Reshaping Insurance, Risk, and Revenues for BESS Owners and Operators

Risk management is one of the primary concerns that keeps energy storage leaders awake at night. When risk management is underpinned by predictive battery analytics, however, there are several emerging value-creation levers that battery energy storage system (BESS) owners and operators are realizing — one of which is moving towards a proactive asset management approach.

Risk management is one of the primary concerns that keeps energy storage leaders awake at night. When risk management is underpinned by predictive battery analytics, however, there are several emerging value-creation levers that battery energy storage system (BESS) owners and operators are realizing — one of which is moving towards a proactive asset management approach.

This new approach to asset management is also drawing the interest of the insurance industry.

New territory for insurers

As insurance carriers become more familiar with the range of risks inherent to storage technologies, they are coming to terms with the fact that batteries are unlike other renewable assets. Batteries involve an ongoing chemical process, which is completely different than mechanical-based technologies like solar or wind.

To put this in perspective, large-scale storage systems might have half a million or more battery cells—each having its own chemical reaction. This adds a significant amount of complexity and potential risk to storage projects.

Several of the more progressive carriers recognize that data analysis is a path toward better understanding these complex assets. These carriers use advanced battery analytics to understand what’s happening inside the systems they insure and translate it into insurance KPIs. This reduces their risk exposure.

Meanwhile, BESS owners and operators use the same battery data to inform their operational decisions, such as whether to replace a module, adjust equipment, or take corrective action to ensure optimal system performance. Rather than wait for a failure, maintenance can be scheduled at a preferred time that won’t have as big of an effect on revenue.

For example, BESS operators that deploy predictive battery analytics technology across their system during commissioning, often discover that one or more battery cells are not behaving correctly and should be replaced under the manufacturer’s warranty. For the insurer, having that information provides a more detailed picture of the BESS asset, as well as confidence that initial equipment shortfalls have been addressed and the system is now capable of running at peak performance with a reduced risk for safety incidents.

Having this inside-out perspective of the asset enables the insurer to be more precise and confident in their underwriting, and helps the BESS owners to optimize their Operations and Maintenance planning.

A high degree of caution

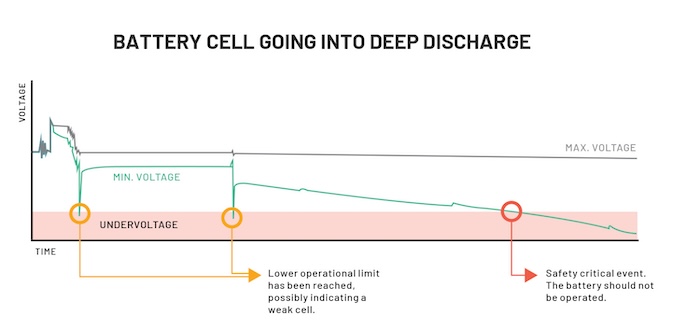

BESS insurance typically aims to protect the value of the system’s assets and revenues. Some insurance policies also include performance guarantees related to an owner or operator’s ability to fulfill contractual obligations or manage certain expectations regarding battery degradation and useful life. Battery systems are generally regarded with a high degree of caution because of the risk of thermal runaway.

Predictive analytics' ability to identify patterns and causal trends long before these issues become unstoppable makes the technology appealing to BESS owners and operators and insurance companies alike. Being able to spot potential problems early and act before they have a chance to do any harm improves overall safety and risk management for BESS operations.

The bigger the sample, the sharper the insights

While sometimes a lone indicator can warn of a potentially severe failure, looking at multiple system conditions in combination provides a clearer and deeper picture of system changes that could have downstream implications.

Effective risk monitoring requires tracking numerous indicators across multiple sites, then building an aggregate dataset that can be analyzed with AI and machine learning to pick out holistic patterns. Reviewing multiple system conditions enables predictive analytics technology to provide a clearer and deeper picture of system changes that could have downstream implications, compared with conventional data generated from a standard battery management system.

Unlocking business value

Insurance providers are now incentivizing the use of predictive analytics. Some owners and operators are receiving better insurance considerations, similar to how some insurers provide credit to automobile or homeowner’s insurance policyholders who take additional actions to reduce their risk of accidents.

BESS owners and operators often face pressure to cut costs and maximize revenues, but they often have relatively few levers to pull, since they don’t set electricity rates and have little flexibility when it comes to overhead costs. However, there are things BESS operators can do to ensure their system consistently produces maximum output, while minimizing maintenance costs and running their system in a way that extends useful life. Predictive battery analytics can help achieve these goals, while also reducing risk.

BESS operators who are adopting predictive analytics technology often reap immediate business benefits through improved physical operation and lower incident risk, as well as better insurance terms and conditions, as more insurers understand the unique risk-reducing advantages predictive analytics can bring.

Matt Besch is VP of Marketing at ACCURE Battery Intelligence, which makes batteries safer, more reliable, and sustainable using analytics.

ACCURE Battery Intelligence | www.accure.net

Author: Matt Besch

Volume: 2024 July/August