for grid-scale, microgrids, and home stationary energy storage systems. New, advanced zinc batteries can play a pivotal role in this shift.

The case for zinc in energy storage

Energy storage manufacturers want to decrease reliance on overseas supply chains dominated by China and other politically unfriendly countries, especially for processed materials and battery components made with lithium and cobalt. Zinc is abundant and already safely mined in the United States, most notably at one of the world's largest zinc mines, the Red Dog Mine in Alaska.

Zinc-based batteries are a cost-effective alternative for stationary energy storage, providing advantages over both lithium-ion and lead-acid batteries. Compared to lithium-ion, zinc batteries don't carry the same fire risk, use low-cost, non-toxic, and widely available materials, can be economically recycled, and have a wider operating temperature range.

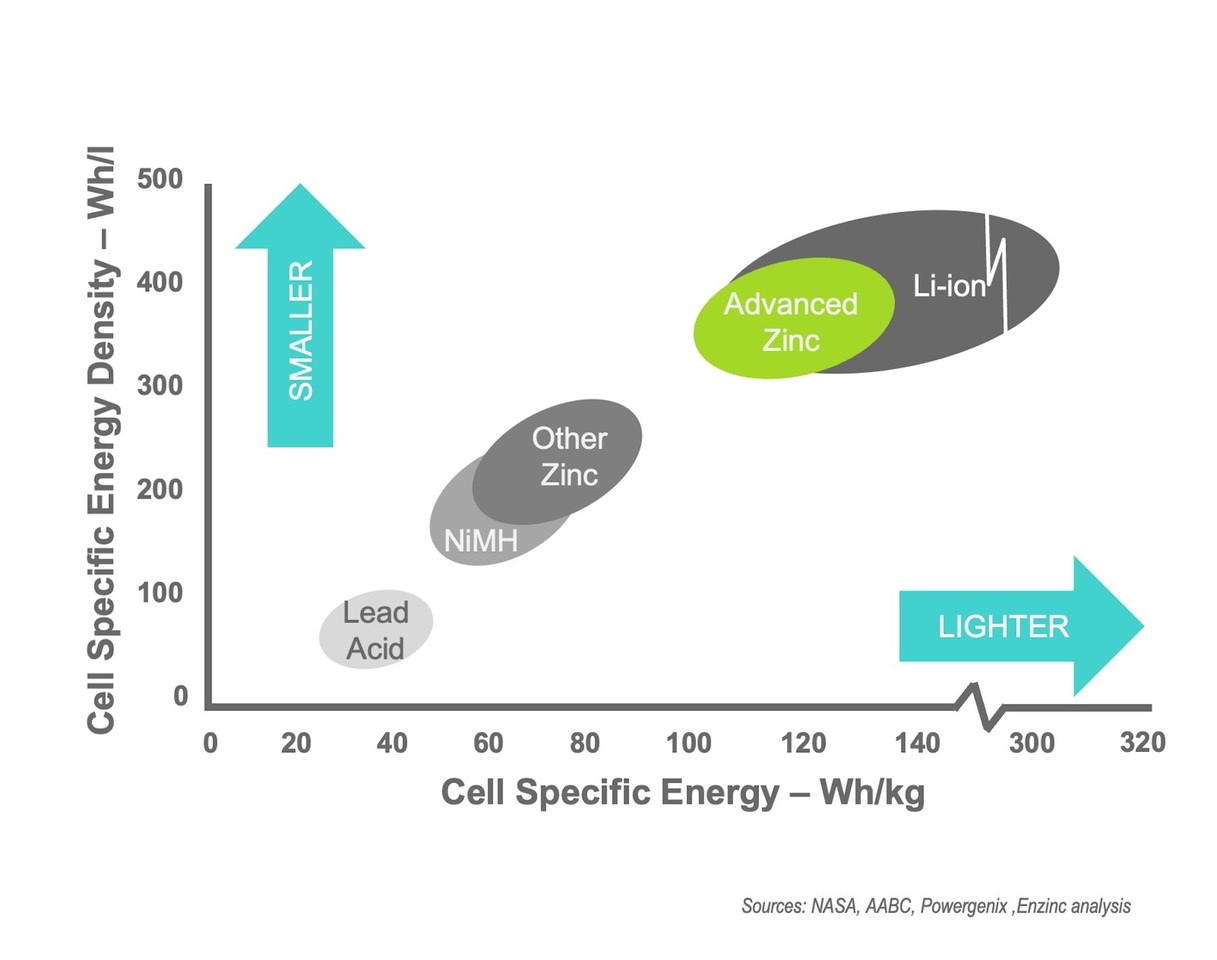

Zinc batteries are powerful and can be a drop-in replacement for lead-acid batteries. Depending on the manufacturer, they deliver energy densities of 60–130Wh/kg without resorting to bulky and complex flow systems. These higher capacities make zinc batteries competitive for grid energy storage.

And here’s the bonus: they can be produced in the same factories as lead-acid batteries, with minor equipment upgrades.

Why lithium may not be the best choice for stationary storage

Lithium-ion batteries have gained dominance due to their high energy density, which is critical in the automotive sector. Integrators who work with them understand that energy density is effectively lowered by the systems required to mitigate their inherent fire risk: Battery Management Systems (BMS), active cooling, and fire protection systems. These systems drive up costs and complexity, rendering them less suitable for stationary energy storage, where community acceptance, reliability, and cost are more important than weight and size.

Recent fires at grid-scale energy storage sites have led to increasing community resistance to deploying large lithium-ion battery systems, especially in populated areas. Additionally, fires at production facilities mean that lithium gigafactories face increasing opposition from local communities concerned about safety.

To date, however, the non-lithium offerings tend to be flow batteries, with significantly lower energy density and higher maintenance requirements due to their mechanical systems.

Lead-acid: still here but outmatched

Lead-acid batteries are no longer considered a serious option for stationary energy storage, except for a few small off-grid applications. Advanced Glass Mat (AGM) technology has increased energy density to 40–50Wh/kg, compared to older flooded lead-acid batteries’ 20–30Wh/kg. Lead-acid still dominates the market for vehicle starting, lights, and ignition (SLI) batteries; however, even the best lead-acid batteries fall short for stationary energy storage due to their relatively low energy density and shorter lifespan.

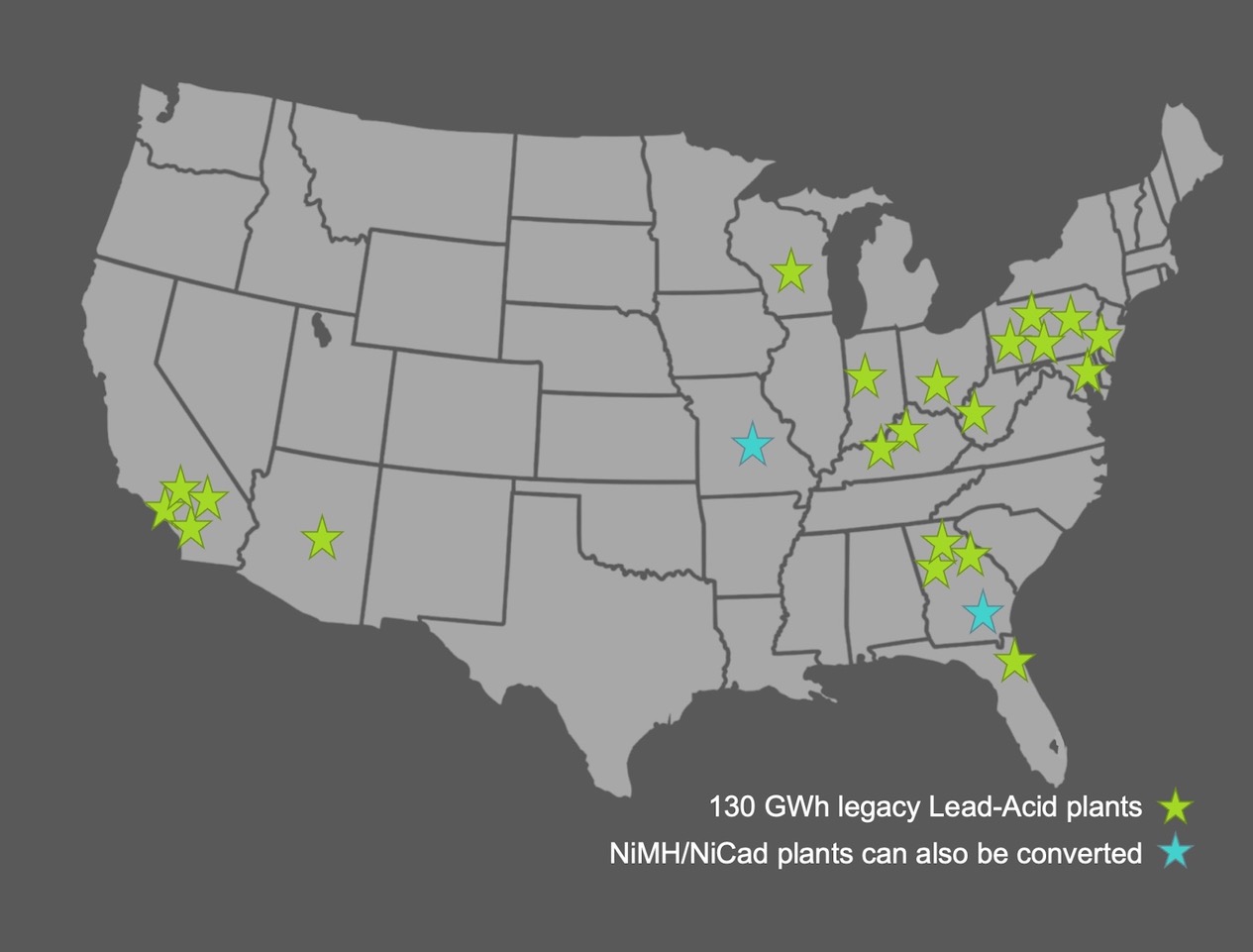

The advantage lead acid does have, however, is a large and robust American manufacturing infrastructure. It is not concentrated overseas because the batteries are heavy and relatively cheap, and America is already home to global brands and many smaller regional players.

With minor upgrades, these existing factories could be repurposed to make advanced zinc-based batteries. Not only would this allow the existing workforce to be quickly redeployed to meet growing demand, it would also bolster the domestic battery supply chain, reducing reliance on imports.

A diversified battery ecosystem

The battery industry is at a crossroads. Today, lithium-ion batteries dominate. As demand for energy storage balloons, however, relying too heavily on a single chemistry exposes the industry to risk.

As we saw in the solar industry, concentrating the production of key materials — like polysilicon, more than half of which is produced in China — led to political risk, supply chain bottlenecks, and price volatility. A battery industry that sees lithium-based batteries as the one-size-fits-all solution will be similarly vulnerable. Despite an expected strong rise in demand for battery-grade lithium through at least 2030, U.S.-based lithium extraction is not keeping pace. On the other end of the equation, lithium battery manufacturing capacity may overshoot the need.

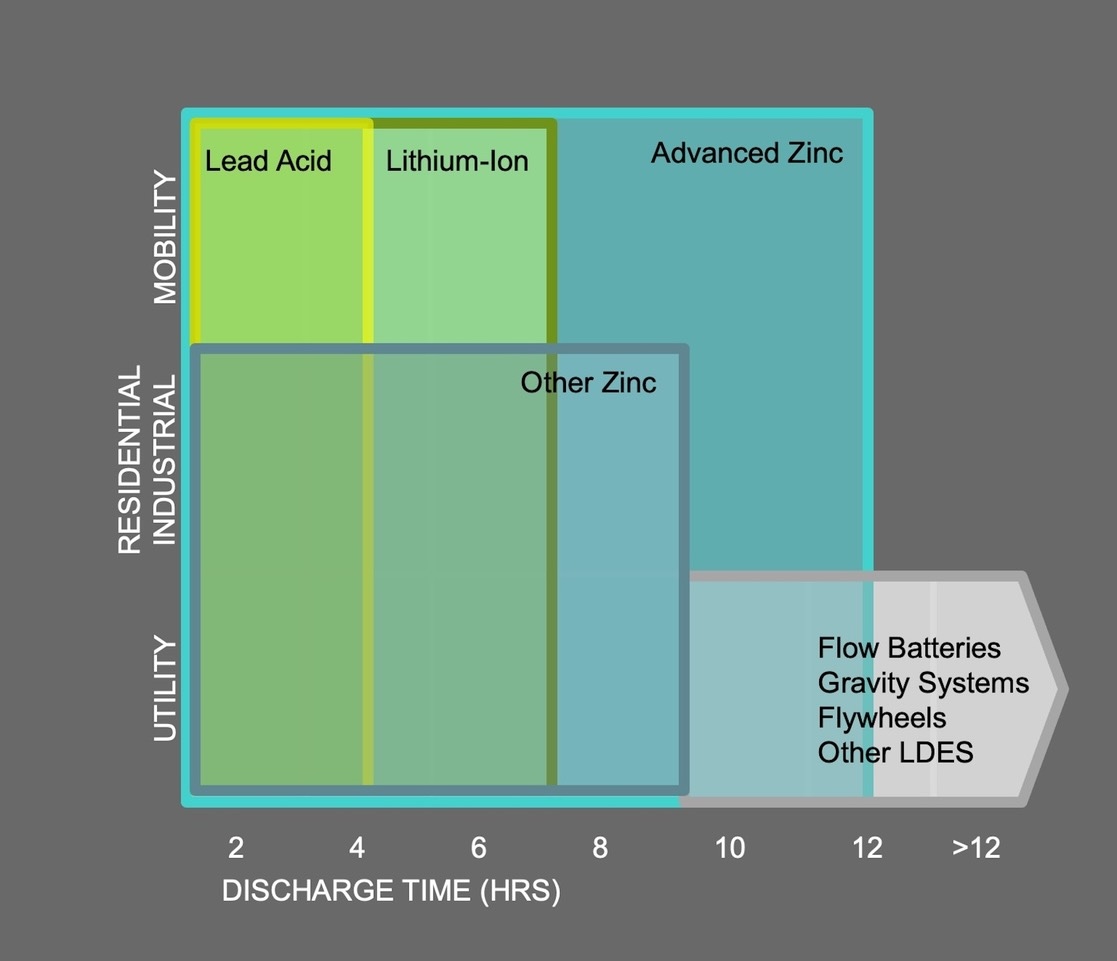

While lithium-based technologies have a place, especially in the high-end EV market, there’s a growing recognition that no single chemistry is best for all use cases. A diversified battery ecosystem lets stationary energy storage developers choose the battery chemistry that best matches a project's risk, energy, and cost constraints.

Advances in zinc batteries and other aqueous chemistries

The new Aqueous Battery Consortium, a Department of Energy-funded project led by Stanford University and the SLAC National Accelerator Laboratory, is exploring ways to make large, powerful, and environmentally sustainable batteries using water-based electrolytes and abundant materials. The group focuses on developing safe, high-density, cost-effective aqueous batteries for grid-scale energy storage. Battery chemistries that use aqueous electrolytes include nickel, zinc, manganese, bromine, and iron-based systems.

The consortium is working to overcome traditional challenges associated with aqueous batteries, including corrosion and low energy density. Some battery companies have already solved those issues for zinc, one using a technology developed by the U.S. Naval Research Laboratory that’s named as one of its top 25 technologies for the next quarter century.

Conclusion: zinc as a key to the future of stationary energy storage

The energy storage industry must embrace a more diverse range of battery technologies, especially for stationary applications. With their inherent safety, availability, and cost advantages, zinc batteries will offer a compelling alternative to lithium-ion as production scales up. As the demand for stationary energy storage grows, zinc-based batteries and other aqueous chemistries could play a critical role in ensuring the reliability, safety, and sustainability of our energy future.

By leveraging the U.S.'s plentiful supply of zinc and established network of lead-acid battery factories, the country is well-positioned to take the lead in this next wave of energy storage innovation.

Michael Burz is CEO and founder of Enzinc. Engineers at Enzinc operate from a state-of-the-art Product Development Center at the University of California, Berkeley’s Richmond Field Station, to bring battery solutions to the market

Enzinc | enzinc.com

Author: Michael Burz

Volume: 2024 November/December