Helping California Solar Recover from NEM 3

It’s no secret that California is the nucleus of the solar industry in the United States, with the country’s largest market generating over 30 percent of the state’s electricity, supporting tens of thousands of jobs. The state took an early and large lead in distributed solar compared to others. This was not by luck; policymakers in Sacramento have long been aggressive advocates of solar power. A significant driver of California’s rapid solar adoption was a user-friendly net metering policy (first established in 1995) that treated solar energy exports and grid imports as equal in value. The simplicity of this policy made it easy for homeowners and businesses to understand how distributed solar on their buildings was a smart financial investment.

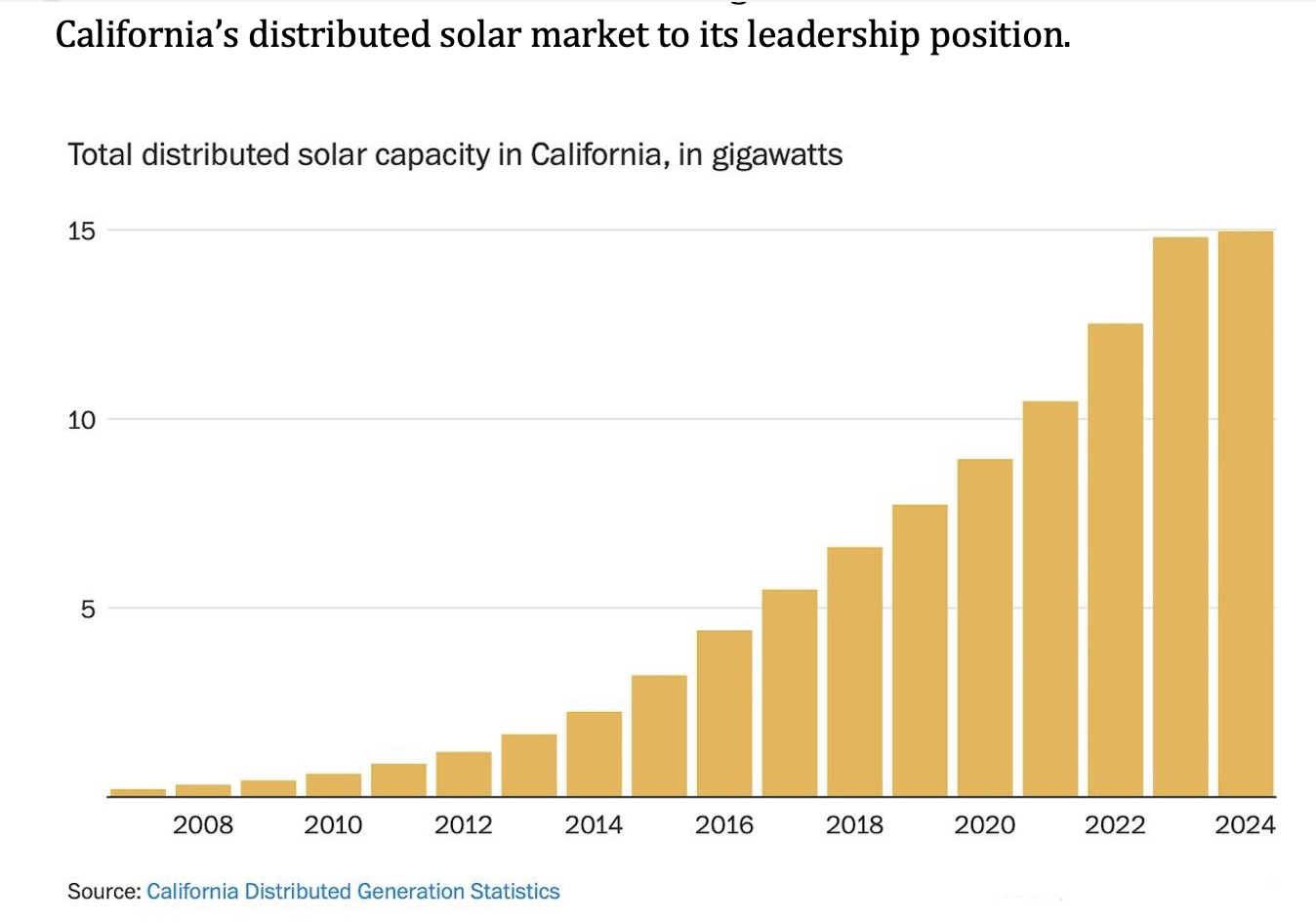

Today the state has nearly 49 gigawatts of total solar power installed. Of that, about one third — nearly 15 gigawatts — is distributed solar installed on 1.8 million homes and businesses. This stands in stark contrast to the next largest overall solar market, Texas, where over 32 GW has been deployed, but residential installations are estimated to be fewer than 300,000. In short, net metering did what it was intended to do: drive California’s distributed solar market to its leadership position.

New net metering policy brings new realities

Recent policy changes, however, have dramatically altered the economics for solar in California. The latest iteration of net metering, known as NEM 3 (or Net Billing), decoupled the value of exports and imports. The value of solar exports (when a building produces more than it uses) has been reduced by ~70 percent, on average.

It’s even more complicated than that: the value of exports also changes every hour of the year. During most hours, exports are only worth pennies. But there are a few hours, during the evenings in late summer, when exported power is worth 2 to 3 times more than imports.

This drastic change in export values dramatically reduced the payback period for solar, and the additional complexity of real-time pricing resulted in confusion and uncertainty for those considering solar. For the thousands whose livelihoods depend on installing new systems, these changes appear as a direct threat to their businesses and employment.

California residential export compensation values (for non-CARE customers)

Source: CALSSA

Time-of-Use rates

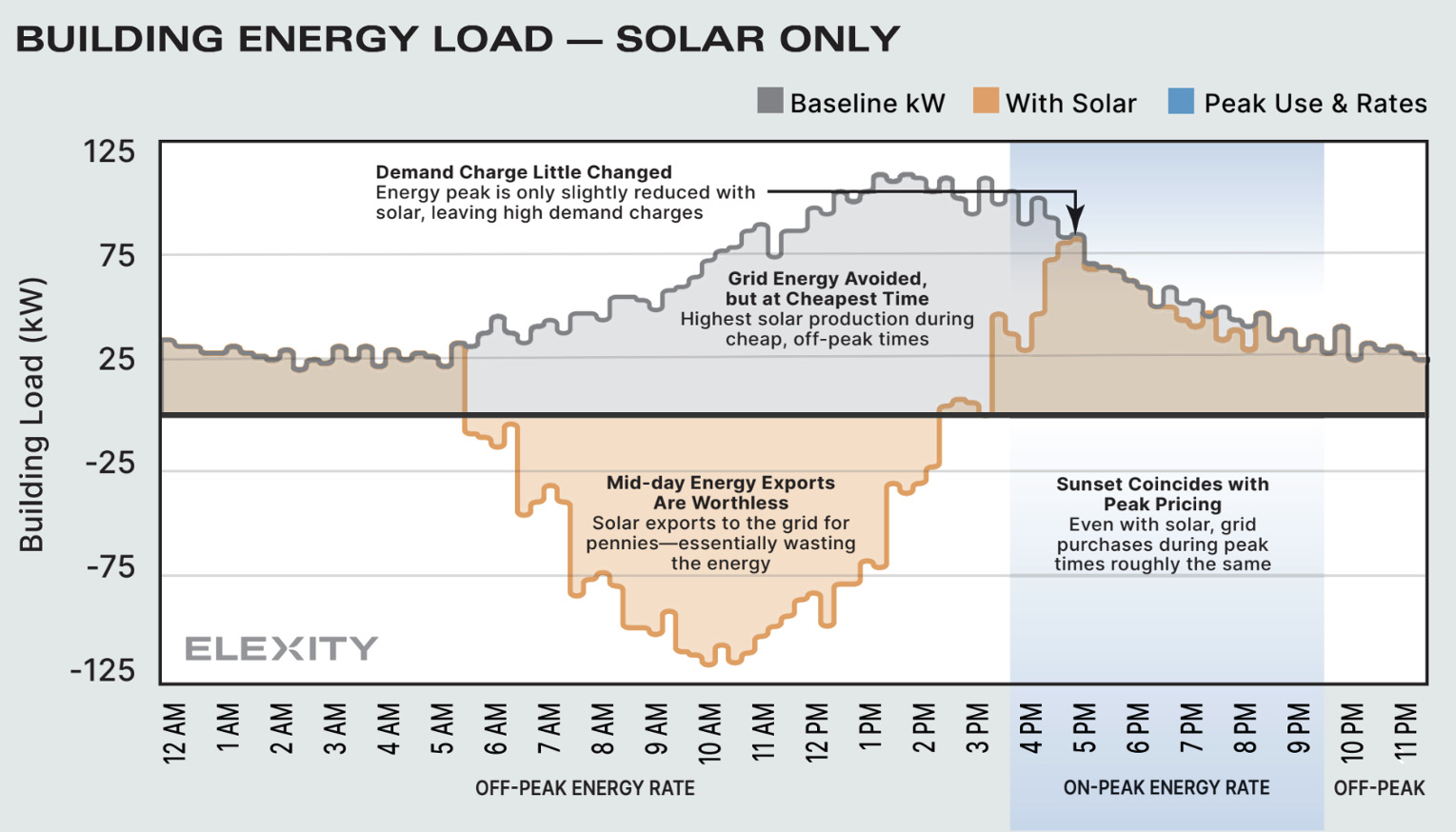

NEM 3 is not the only challenge facing the Golden State’s solar industry. California’s utilities and the CPUC have continued to advance time-of-use (TOU) rates and demand charges as the best tool for encouraging shifts when people use power. Unfortunately, recent changes to TOU structures also impact solar owners. Now more than ever, TOU rates skyrocket in the evening, just when solar energy drops off, while during the day, when solar is most productive, the rates are at their lowest. This provides little benefit for residents and businesses with solar, as the result is cheap grid energy at times when solar generation is high. Meanwhile, there’s little that solar can do to reduce demand charges — the peak load for most buildings occurs in the early morning or late afternoon, when solar production is low.

Source: Elexity

Many in California perceived NEM 3 as making solar far more expensive, since exports to the grid would be nearly worthless while TOU rates meant they could not avoid the high cost of grid energy. However, with a perspective adjustment in how homeowners and businesses perceive solar, the country’s largest solar market can yet be saved.

Benefitting from the right tools

Energy storage would seem to be a natural solution for solar to make economic sense again for private building owners. But it is important to note that traditionally storage has not been a significant part of California’s distributed solar equation. Before NEM 3 and the new TOU rates, there was not a major financial benefit to be gained by adding energy storage in homes and businesses. Though California has, by some distance, the largest installed base of energy storage in the country, this has been due to massive amounts of utility-scale storage. Utilities see the benefit in storage for resiliency, to defer substantial grid upgrades, and to avoid having to curtail solar production. Indeed, as of September 2024, nearly 84 percent of the state’s storage capacity comes from utility installations, according to the California Energy Commission.

The benefits of storage for homes and businesses have been less clear with high solar export dividends, but now the equation has shifted. On-site energy storage paired with intelligent energy management software can be a boon for residential and commercial solar in the NEM 3 landscape. The combination of storage and software to manage energy usage enables customers to take advantage of TOU rates and lower their demand charges, in ways not possible with solar alone. Working in concert with storage and solar assets, an intelligent EMS will direct energy to the battery during lower TOU grid rates, then push energy to the building from storage when grid energy is expensive in the evening — coinciding with a dropoff in solar production. The software’s load control capabilities, meanwhile, can lower demand charges up to 40 percent by shaving peaks caused by HVAC systems and EV chargers.

In optimizing solar usage, a storage + EMS solution makes distributed solar a net-positive investment — even under NEM 3 rules. Building owners wary of the cost of storage will benefit from the IRA and other incentives which, combined with the falling cost of batteries, are making energy storage increasingly affordable. By installing energy storage and load control software, residents and businesses can see a return on their distributed energy system investment within five years. Building owners can even shave a couple of years off that term if they use their storage + EMS to take part in California’s grid services programs that pay for load reduction and grid support. They can also participate in CAISO’s wholesale energy market to make money from their distributed assets.

NEM 3 doesn’t have to be the death of California solar

Generous net metering incentives may have helped build the country’s largest solar market, but it will not be a factor in the state’s continued solar growth. That does not have to spell the end of solar in California. By pairing their solar with storage and load control EMS, homeowners and businesses will still see major returns on their energy investment, even with NEM 3 in place. Commercial and residential solar may no longer make sense on their own in California, but with storage and load control, they simply join the rest of us who get by with a little help from our friends.

Mike Grenier is President of Elexity, Inc., developer of an EMS platform that includes a mobile and web-based building energy management app that remotely coordinates and optimizes batteries, climate control systems, EV chargers, and solar; tracks and analyzes utility bills; and reports on building performance scores and emissions.

Elexity, Inc. | www.elexity.io

Author: Mike Grenier

Volume: 2024 November/December

.png?r=6324)