Solar

Erika and Achim Ginsberg-Klemmt

Solar

Jonathan Lwowski

Solar

Dr. Eric Schneller

As part of its Earth Week celebration, Fullerton College held a ribbon cutting ceremony to commemorate the completion of a new solar canopy system developed in partnership with ForeFront Power, a leading developer and asset manager of commercial and industrial-scale solar energy and storage projects. The 1 megawatt-DC (MW DC) solar parking canopy array, located in Student Parking Lot 5 adjacent to Sherbeck Field, is projected to save Fullerton College nearly $6 million in energy costs over the next 20 years.

Fullerton College pursued this project to save on utility costs, reduce its carbon footprint, and advance its sustainability goals of transitioning campus energy consumption to 100% renewable energy. The solar carport system will generate 1.8 million kWh of renewable energy, which is enough to power the annual electricity use of over 300 homes. This energy output will offset roughly 19% of the College’s electrical consumption.

The clean, renewable electricity production from the solar energy system will help the College avoid 1,000 tons of CO2 emissions annually, which is roughly equivalent to taking 200 cars off the road each year or offsetting the emissions from over 1 million pounds of coal burned. Put another way, the CO2 avoided each year will equal the amount of carbon sequestered by over 900 acres of U.S. forests in a year.

“After over a century of being in operation, Fullerton College is moving into the future by implementing clean energy solutions that will allow us to reliably produce clean energy, reduce harmful emissions, and reinvest energy savings into student success,” said Dr. Cynthia Olivo, President of Fullerton College. “What better time than during Earth Week to reaffirm our responsibility to the planet and future generations.”

This is a pilot solar project for North Orange County Community College District to help demonstrate how solar can benefit other campuses in the District. The project is the culmination of an initial Solar Feasibility Study completed in 2021, which helped the College identify the project site, as well as implement the College’s 2023-2026 Campus Sustainability Plan, which approved the development of the Student Lot 5 solar carport project through a Power Purchase Agreement (PPA) with ForeFront Power.

The PPA with ForeFront Power enabled Fullerton College to develop its project at no upfront cost and without using bond funds. Under the terms of the PPA, ForeFront Power develops, owns, and maintains the solar energy portfolio and charges the College a fixed, lower rate than the utility for electricity, locked in for the 20-year duration of the agreement. ForeFront Power will continue to operate and maintain the system at no cost to the College, while the College benefits from budget certainty by avoiding utility rate increases for decades to come.

“As a trusted renewable energy partner to California schools, ForeFront Power is honored to have the opportunity to help Fullerton College kick off the beginning of a decades-long journey towards transitioning to clean, renewable energy,” said Nate Smith Ide, Senior Manager at ForeFront Power. “By making clean energy more accessible and simplifying the procurement process, we’re helping schools like Fullerton College lead the way for other public institutions across California and beyond.”

Fullerton College selected ForeFront Power to develop, finance, and construct its solar and energy storage portfolio via the Renewable Energy Aggregated Procurement (REAP) Program offered by SPURR. SPURR, a Joint Powers Authority of hundreds of public education agencies, uses competitive solicitations, aggregated buying power, and technical expertise to obtain excellent pricing and terms for utilities-related goods and services. The REAP Program allows any California public agency to obtain the best solar and energy storage pricing and terms from a competitive statewide solicitation.

ForeFront Power | https://www.forefrontpower.com/

NuGen Go, the eMobility financing arm of NuGen Capital Management (NuGen), has partnered with NorCal Logistics and Motiv Electric Trucks to bring a fleet of new, fully electric vehicles to Northern California’s FedEx delivery routes. “NuGen is committed to building a cleaner, more reliable, and lower-cost energy grid. Financing transportation electrification and infrastructure is a key part of achieving that vision,” said Michael Baer, Managing Director of eMobility & Analytics at NuGen. “Our collaboration with NorCal Logistics and Motiv Electric Trucks showcases how our deep-rooted experience in the transportation, finance, logistics, and clean technology sectors can come together to drive real progress. We’re proud to help deploy these electric FedEx trucks and look forward to accelerating fleet electrification across the country.”

NorCal Logistics, a woman-owned FedEx contractor and leading pick-up and delivery service provider with nearly 25 years of experience in Northern California, partnered with NuGen to secure bridge funding and additional turnkey financing to support adding electric delivery trucks into their FedEx ground routes. The American-made, 100% electric Class 6 step vans were manufactured by California-based Motiv Electric Trucks and serve as the first electric vehicles in NorCal Logistics’ fleet.

“Adding electric vehicles to our fleet is a major step forward in NorCal Logistics’ long-term commitment to playing our part in building a more sustainable future for the next generation,” said Liz Litsas, CEO & CFO, NorCal Logistics. “We're proud to be reducing our carbon footprint while continuing to deliver for our customers. We appreciate NuGen’s partnership; their team’s deep experience in America’s clean energy sector played a critical role in helping us move this initiative from concept to reality.”

Founded in 2009 and headquartered in the San Francisco Bay Area, Motiv is a leading manufacturer of medium duty, zero-emission electric trucks and buses. Motiv produces a range of vehicles; including step vans, shuttle buses, box trucks and work trucks, all of which eliminate tailpipe CO2 emissions and particulate matter, have a lower Total Cost of Ownership compared to gas trucks, and offer drivers and passengers a more comfortable, healthier and safer ride.

“NuGen is filling a critical need in the electric truck industry,” said Scott Griffith, CEO of Motiv Electric Trucks. “While there are numerous incentives available for fleets, there is often a significant time gap between when trucks are ordered, when they are delivered and when incentive payments arrive. By filling that gap, NuGen will enable more fleets to fully take advantage of financial incentives that lower the cost of vehicles, resulting in faster adoption nationwide.”

NuGen | www.nugencapital.com

Thin film photovoltaics (PV) currently comprises a small portion of the total solar market, yet offer extensive opportunities for applying solar power in new and emerging applications. Many types of this technology offer design simplicity, ease of manufacturing, as well as cost competitiveness with silicon, making it well suited to high volume production. Despite these advantages, thin film PV has struggled to gain the same market foothold as silicon-based solar panels. The key questions remain: why has thin film PV lagged behind, and what factors could help it become more competitive in the solar industry?

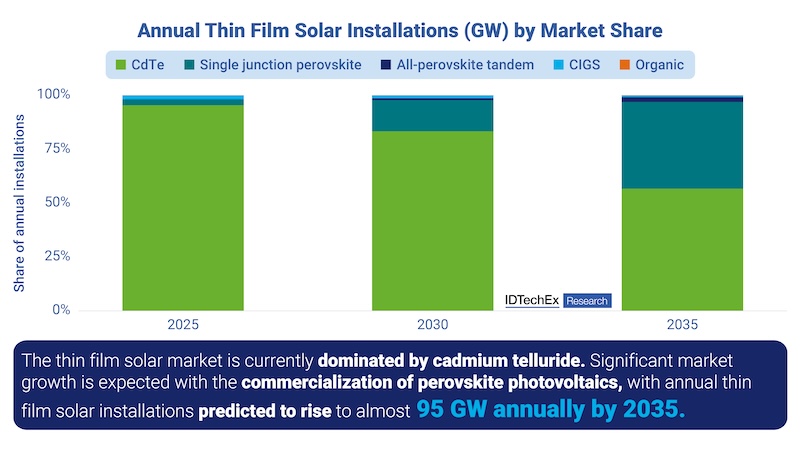

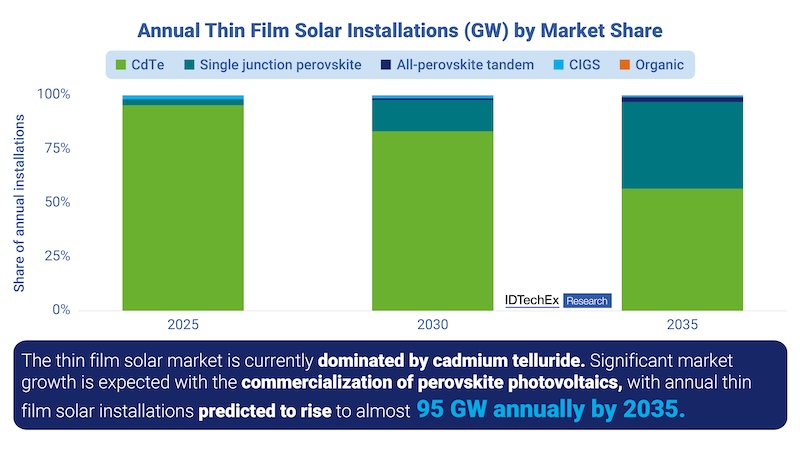

Annual thin film solar installations (GW) by market share. Source: IDTechEx

IDTechEx's report, "Thin Film Photovoltaics Market 2025-2035: Technologies, Players, and Trends", provides a deep dive into the entire thin film PV sector, analyzing the technologies, applications, and market players targeting its uptake. The report extensively covers the entire thin film PV market technologies, including dye-sensitized solar cells (DSSC), organic photovoltaics (OPV), perovskite PV, cadmium telluride (CdTe), copper indium gallium selenide (CIGS), gallium arsenide (GaAs), amorphous silicon (a-Si), and copper zinc tin sulfide (CZTS). Profiles of over 35 key market players and a detailed assessment of major applications such as solar farms, residential rooftops, building-integrated PV (BIPV), and wireless electronics help to formulate granular 10-year forecasts for the entire solar market. IDTechEx forecasts that the thin film PV market will surpass US$11 billion by 2035, with growth largely driven by the rise of a new thin film solar technology.

CdTe PV continues to dominate the thin film solar market

Cadmium telluride (CdTe) PV remains the dominant thin film solar technology and is the second most widely used solar technology after silicon. This technology has been researched since the 1950s, with modules first brought to market in the early 2000s. CdTe PV modules offer the same longevity as silicon modules (~25 years), and despite its smaller scale of production, they are very cost competitive. Additionally, due to a straightforward, relatively low temperature, and automated manufacturing process, CdTe solar modules boast an energy payback time of less than a year.

Unlike silicon PV, which is heavily reliant on China's supply chain, CdTe PV production is largely centered in the United States (US), where it has benefited significantly from policy incentives. First Solar, the largest CdTe manufacturer, accounts for over 90% of global CdTe PV production, with the US being the largest market for this technology, contributing over 30% of its utility-scale solar capacity. The 2022 Inflation Reduction Act (IRA) has further driven CdTe PV expansion by incentivizing domestic PV manufacturing, and with the uncertainty in global import tariffs, US-based CdTe PV production is likely to grow even further.

Despite its advantages, however, CdTe PV does face some challenges. The primary concern is the scarcity of tellurium, a rare element crucial for CdTe solar cells. Future shortages could lead to price volatility and restrict production capacity. In 2023, 640 metric tons of refined tellurium were produced, up from 584 metric tons in 2022, with demand continuing to rise due to its use in both growing PV and thermoelectric markets. In response, First Solar has introduced a global recycling initiative to recover 90% of materials from used modules, including CdTe absorber layers and glass substrates. While current tellurium recycling rates remain low due to the long lifespan of solar modules, early deployments reaching end-of-life from 2025 onward will likely boost the secondary tellurium supply.

Despite its longevity and cost efficiency, CdTe PV is unlikely to challenge silicon PV on a large scale. However, IDTechEx forecasts that CdTe will continue to dominate the thin film solar market, at least until the rise of a new, and highly promising technology begins to shift the landscape.

Perovskite PV to boost the thin film solar market and compete with CdTe PV

Perovskite PV is an emerging thin film solar technology that has garnered substantial academic and industry attention. This technology fundamentally operates similarly to both CdTe and silicon PV technologies but makes use of a perovskite-based semiconductor as the active layer. Perovskites are a class of materials with a cubic crystal structure in the form ABX3. In semiconducting perovskites, the A-site contains large organic cations (such as methylammonium or formamidinium), the B-site features lead or tin, and the X-site consists of halide ions.

Fabrication of perovskite solar cells is both sheet-to-sheet or roll-to-roll compatible, allowing for scalable and automated manufacturing, which is highly attractive from a financial perspective. Perovskite synthesis also requires relatively abundant and inexpensive raw materials, again helping to considerably lower manufacturing costs. By the end of the decade, IDTechEx finds that perovskite PV will be substantially lower in cost than both alternative thin film technologies as well as silicon PV, accelerating its commercial adoption.

Beyond single-junction perovskite cells, researchers are exploring tandem device architectures to push efficiency levels even higher. Single-junction technologies, including silicon, CdTe, or alternative thin films, are approaching a theoretical efficiency limit of around 30%. To overcome this limitation, perovskites can be integrated with other solar materials to create multi-junction cells, which can achieve theoretical efficiencies of up to 43%. Among the most promising tandem technologies gaining commercial interest are perovskite/silicon and all-perovskite PV. The nature of perovskite PV means that it minimally impacts the overall mechanical properties of the underlying solar device.

Perovskite photovoltaics are beginning to enter early-stage commercialization, with many industry leaders recognizing them as the next major breakthrough in solar technology. The rapid pace of innovation, growing investment, and the projected expansion of the perovskite PV market are helping to boost the thin film solar sector. IDTechEx finds that by 2035, perovskite PV will make up over 40% of all thin film solar installations, signaling a major shift in the industry.

For further details on perovskite photovoltaics and alternative thin film solar technologies, see IDTechEx's report, "Thin Film Photovoltaics Market 2025-2035: Technologies, Players, and Trends". Downloadable sample pages are available for this report.

IDTechEx | www.idtechex.com

Leading renewable energy consultancy and service provider Natural Power has provided technical due diligence and advisory services on behalf of Ardian, one of the world's leading private equity firms, for its acquisition of Akuo Energy, a leading independent power producer specialising in renewable energy, and its project portfolio.

The portfolio includes a mix of solar, wind, storage and hybrid projects located across Europe, Latin America, and the USA.

The project was led by Natural Power France, and due to the scale and nature of the portfolio, was supported by Natural Power’s UK and US teams, along with multiple local partners assisting with the review of some country-specific aspects.

Axelle Foix, Senior Due Diligence and project manager at Natural Power said: “We’re proud to have supported Ardian on this landmark acquisition. The portfolio is exceptionally diverse in terms of geography, technology and development stage, which made this a complex and rewarding project. Our international team, led from France and supported by colleagues in the UK, US and local markets, delivered a thorough and collaborative technical review across the operational and development assets. It’s a great example of our ability to bring together global expertise and local insight to support high-impact renewable investments.”

Natural Power’s experience supports banks, developers, independent power producers, utilities, and investment funds to make sound financial decisions when it comes to green energy projects. Find out more about services available here: www.naturalpower.com/uk/expertise/service/advisory/due-diligence

Natural Power | www.naturalpower.com

Ingeteam strengthens its presence in the Australian solar sector after being awarded two contracts by the company European Energy to supply its technology to two new photovoltaic plants to be built in Australia. The projects, called Lancaster and Mulwala, will contribute to the decarbonization of the country and will further its commitment to renewable energies.

.jpg)

The Lancaster solar plant will be located in Victoria and will have an installed capacity of 106 MW. The Mulwala Solar plant will be located in New South Wales and will have a capacity of 31 MW. Together, these projects are expected to come on line next year, generating approximately 255 GWh of renewable energy annually, enough to power around 54,000 Australian homes.

Specifically, the company will supply 77 inverters of its INGECON SUN Power B Series model, integrated into 22 medium-voltage power transformer stations. The scope of supply includes the commissioning of the equipment and the control electronics for the photovoltaic plants (PPCs).

Jorge Guillén, sales manager for the photovoltaic and storage sector in Australia, emphasizes that “this is the first project we have carried out for this client, which has placed its trust in Ingeteam because of our technical capacity and proven solvency in the more than 4 GW supplied in the country. We are very proud to contribute to the electrification of Australia, decarbonizing its energy matrix”.

Ingeteam has had a subsidiary in North Wollongong for more than 10 years and has a solar market share of around 25% in the country, where it has positioned itself as a technology partner that accompanies the plant developer, helping it to successfully meet the demanding technical prerequisites for grid connection.

Ingeteam | www.ingeteam.com

Atlas Renewable Energy, an international leader in renewable energy solutions and one of the top renewable energy companies in the region, has officially inaugurated its BESS del Desierto battery energy storage system (BESS). Developed in partnership with COPEC through its energy trading arm EMOAC, the project is one of the largest energy storage systems in Latin America.

Located in Chile’s Antofagasta region, BESS del Desierto has an installed capacity of 200 MW / 4 hours and storage capacity of 800 MWh. The project will use this battery storage technology to store excess solar energy generated during the day and redistribute it during peak consumption hours, increasing the energy grid’s stability while reducing renewable energy curtailment.

“Looking ahead, you do not have to choose between sustainability and reliability,” stated Carlos Barrera, co-founder and CEO of Atlas Renewable Energy. “As BESS del Desierto proves, we can have both. And Latin America, with its abundance of resources, with its ingenuity, is in a position to be a leader in this transformation globally.”

“BESS del Desierto is undoubtedly a milestone for Atlas, Chile, and for all of Latin America, but it is not unique in Atlas’ portfolio,” stated Alfredo Solar, Regional Manager of Chile & the Southern Cone for Atlas Renewable Energy. “We have multiple megaprojects in various stages of development, all of them using energy storage systems. This demonstrates the leadership Atlas has cultivated in this space, and we are very proud to see the fruits of our efforts with BESS del Desierto.”

Atlas is already preparing to use the experience gained in Chile as a reference for future implementation of battery storage in other countries in the region, including Brazil, Colombia and Mexico, reinforcing its role as an active driver of innovation and sustainability in the energy sector.

BESS Beyond Chile

As the region continues its energy transition, battery energy storage systems will become increasingly important due to their role in resolving one of renewable power’s largest challenges: intermittency. BESS solutions change this, allowing companies with high energy needs to use renewable energy even when the sun isn’t shining.

Companies from many sectors already recognize this, as proven by the $510 million financing Atlas recently closed for its Estepa project. Marking the company’s largest financing deal in its history, the hybrid solar photovoltaic and battery storage project is supported by two long-term power purchase agreements signed with Codelco and Colbun, two key players in Chile’s mining and energy sector.

“At Atlas, we don’t see this project as the finish line,” Barrera added. “This is a starting point. The challenge is no longer to prove that renewables work - it’s to prove that we can deploy them at the speed our world demands. BESS del Desierto shows that this is possible. ”

Atlas Renewable Energy | www.atlasrenewableenergy.com

To support public commercial EV charging infrastructure and fleet electrification, Greenlane has opened its inaugural advanced charging site in Colton, California, and secured its first commercial fleet customer, Nevoya, the first zero-emissions electric trucking carrier and technology-driven logistics platform in the U.S. The flagship facility, located at the intersection of Interstates 215 and 10, was completed just eight months after breaking ground, thanks to effective collaboration between public and private sector partners. It features over 40 high-speed chargers and a comfortable amenities lounge to accommodate truck drivers transporting vital goods throughout the region. The site is the first of several planned for the company’s I-15 commercial EV charging corridor. Greenlane plans to expand its network with future sites expected roughly every 60 to 90 miles in Long Beach, Barstow, and Baker, CA, pending site viability assessments and evolving needs.

As Greenlane’s first commercial fleet customer, Nevoya will begin operating a fleet of electric trucks out of the Colton site in early May 2025, utilizing charging infrastructure and on-site office space. The two companies plan to scale the partnership to include up to 100 of Nevoya’s electric trucks, leveraging Greenlane’s charging network as part of a broader collaboration to further advance sustainable freight solutions.

"At Nevoya, we’re committed to driving maximal efficiency and ease for our fleet and drivers, making Greenlane a natural partner as they lead the way for a national network of ZEV fleet refueling infrastructure,” said Sami Khan, co-founder and CEO of Nevoya. “We are honored to be the first to establish operations at the Colton site and excited to join forces with Greenlane to make switching to electric trucks scalable, cost-effective, and inevitable. Together, we have an opportunity to make strides in electrifying America’s supply chains.”

Cutting-edge infrastructure and technology were used at the Colton site to support the critical freight route along I-15, including 41 OEM-agnostic chargers with 12 pull-through lanes featuring CCS 400 kilowatt (kW) dual-port chargers with liquid-cooled cables designed to accommodate large Class 8 electric trucks. In addition, 29 bobtail lanes feature CCS 180 kW chargers, offering intelligent energy management for optimized fleet operations. The site is also engineered with precast cable trenching, allowing for future equipment expansion and upgrades to megawatt charging as fleet demand grows.

In addition to charging technology, Colton offers a range of driver-focused amenities, including a spacious lounge with food and beverage options, a water refill station, and restrooms. The facility provides free Wi-Fi, mobile device charging stations, and 24/7 customer support. Additional security measures include round-the-clock on-site attendants, security cameras, gated access, and enhanced lighting. To further support the broader transportation industry, the site also provides the ability to lease office space and truck and trailer parking, offering fleets a safe and convenient place to work and park overnight.

"America’s trucking industry keeps our economy moving, and we are committed to supporting the drivers at the heart of it,” said Patrick Macdonald-King, CEO of Greenlane. “Opening the Colton site and bringing on a top-tier partner like Nevoya in the same week is awesome, but it also reinforces that investment in high-traffic freight corridors helps drive economic growth by supporting local businesses through increased traffic and creating quality job opportunities for municipalities that have sought this growth for years. By ensuring truckers have access to reliable, high-speed charging when and where they need it, our team is helping electrify the backbone of American commerce.”

Earlier today, a ribbon cutting took place to commemorate the official opening of the Colton location. The ceremony included speeches from Greenlane’s CEO, Patrick Macdonald-King, City of Colton Mayor Frank J. Navarro, South Coast Air Quality Management District Board representative and Mayor of Highland, Larry McCallon, Daimler Truck North America’s Vice President and Chief of eMobility, Rakesh Aneja, and Nevoya’s Chief Commercial Officer, John Verdon.

The development of the Colton charging site was made possible in part by a $15 million grant from the South Coast Air Quality Management District under the Carl Moyer Zero-Emission Infrastructure Program. To learn more about Greenlane’s charging corridor and technology ecosystem, including an app, fleet portal, and much more, visit www.drivegreenlane.com or visit the Colton Greenlane Center at 1650 Fairway Drive in Colton, CA.

Greenlane Infrastructure | www.drivegreenlane.com

Nevoya | nevoya.com

Alternative Energies Mar 31, 2025

Green buildings are transforming the way we design, construct and operate structures by focusing on energy efficiency, environmental responsibility and occupant well-being. As technology evolves, innovations like organic printed semiconductor systems....

A historic milestone in renewable energy deployment has been reached in the United States, and it all started with the vision and leadership of Chief Henry Red Cloud at the Red Cloud Renewable Energy Center (RCR) in Pine Ridge, South Dakota....

Given the Trump administration’s past approach to renewable energy, solar developers and installers nationwide are bracing themselves for another period of lack of support for renewables. But the success of the Inflation Reduction Act’s (IRA) ....

The global solar industry has experienced substantial growth and maturation over the past decade. As a result, we now have easy access to high-efficiency solar panels equipped with extended warranties of 25 years or more. Considering that we rarely e....

Renewable energy sources such as wind an....

As wind energy continues to expand its r....

As the renewable energy sector continues....

Significant advancements in battery technology—including lithium-ion, solid-state, and other emerging technologies have occurred in recent years as was recently acknowledged by institutions such as the International Energy Agency and BloombergNEF([....

The move toward green, clean, sustainable energy will require a massive investment in research and development (R&D) to develop the innovations that will accelerate the modernization of North America’s electrical grids. Advancements in Battery ....

With the increase of electric vehicles on the road, there is growing demand for EV chargers. Drivers are left with a few different options: they can use a public charger, they can charge at work if they are lucky enough to have that option, or they c....

Green buildings are transforming the way we design, construct and operate structures by focusing on energy efficiency, environmental responsibility and occupant well-being. As technology evolves, innovations like organic printed semiconductor systems....

For fuel cell-powered transportation, the future hinges on investment in six key areas As a transportation mode that uses the universe’s most abundant element, one that’s renewable and yields zero tailpipe emissions other than water, hydrogen-....

As the global energy transition marches on, hydrogen remains a promising energy carrier for a decarbonized system. Demand for clean hydrogen is expected to increase two to four times by 2050, facilitating the shift to a carbon neutral grid and cleane....