Solar

Daniel E. Chartock

Energy Storage

Emerson

Solar

Garth Schultz and Mark Cerasuolo

Constellation (Nasdaq: CEG) and Calpine Corp. announced they have entered into a definitive agreement under which Constellation will acquire Calpine in a cash and stock transaction valued at an equity purchase price of approximately $16.4 billion, composed of 50 million shares of Constellation stock and $4.5 billion in cash plus the assumption of approximately $12.7 billion of Calpine net debt. After accounting for cash that is expected to be generated by Calpine between signing and the expected closing date, as well as the value of tax attributes at Calpine, the net purchase price is $26.6 billion, reflecting an attractive acquisition multiple of 7.9x 2026 EV/EBITDA.

The agreement creates the nation’s largest clean energy provider, opening opportunities to serve more customers coast-to-coast with a broader array of energy and sustainability products. Already the nation’s largest producer of 24/7 emissions-free electricity, Constellation will add Calpine, the largest U.S. producer of energy from low-emission natural gas generation and an expanded renewable energy portfolio, including the largest geothermal generation operation in the U.S. The combination also forms the nation’s leading competitive retail electric supplier, providing 2.5 million customers with a broader array of customized energy and sustainability solutions and new product offerings to help them manage energy costs and achieve their sustainability goals.

“This acquisition will help us better serve our customers across America, from families to businesses and utilities,” said Joe Dominguez, president and CEO, Constellation. “By combining Constellation’s unmatched expertise in zero-emission nuclear energy with Calpine’s industry-leading, best-in-class, low-carbon natural gas and geothermal generation fleets, we will be able to offer the broadest array of energy products and services available in the industry. Both companies have been at the forefront of America’s transition to cleaner, more reliable and secure energy, and those shared values will guide us as we pursue investments in new and existing clean technologies to meet rising demand. What makes this combination even more special is it brings together two world-class teams, with the most talented women and men in the industry, who share a noble passion for safety, sustainability, operational excellence and helping America’s families, businesses and communities thrive and grow. We look forward to welcoming the Calpine team upon closing of this transaction.”

Calpine’s low-emission natural gas plants will play a key role in maintaining grid reliability for decades to come as customers transition to cleaner energy sources. Both companies have been early investors in carbon sequestration technology to help ensure America’s abundant natural gas can continue to reliably power customers. At the same time, Constellation will invest in adding more zero-emission energy to the grid by extending the life of existing clean energy sources, exploring new advanced nuclear projects, investing in renewables and increasing the output of existing nuclear plants, in addition to restarting the Crane Clean Energy Center in Pennsylvania.

Andrew Novotny, president and CEO of Calpine, said, “This is an incredible opportunity to bring together top tier generation fleets, leading retail customer businesses and the best people in our industry to help drive a stronger American economy for a cleaner, healthier and more sustainable future. Together, we will be better positioned to bring accelerated investment in everything from zero-emission nuclear to battery storage that will power our economy in a way that puts people and our environment first. It’s a win for every American family and business in our newly combined footprint that wants clean and reliable energy. ECP’s commitment to these goals over the last seven years was critical to the progress we have made as a company and to laying a foundation for future growth.”

Tyler Reeder, president & managing partner of ECP, said, “Since acquiring Calpine in 2018, we have focused on unlocking value and driving future potential growth avenues for the business, which we believe have been recognized through this combination. We truly cannot thank the Calpine team enough for their partnership and are excited to support their continued contributions to the Constellation team. Following the closing of the transaction, we will remain committed as a shareholder of Constellation, reflecting our high confidence in the continued value and growth potential created by this combination.”

The transaction will deliver benefits to Constellation’s owners, with expected immediate adjusted (non-GAAP) operating earnings per share (EPS) accretion of more than 20% in 2026 and at least $2 per share of EPS accretion in future years. The transaction is projected to add more than $2 billion (non-GAAP) of free cash flow annually, creating strategic capital and scale to reinvest in the business. Constellation’s base earnings outlook is expected to continue growing at a double-digit rate through the decade. Constellation remains committed to a strong, investment-grade balance sheet with current ratings expected to be affirmed by S&P and Moody’s.

Strategic Benefits:

Additional Transaction Details

The cash and stock transaction will have a value of approximately $16.4 billion, composed of 50 million shares of Constellation stock using the trailing 20-day VWAP of $237.98 and $4.5 billion in cash plus the assumption of approximately $12.7 billion of Calpine net debt. Constellation expects to fund the cash portion of the transaction through a combination of cash on hand and cash flow generated by Calpine in the period between signing and closing of the transaction (that will be assumed at closing).

Reflecting their confidence in Constellation’s growth and value creation through this acquisition, Calpine’s significant shareholders, including ECP, Canada Pension Plan Investments (CPP Investments) and Access Industries, have agreed to an 18-month lock-up with respect to their equity ownership of Constellation common stock, subject to an agreed upon schedule for potential sales.

The transaction is expected to close within 12 months of signing, subject to the satisfaction of customary closing conditions, including the expiration or termination of the waiting period pursuant to the Hart-Scott-Rodino Act, and regulatory approvals from the Federal Energy Regulatory Commission, the Canadian Competition Bureau, the New York Public Service Commission, the Public Utility Commission of Texas and other regulatory agencies.

Following the close of the transaction, Constellation will continue to be headquartered in Baltimore and will continue to maintain a significant presence in Houston, where Calpine is currently headquartered.

Constellation | https://www.constellationenergy.com/

Energy Capital Partners | www.ecpgp.com

Solvari is proud to announce the addition of Josh Plaisted to its Advisory Board. Mr. Plaisted brings 25-years of solar industry experience, including a successful exit for his startup, EchoFirst. As the co-founder and CTO, he was instrumental in raising $20M in equity funding to develop and bring to market a unique solar hybrid technology. Mr. Plaisted helped secure the first of its kind contract for solar as a standard feature in new home construction with one of the nation’s largest homebuilders. Through this partnership, over 2,500 system were installed across a dozen states proving the commercial viability of net zero home construction.

Solvari is proud to announce the addition of Josh Plaisted to its Advisory Board. Mr. Plaisted brings 25-years of solar industry experience, including a successful exit for his startup, EchoFirst. As the co-founder and CTO, he was instrumental in raising $20M in equity funding to develop and bring to market a unique solar hybrid technology. Mr. Plaisted helped secure the first of its kind contract for solar as a standard feature in new home construction with one of the nation’s largest homebuilders. Through this partnership, over 2,500 system were installed across a dozen states proving the commercial viability of net zero home construction.

Mr. Plaisted also brings extensive executive level experience as a former VP of Product Development at Flex, the 4th largest electronics manufacturing services company in the world, and at SunEdison which was the world’s largest renewable energy developer during his tenure. At SunEdison, he managed over 45 engineers globally and led the development of power electronics, controls & monitoring, solar structures for residential applications, and system integration efforts for solar, storage, and home energy management.

“I am very excited with the addition of Mr. Plaisted to Solvari’s Advisory Board” said Samuel Truthseeker, CEO of Solvari. “We believe his product and industry knowledge coupled with his executive experience will be helpful in areas of operations, supply chain, systems integration, market fit, and upstream and downstream partnerships.”

When asked about Solvari's role in the evolving solar market, Mr. Plaisted remarked: “There is a big price difference between the US, EU and AU rooftop solar. I believe Solvari’s technology can help close this gap by minimizing customer acquisition costs through enabling roofers and other contractors that have existing customers and are already in the home to offer solar. In my experience, Roofers see the possibility of growing their business with solar, but are waiting for a high margin low complexity solution that is simple, fast, and easy to operationalize before they will commit. I believe Solvari is that solution.”

When asked why he decided to join Solvari’s Advisory Board, Mr. Plaisted replied:

"Throughout my years working with Mr. Truthseeker, he consistently demonstrated his problem-solving ingenuity through his engineering expertise, deep market insight, and sharp business acumen. Recognizing early the true promise of direct-to-deck mounting and advanced polymeric racking, he applied relentless determination and grit to turn those visionary concepts into reality through Solvari."

Mr. Plaisted will advise on our supply chain, fundraising, future product development, and operations. In addition, he will provide guidance on strategic relationships and commercial opportunities for Solvari and its products.

Solvari | www.solvarisolar.com

PureSky Energy, a leader in sustainable energy solutions, announced today that Cotuit, a 4.4 MWdc community solar farm with 1.4 MWdc battery energy storage solution in Sandwich, MA, has reached commercial operation, marking PureSky's 11th site in the State of Massachusetts and 35th across the United States.

ASD Cotuit MA Solar LLC

The Cotuit solar farm supports the region through supplying lower cost energy and revenue to the municipality. PureSky donated the land to the local municipality, Sandwich and is leasing it from them, providing annual income. As the single offtaker of the Cotuit community solar farm, a second neighboring municipality has also agreed to purchase community solar credits at a reduced rate, saving on the cost of electricity for the lifetime of the solar farm. This commitment demonstrates their leadership and dedication to local renewable energy development and innovations in energy storage, increasing the resilience of the grid and reducing the risk of power outages.

"Partnerships with municipalities are fundamental to advancing the renewable energy transition and increasing the resilience of the grid through battery energy storage solutions," says Nicholas Topping, Vice President of Community Solar at PureSky Energy. "The town demonstrated exceptional leadership in quickly recognizing the value of community solar as an innovative way to support local renewable energy development and bring the benefits of solar to their residents."

The Cotuit community solar farm exemplifies how renewable energy is well-positioned to build innovative partnerships that support the local community while advancing a clean and reliable energy future. As the strain and demand on electricity grids increase in Massachusetts and across the United States, building long-term relationships with local communities are pivotal to transitioning to more sustainable and resilient energy grid. The Cotuit community solar farm underscores PureSky's commitment to expanding access to the benefits of community solar and to deliver renewable energy solutions that serve local communities.

PureSky is committed to delivering sustainable energy solutions to the State of Massachusetts. Corporations, municipalities, organizations, and institutions interested in learning more about becoming project anchors should contact customercare@pureskyenergy.com.

PureSky Energy | www.pureskyenergy.com

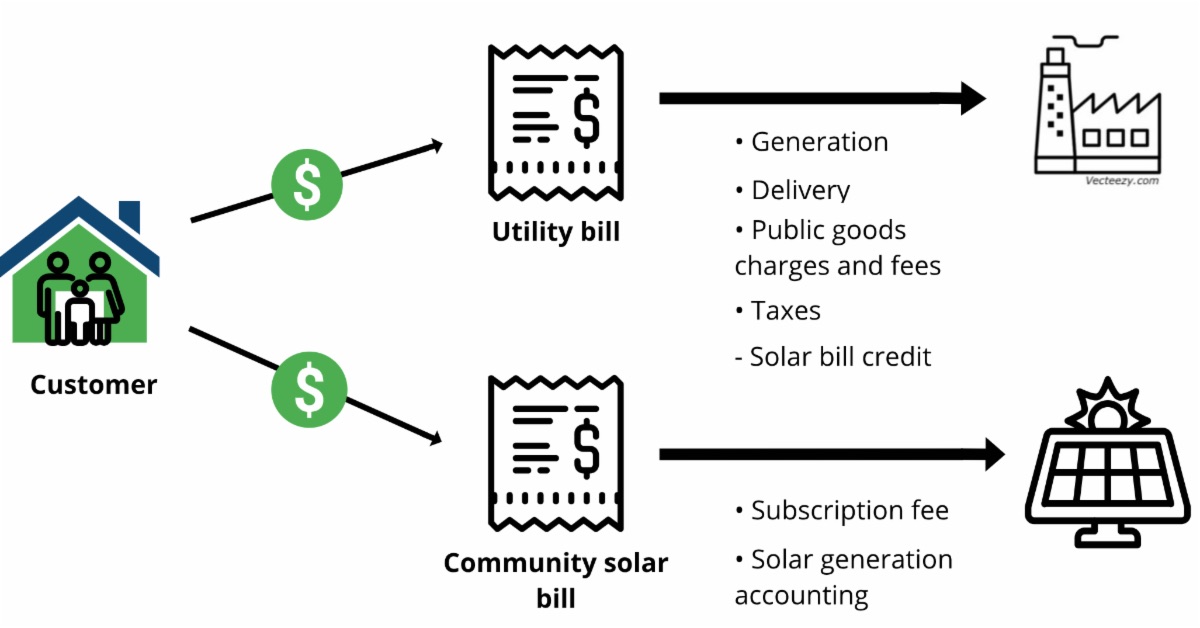

As community solar grows nationwide, customers sometimes face a confusing situation – getting a bill from their community solar provider and a separate bill from their utility. Customers have to do their own math to calculate the savings from their subscription.

In other cases, utilities and community solar companies have joined forces to provide a single bill, with all charges and credits consolidated. Single bills provide increased transparency, improved customer experience, and, ultimately, increased retention rates and decreased subscriber acquisition costs.

In a new report for the National Community Solar Partnership (NCSP+) program, national lab researchers explore the issues around consolidated billing, including costs and benefits, software changes, consumer protection, and alternative approaches.

Complications

While consolidated billing is simple in concept, it can face daunting administrative, technical, and financial hurdles. Billing structures can vary across states and utilities, with complex and disparate customer data. Software can be complicated and expensive, creating a need to either update existing systems or adopt new platforms. Billing can be managed completely differently between regulated and competitive retail markets.

Implementation timelines can sometimes require several years to deploy automated systems. And implementation costs can range from hundreds of thousands to millions of dollars, depending on the utility’s existing infrastructure and experience.

Implications and alternatives

Consumer protections are also of paramount importance for billing. Community solar subscriptions can complicate how partial payment or nonpayment is handled, and could lead to utility service disconnections. We briefly review lessons learned from on-bill repayment programs, such as Pay As You Save, to see how other third-party transactions are managed on utility bills.

Lastly, the report explores alternatives to utility consolidated billing, such as third-party consolidated billing, automatic bill crediting, and “single accounting/dual billing” approaches, which aim to provide similar benefits without the full-scale adoption of utility consolidated billing. These alternatives could offer simpler and more immediate solutions for states and utilities facing implementation challenges.

Although consolidated billing offers significant benefits for community solar programs, particularly in customer understanding and satisfaction, its implementation can be complex and requires careful consideration of administrative, technical, and financial factors. This report helps states and utilities learn from the experiences of others to find the most suitable path forward.

The report, Community Solar Consolidated Billing: An Exploration of Implementation and Alternatives, was written as a response for technical assistance under the National Community Solar Partnership (NCSP+), an initiative of the U.S. Department of Energy’s Solar Energy Technologies Office. It was written by Simon Sandler and Jenna Harmon of the National Renewable Energy Laboratory and by Bentham Paulos of Lawrence Berkeley National Laboratory.

National Renewable Energy Laboratory | https://www.nrel.gov/

Tech Safety Lines, a global leader in life-saving safety training and equipment for industries including wind energy, construction, and telecommunications, has been honored as the first-ever recipient of the Mayor’s Spotlight Award. CEO Diane Waghorne accepted the prestigious award on behalf of the company during a ceremony at City Hall, where Mayor Steve Babick delivered a keynote address highlighting Tech Safety Lines’ industry leadership and community contributions.

The Mayor’s Spotlight Award, part of Carrollton’s Business Retention & Industry Development Program, was established to recognize exemplary local businesses that drive innovation, growth, and excellence while enhancing the community’s prosperity. This award celebrates companies that embody Carrollton’s vision of a thriving business ecosystem and a strong, connected community.

Mayor Babick lauded Tech Safety Lines for its global impact on safety training and equipment while remaining deeply engaged with local initiatives. Since establishing its Carrollton headquarters in 2012, Tech Safety Lines has set international standards for fall protection and rescue training. The company also demonstrates its commitment to public safety by offering state-of-the-art training facilities free of charge to local first responders for skill development and internal exercises.

Diane Waghorne, the driving force behind Tech Safety Lines’ innovation and success for more than two decades, delivered a heartfelt speech. “Receiving the inaugural Mayor’s Spotlight Award is a tremendous honor,” Waghorne remarked. “Carrollton has been an integral part of our journey, providing a supportive and dynamic environment that aligns with our mission to protect lives. This recognition reflects the hard work of our incredible team, the trust of our clients, and the strength of our partnerships. We look forward to deepening our roots in this community and continuing to lead with safety and innovation.”

The ceremony also featured a video presentation showcasing Tech Safety Lines’ achievements and ongoing community engagement.

Tech Safety Lines | www.techsafetylines.com

The National Association of Manufacturers (NAM) announced that National Electrical Manufacturers Association (NEMA) President and CEO Debra Phillips has been appointed to its Board of the Council of Manufacturing Associations (CMA). NEMA represents leading manufacturers of electrical technologies essential to a resilient grid, modern mobility systems, efficient industrial operations and smart building applications. Electrical manufacturers are instrumental to America’s critical infrastructure, national security and economic growth.

As part of the CMA Board, Phillips will guide work to advance policies that enhance U.S. manufacturing priorities and to collaborate across the American manufacturing sector to achieve shared objectives.

“There has never been a more exciting moment for U.S. manufacturing and I look forward to advancing the opportunities for our critical sector as part of NAM’s CMA Board,” said Debra Phillips, President and CEO, NEMA. “The electroindustry is one of the largest manufacturing sectors in the U.S. economy and this new role will provide an opportunity to add our voice and leadership to the growing domestic manufacturing base. I look forward to working together with fellow industry leaders to advance our shared goals.”

NEMA | www.nema.org

On Friday, January 10, 2025, the US Department of the Treasury officially published final guidance regarding the 45V Clean Hydrogen Production Tax Credit.

Clean Energy Group applauds the Treasury for not bowing to industry pressure to relax the core principles of its initial draft guidance, ensuring that 45V will primarily incentivize green hydrogen, which (as long as stringent guardrails are in place) is the only form of hydrogen production that will not lead to a dangerous increase in greenhouse gas emissions. However, some concessions in the final guidance, in combination with other federal funding and tax credits for fossil fuel powered hydrogen, leaves experts concerned.

“Treasury’s 45V final guidance is a step in the right direction, but it does not go far enough,” says Abbe Ramanan, Clean Energy Group Project Director. “Without stricter guardrails in place, increased hydrogen production will perpetuate fossil fuel dependence and exacerbate climate change and local pollution.”

The final rules maintain the “three pillars” approach of the draft guidance, requiring that hydrogen production facilities must meet the following standards to be eligible for the 45V tax credit:

While the final guidance maintains these core principles, it does contain several concessions to industry lobbying that have the potential to jeopardize emissions reductions. These include loosened restrictions on what energy generation is eligible to meet the incrementality requirement, opening three pathways for using existing energy generation:

In another capitulation to the fossil fuel industry, fossil fuel alternatives like biomethane, which has a similar emissions intensity to natural gas, can be used as a feedstock for qualifying hydrogen production, although some stipulations have been put in place to limit undercounting the emissions intensity of those fuels.

The final guidance for 45V comes as the US Department of Energy’s Regional Hydrogen Hubs Initiative has continued to move forward despite significant pushback from climate scientists, environmental justice advocates, and members of communities likely to be impacted by the Hubs. The seven Hubs are supported by $7 billion in federal funding, and many of them plan to produce hydrogen at least partially with fossil fuels. While the final guidance for 45V means that some of the Hubs may not be eligible for the highest tier of the tax credit, other federal tax credits are available to subsidize fossil fuel powered hydrogen, including the 45Q tax credit for carbon capture, for which blue hydrogen projects could qualify.

Clean Energy Group |. www.cleanegroup.org

Alternative Energies Jan 10, 2025

Constellation (Nasdaq: CEG) and Calpine Corp. announced they have entered into a definitive agreement under which Constellation will acquire Calpine in a cash and stock transaction valued at an equity purchase price of approximately $16.4 billion, co....

As clean energy adoption continues to grow, the logistics of retrofitting existing buildings for solar energy have become an important topic for homeowners looking to reduce their carbon footprint and capitalize on financial incentives. Retrofitting,....

When you spend most of your time talking to farmers and folks in rural America, the biggest thing you’ll learn is this: It is harder than ever to be a farmer. In a business with already razor thin margins, equipment and supplies have significantly ....

Around 20-30 percent of solar installations are impacted by main panel limitations. NEC’s 120% rule often necessitates expensive main panel upgrades, potentially costing $2,000 to $5,000 or more with labor, permitting, and additional electrical wor....

Back in 2015, America planted the seeds ....

When the shift to clean and more renewab....

In the quest for sustainable energy, win....

Though battery storage for electric utilities has been the focus of much attention in recent years, the technology is not entirely new . Power generation and distribution companies have had access to battery energy storage systems for a long time. Ho....

2024 finally marked the return to a "normal" consumer auto market. After four years of turmoil, car buyers no longer face inventory shortages or long waits for their preferred vehicles. While many factors contributed to the auto market i....

Power grids are fundamental to the energy supply for commercial and residential electricity. There is growing energy demand around the world, and more renewable energy sources are being built all the time. Unfortunately, many existing grids and trans....

Constellation (Nasdaq: CEG) and Calpine Corp. announced they have entered into a definitive agreement under which Constellation will acquire Calpine in a cash and stock transaction valued at an equity purchase price of approximately $16.4 billion, co....

It’s a fact of life in industrial processing that in order to accomplish “good” things you must sometimes have to work with potentially “bad” things. Such is the case with liquid hydrogen, or LH2. As the industrial world continues to look f....

Transitioning away from a fossil fuel-based society will drastically increase demand for metals used in clean energy technologies. As a result, many of these metals, including nickel, cobalt, graphite, lithium, copper, and the rare earth elements (RE....