Q1 Storage Pricing Insights Report Introduction

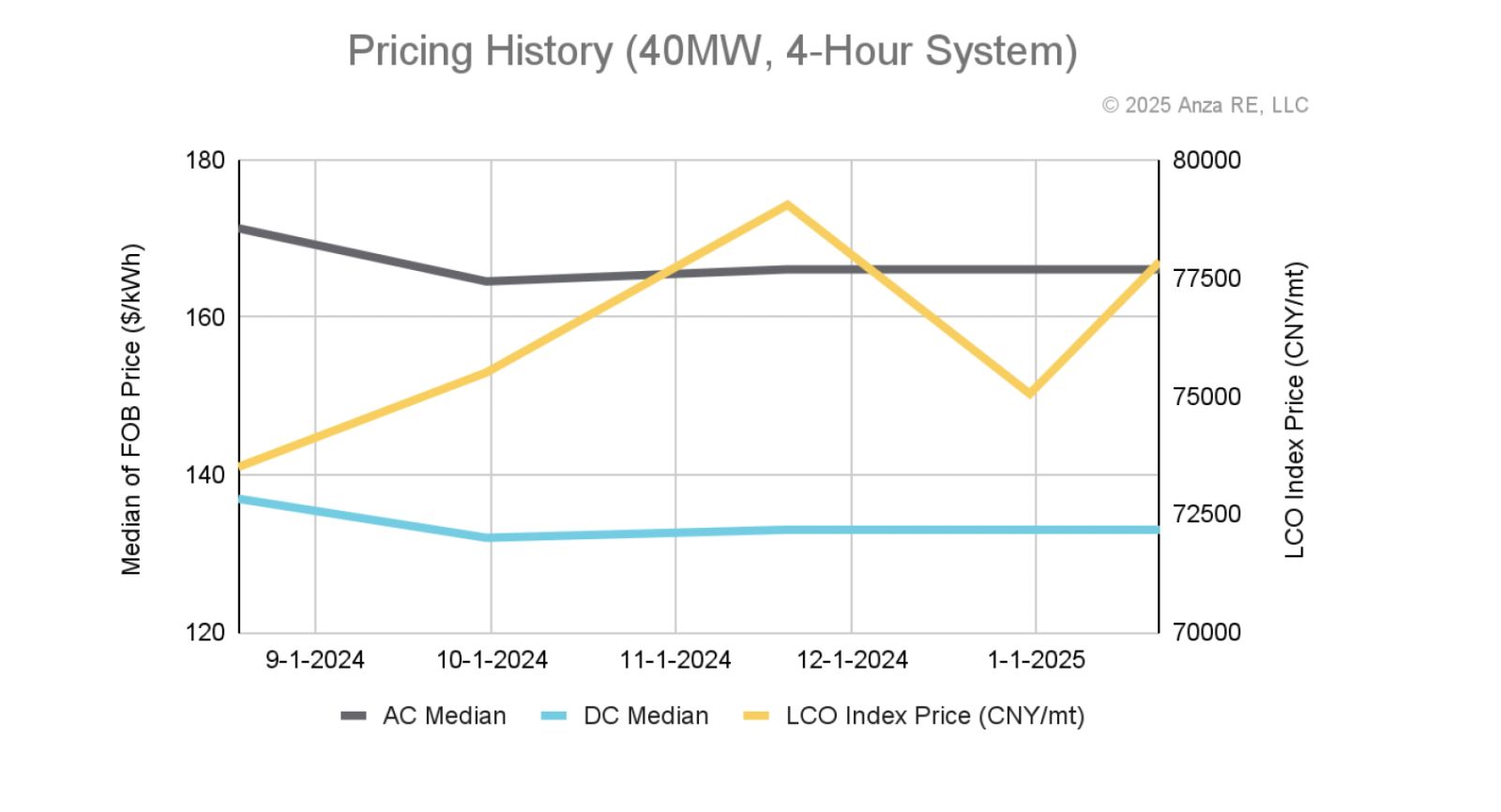

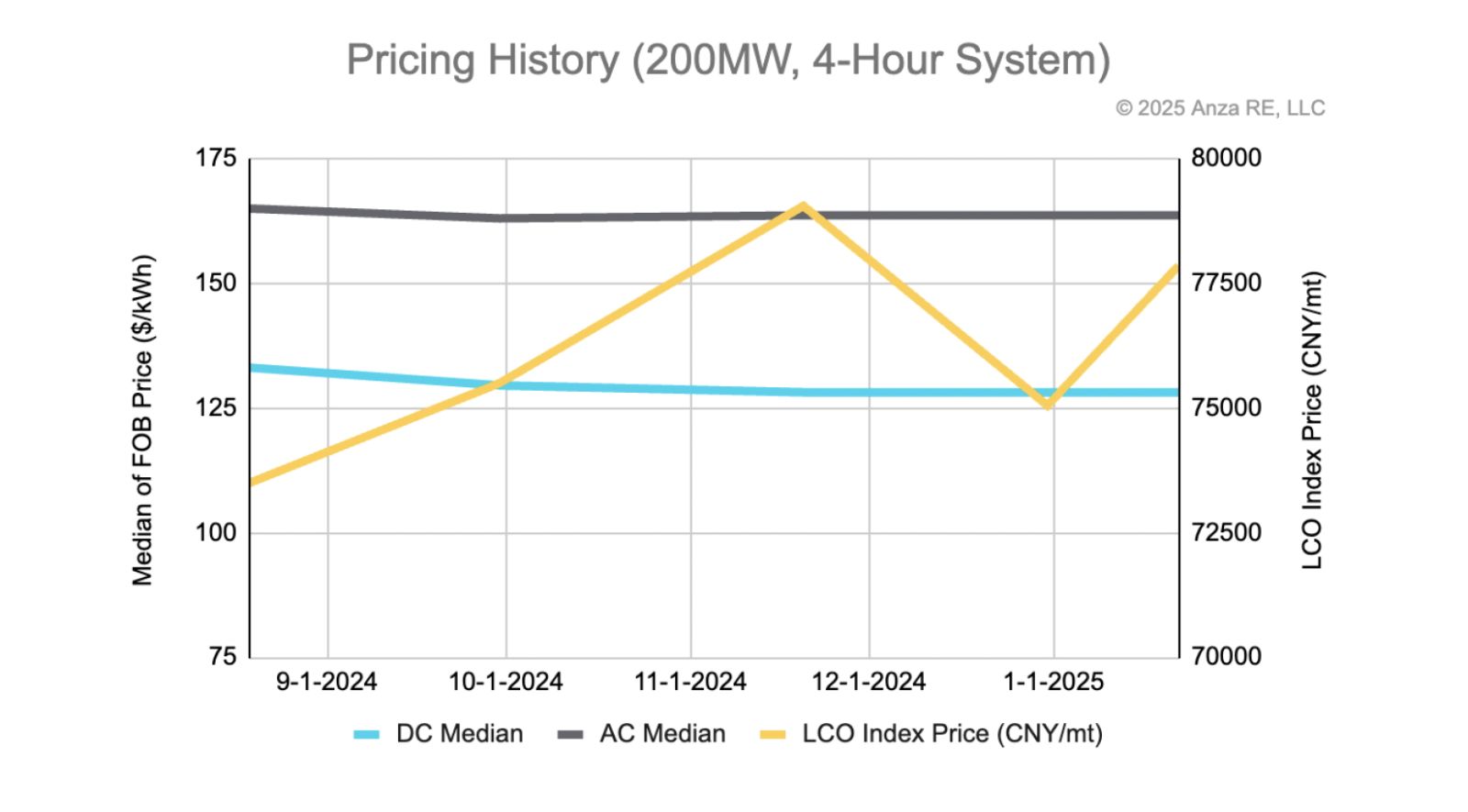

Anza’s inaugural quarterly Energy Storage Pricing Insights Report provides an overview of median list-price trends for battery energy storage systems based on recent data available on the Anza platform. We focus on two primary project archetypes: a 40 MW distributed generation (DG) project and a 200 MW utility-scale project, both sized at a 4-hour duration.

Please note:

● All figures presented are Delivered Duty Paid (DDP) prices, including U.S. Section 301 tariffs and shipping.

● The figures include data through January 31, 2025, and therefore do not currently include the 10% Chinese tariff that went into effect on February 4, 2025. We are actively collecting details from manufacturers about how pricing will change. Working with Anza gives you more market visibility during times of uncertainty.

● AC systems include the battery block, Power Conversion System (PCS), and Energy Management System (EMS).

● DC systems include only the battery block.

Key Market Factors Affecting Current Energy Storage Prices

1. Lithium Carbonate Index Prices are Leveling ○ After a steady increase from August through mid-November 2024, the Lithium Carbonate Index (LCO) index (CNY/mt) leveled out slightly this quarter, entering February at 77,500. While energy storage system prices are still subject to macro swings, this minor stabilization in lithium carbonate pricing has helped curb steep cost fluctuations in battery cell pricing.

2. More Suppliers, More Pricing Pressure ○ We are seeing more manufacturers enter the storage market than ever before. This increase in competition drives greater pricing pressure overall, helping push list prices down from prior quarters—particularly in the DG-scale segment.

3. Tariffs Are a Major Focus ○ Tariff-related issues continue to shape pricing strategies. While pricing decreased slightly from August 2024 through January 31, 2025, the imposition of Trump’s 10% universal tariff on Chinese imports is expected to significantly impact moving forward, with suppliers adjusting their quotes or deal structures accordingly. Additionally, the ITC’s preliminary affirmative determination on January 31, 2025, that Chinese active anode material will likely harm the U.S. industry adds further complexity to the tariff landscape.

4. Rise of Commercial AC and DC-Integrated OEM “Wraps” ○ There has been a notable rise in AC-integrated or “all-in-one” systems offered by system integrators and battery OEMs. This trend and the emergence of DC-integrated OEM wraps contribute to pricing variability and occasional margin compression in integration services.

5. DG vs. Utility Scale Trend ○ The continued expansion of supplier options and volume discounts for larger projects pull pricing downward for utility-scale projects. At the same time, increased competition among smaller project suppliers is closing the gap between DG and utility-scale prices.

DG-Scale 40 MW, 4-Hour System

For our analysis of a 40 MW, 4-hour distributed generation (DG) system, the median list prices have shown small changes since late August. Specifically, median AC pricing has decreased by approximately $4/kWh (about 3.0%), while median DC pricing has declined by roughly $3/kWh (around 2.9%).

Utility-Scale (200 MW, 4-Hour System)

In the case of a 200 MW, 4-hour utility-scale project, median pricing hasn’t similarly shifted since late August. Here, median AC pricing has dropped by about $1/kWh (approximately 0.8%), and median DC pricing has fallen by roughly $4/kWh (around 3.7%).

Conclusion

The data provided in our Q1 report provides an important benchmark as we reach what may be a turning point in energy storage pricing dynamics. At the macro-level, we are still in an overcapacity world across the entire battery value chain. However, while most storage suppliers have stayed put on their pricing in recent weeks (as reflected in our data through the end of January 2025), this is almost certainly about to change. The China-wide tariffs that went into effect at the beginning of February, along with the U.S. ITC’s affirmative determination of harm from Chinese imports of anode materials on January 31, have made establishing firm energy storage system pricing highly challenging in the early days of February as suppliers adjust to the new market developments.

The pricing data presented in this report is just a fraction of the extensive information available on the Anza platform. Our clients can access real-time, direct-from-supplier prices from 20 manufacturers, detailed product configurations, and equipment counts that aid development designs and financial modeling. In addition to providing negotiated and transaction pricing, our advisory services support the production of approved vendor lists, optimized shortlists, and best-and-final offerings, including contract negotiations.

Anza Renewables | https://www.anzarenewables.com/