NEW REPORT: Inflation Reduction Act Delivers Massive Economic Boost and 4X Return on Investment

A new independent study reveals that the Inflation Reduction Act (IRA) will deliver substantial economic benefits for the United States, notably growing the economy by $1.9 trillion over the next ten years. The benefits extend across the energy sector, positively impacting renewable resources, oil, gas, hydrogen, nuclear energy, and battery storage systems as well as the power sector, transportation, manufacturing, and more. Among the most significant impacts in the last two years is the substantial increase in domestic manufacturing of clean energy systems.

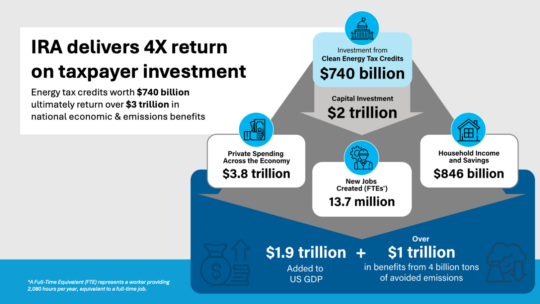

The report, commissioned by the American Clean Power Association (ACP) and conducted by ICF, analyzed the economy-wide impacts of the IRA’s energy tax credits, finding that the law will incentivize significant investments, create millions of jobs, and boost economic growth—having a lasting impact on the U.S. economy.

ACP is joined in support of the report findings by five organizations, including the U.S. Chamber of Commerce, the Edison Electric Institute, the National Electrical Manufacturers Association, the National Hydropower Association, and the Nuclear Energy Institute. A copy of the endorsement letter may be found here.

The study examines the IRA’s impact across various sectors, including power, transportation, buildings, sustainable aviation fuels, hydrogen, and manufacturing. The findings demonstrate the law’s ability to incentivize investments in clean energy technologies and infrastructure, driving economic growth and reducing greenhouse gas emissions. This study underscores the immense potential of the law to drive economic prosperity and energy innovation—a powerful tool for attracting investment, creating jobs, and deploying more energy.

The report’s findings highlight the significant economic benefits that will result from the law’s implementation. Key findings include:

- Massive Economic Impact: The IRA will spur $3.8 trillion in net spending across the U.S. economy, creating a 4x return on taxpayer investment when considering both economic and emissions benefits.

- Economic Growth: The IRA will grow the U.S. economy by $1.9 trillion, contributing to a stronger and more resilient economy.

- Job Growth: The law is expected to create 13.7 million jobs over ten years, providing a significant boost to the U.S. labor market.

- Increased Household Income: Investments resulting from the IRA will add $846 billion to household income, improving the financial well-being of millions of Americans.

“The clean energy tax credits have significantly increased domestic energy production, revitalizing communities across the country and lowering consumer energy bills. By supporting our nation’s diverse array of energy resources, the IRA is strengthening our national security and enhancing economic competitiveness,” said ACP Chief Executive Officer Jason Grumet. “With energy demand skyrocketing, the American energy industry must rise together to provide electricity that is affordable, reliable, and clean. Simply put, consistent federal policy is essential to American power.”

“These provisions are catalyzing tremendous private sector investment in new manufacturing and energy infrastructure that will keep our economy competitive for decades to come and ensure the U.S. leads the world developing technologies to bolster energy security, while also reducing emissions,” said Marty Durbin, Senior Vice President for Policy at the U.S. Chamber of Commerce.

“Energy tax credits are driving innovation and job creation in communities across the country,” said EEI interim President and CEO Pat Vincent-Collawn. “This study further demonstrates how essential these tax credits are for U.S. economic competitiveness and for our member companies’ efforts to help keep electricity bills as low as possible for our customers.”

“The U.S. is witnessing enormous growth in electricity demand driven by artificial intelligence, onshoring of manufacturing, and other economic activity. Retaining and expanding our energy security through highly reliable nuclear energy generation allows for continued innovation and economic prosperity while supporting our national security interests. The provisions in the current tax code are crucial tools in supporting continued investment in a reliable, affordable, and increasingly clean energy grid of the future. The study released today demonstrates the positive impact the tax credits included in the IRA have on energy sector and the broader U.S. economy,” said Maria Korsnick, President and Chief Executive Officer at the Nuclear Energy Institute.

“NHA applauds American Clean Power Association and ICF for conducting this study, which confirms the immense benefits and opportunities for water power that are found in the Inflation Reduction Act. In our industry alone, this landmark law helps incentivize capacity additions at existing hydropower projects, new pumped storage projects, marine energy and adding generation to existing non-powered dams. These opportunities amount to billions of dollars in potential investments for water power. NHA is committed to working with the incoming administration and Congress to keep the IRA in place and make improvements to ensure that existing baseload resources at risk of premature license surrender also receive federal support. Our industry is confident that this law can help water power play a key role in implementing an all-of-the-above American energy strategy that keeps rates low and the lights on,” said Malcolm Woolf, President and CEO of NHA.

“This study underscores the Inflation Reduction Act’s pivotal role in increasing our domestic manufacturing capabilities to accelerate our economic growth and modernize and electrify our nation’s infrastructure to meet growing energy demand. NEMA’s members have already made $12 billion in investments to date around the country to strengthen domestic manufacturing. In the upcoming months, we look forward to working alongside our industry allies and with our partners in Congress and the new Administration to protect key provisions of the IRA that continue to facilitate our nation’s energy transition toward a more connected, resilient energy future,” said Debra Phillips, NEMA President and CEO.

About this report

ICF is a non-partisan, non-political company that delivers a broad and diverse range of independent, unbiased, objective analyses and related consulting services to clients. This report may not be construed as ICF’s endorsement of any policy, regulatory, lobbying, legal, or other advocacy position or organization or political party. Any conclusions presented herein do not necessarily represent the policy or political views of ICF. ICF’s services do not constitute legal or tax advice.