Solar

Erika and Achim Ginsberg-Klemmt

Solar

Sun Ballast

Solar

Dr. Eric Schneller

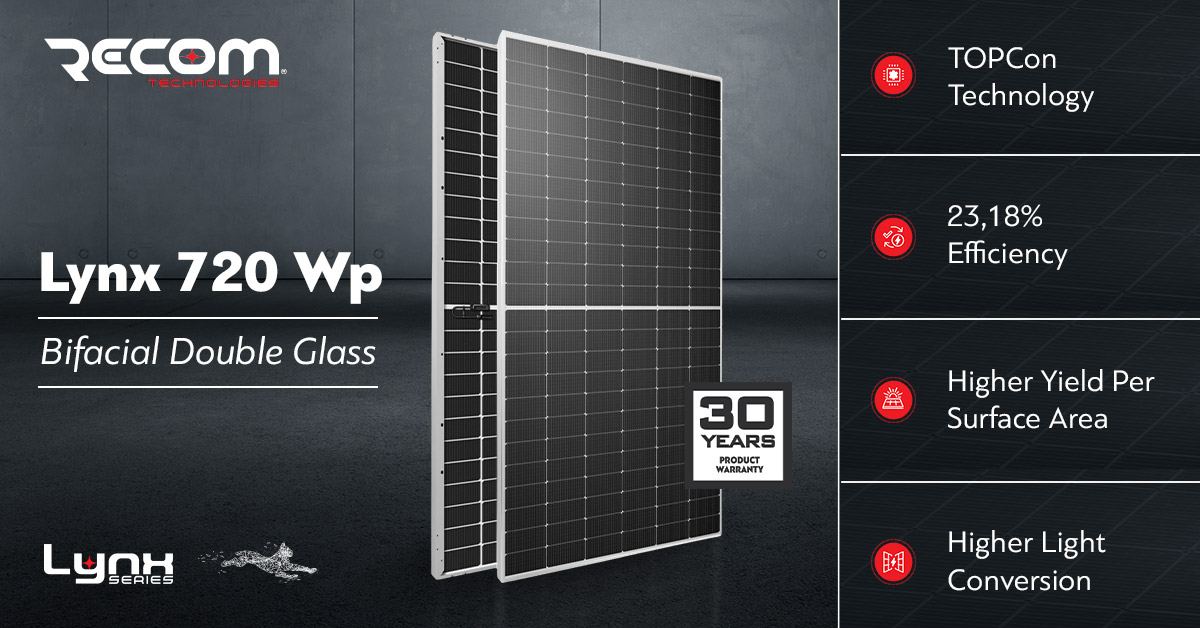

Recom Technologies, a global leader in solar energy solutions, is proud to unveil the Lynx Series TOPCon PV Module, delivering an impressive power output of up to 720Wp. Tailored for large-scale solar projects, this bifacial double-glass module maximizes efficiency and durability, setting new industry standards with cutting-edge TOPCon technology. Backed by a 30-year product warranty, the Lynx Series is engineered to provide long-term reliability and superior performance.

The Lynx bifacial series has already been widely adopted in numerous photovoltaic systems worldwide, delivering more than 10% additional power gain compared to traditional monofacial modules, thanks to its exceptional bifaciality factor of up to 90%. By capturing sunlight on both sides, these modules significantly enhance energy yield and overall project efficiency.

At the core of this innovation is the N-type TOPCon solar cell technology, recognized as the future of photovoltaic advancements. This state-of-the-art technology ensures higher performance, lower degradation rates, and superior efficiency, providing investors with long-term reliability and an accelerated return on investment.

To ensure lasting performance, the Lynx Series module comes with a 30-year product warranty and a 30-year linear power output guarantee. At the end of its service life, the module is guaranteed to retain at least 87.4% of its nominal power output, offering unmatched reliability and peace of mind for solar project developers and investors.

The Lynx Series stands as the ideal solution for those seeking a premium-quality, high-performance PV Module that delivers exceptional results over time. For more technical specifications and detailed information about the Lynx 720Wp PV Module, please click here: https://recom-tech.com/wp-content/uploads/2024/09/RCM-xxx-8DBNMxxx695-720-16-G12-33-SG-15V-005-2024-05-v3.0.pdf

RECOM Technologies | https://recom-tech.com

Catalyze, a fully integrated developer and Independent Power Producer (IPP) of distributed renewable energy assets, announced it has secured a $400 million multiyear debt facility from ATLAS SP Partners ("ATLAS"), the warehouse finance and securitized products business majority owned by Apollo funds. The financing will support the construction and aggregation of Catalyze’s growing portfolio of commercial and industrial, community solar, and battery storage projects across the United States.

The facility is designed to provide Catalyze with flexibility in its growth plans while streamlining financing for future projects. ATLAS’ financing will help support Catalyze’s growing project portfolio, currently consisting of 300 MWs in operations and construction with 1 GW+ of additional investment opportunity from its growing project development pipeline.

“This facility is a critical milestone for Catalyze in our strategy to scale distributed renewable energy solutions for businesses and communities across the United States and will enable us to double in size by the end of the year, reaching 300MW in operation,” said Jared Haines, CEO of Catalyze. “ATLAS’ deep expertise in the distributed generation sector made them an ideal partner. We look forward to building on our partnership to help meet the increasing demand for renewable energy solutions.”

“At ATLAS, we are proud to support Catalyze as they continue to lead in distributed energy project development,” said Can Baysan, Managing Director at ATLAS. “With our extensive experience in solar asset-backed financings, we were able to provide Catalyze with added flexibility that will help them execute on their expansion goals.”

Catalyze’s private equity sponsors, EnCap Investments and Actis, continue to support the company’s growth strategy as it scales its renewable energy offerings.

Catalyze | www.catalyze.com

ATLAS SP | www.atlas-sp.com

EnCap Investments | www.encapinvestments.com

Actis | www.act.is

Edinburgh-based Reoptimize Systems, a pioneering spin-out from the University of Edinburgh, is transforming wind energy efficiency with groundbreaking technology. The company is seeking to raise an additional £1 million from original and new investors as it scales innovative solutions for global wind farms.

With over 400,000 wind turbines worldwide and an industry growing at 8-10% per year, the potential market for Reoptimize Systems is vast. By optimising wind turbine performance through data-driven software adjustments, the company delivers an average 2.3% increase in energy production without requiring hardware changes. This efficiency boost translates into a recurring revenue opportunity worth £1.5 billion globally.

Currently, Reoptimize Systems operates six pilot projects across five countries, consistently demonstrating increased turbine efficiency. The company’s technology fine-tunes turbine power curves, reducing downtime, minimising mechanical stress, and extending operational lifespan. All optimisations are executed remotely, eliminating the need for on-site interventions.

Reoptimize Systems was co-founded by experts in renewable energy, Chief Executive Officer, Juan Pablo Echenique, and Chief Product Officer, Dr. Richard Crozier. Strengthening the leadership team, the company recently appointed Dr. Mike Anderson as Board Chair. Dr. Anderson, a co-founder of Renewable Energy Systems (RES), brings decades of expertise in global renewable energy initiatives. Additionally, energy technology innovator Charlie Blair has joined the team, further reinforcing Reoptimize Systems’ position at the forefront of wind energy optimisation.

The company presents a compelling investment opportunity:

Co-founder Dr Richard Crozier said: “The bottom line is clear: Global wind energy capacity is growing by 8-10% annually, and the recurring revenue opportunity from optimising 400,000 turbines at 2.3% efficiency improvement equals £1.5 billion.”

Dr. Mike Anderson added, “I’m thrilled to join Reoptimize Systems at this pivotal moment. Our technology enhances turbine efficiency, contributing significantly to the renewable energy transition. The potential for global impact is immense, making this an exciting opportunity for both the industry and investors.”

With its proven track record and scalable technology, Reoptimize Systems is poised to play a crucial role in accelerating the clean energy revolution, helping wind farm owners maximise profitability while advancing Net Zero targets.

Reoptimize Systems | https://reoptimizesystems.com/

San Diego Gas & Electric (SDG&E) announced the California Public Utilities Commission (CPUC) has approved an expansion of the company's Westside Canal Battery Energy Storage facility in California'sImperial Valley. This expansion project will add 100 megawatts (MW) of energy storage capacity to the existing 131 MW facility and is projected to be fully operational by June 2025.

"The expansion of Westside Canal is a critical step toward strengthening our region's energy resiliency and advancing California'sclean-energy goals," said Caroline Winn, chief executive officer of SDG&E. "By increasing storage capacity, we can allow more clean energy to be efficiently stored and dispatched when it's needed most, helping to create a more resilient and sustainable grid for our communities."

Following the expansion, SDG&E's Westside Canal complex will feature 231 MW of energy storage and will be the largest asset in SDG&E's utility-owned battery storage portfolio.

SDG&E's utility-owned battery storage portfolio is expected to reach nearly 480 MW of power capacity and over 1.9 GWh of energy storage by year-end, including the Westside Canal expansion and two additional projects in San Diego County currently being constructed.

Westside Canal represents a significant investment in the region's energy infrastructure, supporting local communities by providing more reliable and clean power, and positions the region as a leader in sustainable energy solutions. Battery storage is also part of SDG&E's aim to improve energy affordability by securing federal tax credits that can help reduce electric infrastructure costs. In fact, SDG&E was able to lower the average monthly electric delivery bill for residential customers for the second year in a row, in part, because the company returned $200 million in federal tax credits to customers for recently completed battery storage.

The expansion of Westside Canal will provide four key services that enhance grid reliability and efficiency:

This addition highlights SDG&E's efforts to modernize the energy grid, integrate more renewable energy, and provide a dependable power supply for the region all while prioritizing safety with advanced measures. The facility is designed to meet strict Underwriters Laboratories and National Fire Protection Association (UL/NFPA) standards and include multiple emergency stops, lockable disconnects and lightning protection.

With safety at its core, SDG&E closely adheres to recognized energy-storage safety practices through robust safety systems, strong coordination with first responders, and regular reviews of the latest research, helping advance a safe transition to a cleaner energy future.

SDG&E | https://www.sdgetoday.com/

A new Competitive Ranking by global intelligence firm ABI Research finds that Siemens AG is the leading provider of software for green hydrogen production, narrowly beating Schneider Electric to the top spot overall, leading the market across innovation and implementation criteria. Companies assessed and ranked include:

Market Leaders: Siemens AG, Schneider Electric

Mainstream: ABB, AspenTech, Homer Energy

Followers: Rockwell Automation, SLB, ZeroAvia

“As green hydrogen production capacity is increasingly established in key markets, demand for technologies that facilitate generation is accelerating. Hydrogen producers are actively seeking partners that can help accommodate the demand escalation forecasted from 2026/2027 onwards, by offering software for the design, construction, operation, scaling, and replication of physical electrolysis processes,” explains Daniel Burge, Research Analyst at ABI Research.

The ranking evaluated software vendors based on several key factors, including the impact of their solutions on the capital and operational expenses (CAPEX and OPEX) associated with H2 production costs. It also considered the breadth of their portfolios and how well they support entire plant lifecycles. The evaluation examined how well their solutions accommodate different types of electrolysis (alkaline, PEM, and solid oxide), the geographical reach and strength of their partnerships, the extent to which their solutions are already in use by large-scale producers, and how effectively their portfolios support smaller-scale, on-site green hydrogen generation.

Siemens AG leads the market, closely followed by Schneider Electric, with ABB in third place. Siemens positioned first due to its established partnerships in preeminent green H2 production regions, market-leading digital twins, and extensive, dedicated fleet management capabilities. According to Burge, “Comprehensive offerings that cover the lifecycle of production, from initial design through to the expansion and replication of operational plants, are essential for the emergent green hydrogen ecosystem. This is a commodity market where scale is crucial. Resultantly, end-to-end solutions that can support extremely large productive capacities, across multiple regions, will be vital for up to 90% of future generation.”

“Simultaneously, enterprise-level electrolysis is expected to gain traction as hydrogen solutions are adopted by distributed energy resource owners. Vendors like Homer Energy and ZeroAvia offer stage and industry specific solutions and will play an important role by providing dedicated software for smaller-scale producers. Their unique strengths offer lessons for other, larger vendors in the developing market for green hydrogen,” Burge concludes.

These findings are from ABI Research’s Software for Green Hydrogen Production Competitive Ranking report. This report is part of the company’s Smart Energy for Enterprises and Industries research service, which includes research, data, and ABI Insights.

ABI Research | www.abiresearch.com

Stardust Solar Energy Inc. (TSXV: SUN) ("Stardust Solar" or the "Company") is pleased to announce its expanding presence in the Lone Star State with a new franchise awarded to James and Valerie Mosley in Dallas-Fort Worth, Texas. Stardust Solar now has a total of 80 franchise territories across North America. This franchise forms part of the couple's investment in two territories, including one previously established in Columbia, South Carolina. With a growing population of over 7.5 million people, Dallas-Fort Worth is one of America's most dynamic regions for residential and commercial solar installations.

The Dallas-Fort Worth (DFW) territory will initially encompass Arlington and Grand Prairie, positioning the new franchise at the heart of a fast-growing metropolitan area with significant demand for clean energy solutions. Supportive state incentives, favorable sunshine levels, and increased consumer interest in reducing energy costs have created a prime environment for solar adoption.

"Expanding into Dallas-Fort Worth reinforces our strategy of targeting high-growth regions with strong demand for solar energy," said Mark Tadros, Founder and CEO of Stardust Solar. "James Mosley's track record-both as a veteran and as a leader in the renewable space-makes him well-suited to champion our mission of delivering cost-effective, sustainable power to Texas communities."

Along with the DFW franchise, the Mosleys have the option to secure additional regional markets, which could represent up to 27 new territories and over $855,000 USD in potential franchise fees over the next 12 months, should they choose to exercise their option. This potential area development agreement could encompass further zones of the Dallas-Fort Worth metro area and even the greater San Antonio region, highlighting Stardust Solar's commitment to accelerating clean energy growth throughout the state.

"Dallas-Fort Worth is the perfect stage to showcase the impact of solar power," said James T. Mosley. "We look forward to helping families and businesses here reduce their carbon footprints while enjoying lower utility bills."

Stardust Solar | www.stardustsolar.com

Hydrogen has long been a staple of industrial processes, but its potential as a decarbonisation tool remains the subject of intense debate. While its role in refining, steel production, and heavy transport is increasingly recognised, fundamental challenges persist – chief among them cost, infrastructure, and investment uncertainty.

Speaking at StocExpo 2025, industry leaders and energy transition experts examined hydrogen’s future, addressing both its promise and the obstacles hindering widespread adoption.

Hydrogen’s Role in Decarbonisation

Low-carbon hydrogen is widely viewed as a critical enabler of net-zero ambitions, particularly in sectors where direct electrification is impractical. Eugenia Belloni Pocorob, Lead H2 and CC(U)S for the Netherlands at BP, highlighted its importance in reducing refinery emissions. “Decarbonising refinery fuel is essential, and low-carbon hydrogen provides a clear pathway,” she said. However, she acknowledged the formidable hurdles. “The technical and financial challenges remain substantial, but the opportunity for emissions reduction is undeniable.”

The transport sector is also exploring hydrogen’s potential. Amit Rao, principal consultant at S&P Global, noted its long-standing use in industrial applications but pointed to new areas of demand. “We are seeing airline manufacturers investigating pure hydrogen solutions beyond sustainable aviation fuel (SAF). It may seem far-fetched now, but technological advances happen rapidly,” he observed.

Investment and Policy Uncertainty

Despite its promise, the high cost of carbon capture and storage (CCS) and hydrogen projects remains a significant barrier. “The scale of capital required for CCS projects is enormous,” said Rao. “We have already seen major industry players reconsider their green commitments. The question is: where will the funding come from, and who will drive the transition?”

Investor hesitation is another factor slowing progress. Belloni Pocorob pointed out that traditional investors are reluctant to engage in projects with long payback periods. “The appetite for quick returns does not align with the realities of hydrogen investment. We need a different type of investor – one willing to take a long-term view.”

Government intervention has played a decisive role in advancing early-stage projects. Matt Wilson, Head of New Energy Markets at Navigator Terminals, cited the UK’s approach, where government-backed competition frameworks have helped de-risk investments. “By aligning the entire value chain, these initiatives have made projects more viable,” he explained. “Future developments will build on this foundation.”

Geopolitical Headwinds and the US Factor

The trajectory of hydrogen investment is increasingly being shaped by global political dynamics. Rao warned that shifts in US policy could have far-reaching consequences. “We need to wait out the Trump presidency to gain clarity on the long-term outlook. Over the next four years, we are likely to see renewed trade conflicts – not just with China, but across the board. The US is moving towards decoupling from global markets, which will have profound implications for European industry,” he said.

Rising defence spending in Europe could also reshape energy transition priorities. “If governments allocate 3% or more of GDP to defence, other sectors will inevitably face budgetary constraints,” Rao cautioned.

Cautious Optimism Amid Market Adjustments

Despite these challenges, the panel remained cautiously optimistic. Belloni Pocorob noted that while the number of hydrogen projects has declined, awareness and momentum have grown. “We may have gone from 30 projects to fewer than five, but the fact that some are now moving into construction is significant. The energy transition is not just theoretical – we are starting to see real implementation,” she said.

Wilson echoed this sentiment, highlighting progress in the UK. “The projects we have in place are gaining traction. The policy framework is set, and the risk profile has improved. This momentum will carry through to SAF and other hydrogen-linked sectors,” he concluded.

Hydrogen may not yet be the silver bullet for industrial decarbonisation, but its role in the energy transition is becoming clearer. Whether it can fully deliver on its promise will depend on sustained investment, policy support, and the resolution of geopolitical uncertainties.

StocExpo 2025 | https://www.stocexpo.com/en/

Solar Mar 15, 2025

A historic milestone in renewable energy deployment has been reached in the United States, and it all started with the vision and leadership of Chief Henry Red Cloud at the Red Cloud Renewable Energy Center (RCR) in Pine Ridge, South Dakota....

A historic milestone in renewable energy deployment has been reached in the United States, and it all started with the vision and leadership of Chief Henry Red Cloud at the Red Cloud Renewable Energy Center (RCR) in Pine Ridge, South Dakota....

Given the Trump administration’s past approach to renewable energy, solar developers and installers nationwide are bracing themselves for another period of lack of support for renewables. But the success of the Inflation Reduction Act’s (IRA) ....

The global solar industry has experienced substantial growth and maturation over the past decade. As a result, we now have easy access to high-efficiency solar panels equipped with extended warranties of 25 years or more. Considering that we rarely e....

Renewable energy sources such as wind an....

As wind energy continues to expand its r....

As the renewable energy sector continues....

Significant advancements in battery technology—including lithium-ion, solid-state, and other emerging technologies have occurred in recent years as was recently acknowledged by institutions such as the International Energy Agency and BloombergNEF([....

The move toward green, clean, sustainable energy will require a massive investment in research and development (R&D) to develop the innovations that will accelerate the modernization of North America’s electrical grids. Advancements in Battery ....

With the increase of electric vehicles on the road, there is growing demand for EV chargers. Drivers are left with a few different options: they can use a public charger, they can charge at work if they are lucky enough to have that option, or they c....

For fuel cell-powered transportation, the future hinges on investment in six key areas As a transportation mode that uses the universe’s most abundant element, one that’s renewable and yields zero tailpipe emissions other than water, hydrogen-....

As the global energy transition marches on, hydrogen remains a promising energy carrier for a decarbonized system. Demand for clean hydrogen is expected to increase two to four times by 2050, facilitating the shift to a carbon neutral grid and cleane....

For manufacturers looking to spearhead our sustainable energy future, electrolyzers represent an attractive — albeit elusive — solution to the need for efficient green energy production. Attractive because electrolyzers have been deemed by expert....