Vermeer Corporation has announced its acquisition of 186 acres of land and the intent to build an all-new 300,000 square foot facility in the Des Moines metro, located in Bondurant, that will be home to initially 300+ jobs related to the manufacture and support of Vermeer industrial parts and equipment.

This investment supports the growth Vermeer has seen due to an accelerated momentum of innovation, increasing customer demand across all markets, expanded support in the field and a growing strength in the Vermeer brand worldwide.

“I’m incredibly proud of this business my grandfather, Gary Vermeer, began 78 years ago and the team doing the work to equip Vermeer customers around the world. While Pella will always be home to our headquarters, the need for Vermeer equipment has continued to grow and the innovation coming from Vermeer requires continued investment both in Pella and beyond. After announcing the launch of our Vermeer Des Moines team just three years ago, we’re excited to further our commitment to our customers, our team, the greater Des Moines metro and the state of Iowa through this investment,” said Jason Andringa, President and CEO and third generation family member.

Vermeer Des Moines operations began spring of 2023 and today the team of 143, working out of 108,000 square feet, has demonstrated an incredible ability to deliver parts and equipment Vermeer customers need as they feed and fuel communities, manage natural resources and connect people to daily needed infrastructure.

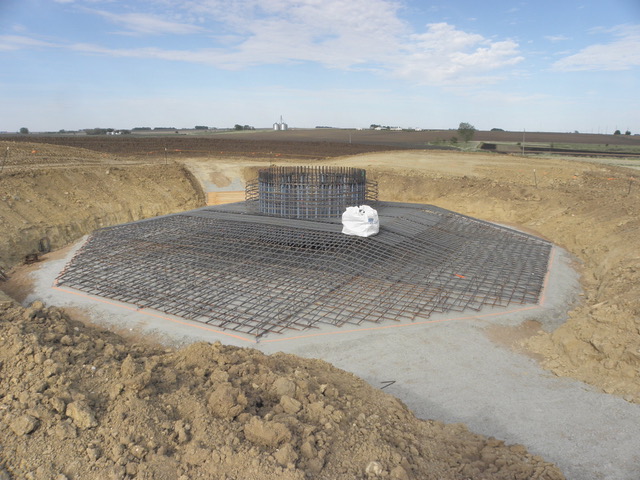

As innovators, Vermeer knows power doesn’t lie in the product alone, but in the tools, the space and the people building the equipment. This state-of-the-art facility will include advanced manufacturing tools and practices, a patented air circulation system and other exceptional investments to ensure another world-class manufacturing location.

Today, the Vermeer Des Moines team builds critical, wearable components Vermeer equipment uses during job site operations, known as Cutting Edge products. The all-new facility will serve as a state-of-the-art center of excellence for all aftermarket components supporting our Cutting Edge business. Additionally, the facility will also include full-spectrum manufacturing capability - including machining, weld, paint and assembly - giving Vermeer Des Moines versatility to meet a continually growing demand and will focus on the manufacture of key products, including new generations of equipment, from our Utility, Tree Care and Landscape product line ups.

“The Des Moines area has proven, in a short amount of time, to be a great place to build out our team and get important work done. We strive to be a top employer in the region, are committed to best-in-class manufacturing and believe this growth only helps demonstrate that. We’re proud to call Iowa home and we’re proud to build our team and our equipment right here in the heart of the Midwest,” said Mindi Vanden Bosch, Vice President of Operations and third generation family member.

The announcement of a new Vermeer Des Moines facility is the most recent investment in a series of strategic growth moves Vermeer has made following a strong growth trajectory since 2016. In the past three years alone, including upgrades across multiple facilities, Vermeer has added a 135,000 square foot expansion at Vermeer MV Solutions in Greenville, SC, opened a 312,000 square foot Global Parts Distribution Center in Pella, leased and built out 108,000 square foot facility in Des Moines, reworked 127,000 square feet of operational space in manufacturing in Goes, the Netherlands and acquired significant ownership in a manufacturer located in Queensland, Australia.

Vermeer has been in close partnership with the City of Bondurant, the Iowa Economic Development Authority (IEDA) and the Greater Des Moines Partnership. Through effective collaboration and a shared vision for the future, the City of Bondurant and the IEDA have been critical in helping make this announcement a reality.

Vermeer Corporation | https://www.vermeer.com/na

_Page_12_Image_0003.jpg)

.gif?r=1586)