Powering the Future: How data center growth and offtake capacity drive renewable energy innovation

The first data center development was built in 1945, to house the Electronic Numerical Integrator and Computer (ENIAC). The ENIAC was the first electronic digital programmable general-purpose computer; it occupied over 300 square feet of space, and weighed over 27 tons. Although it could only perform numeric calculations, this first data center had huge fans and vents to cool the heat generated from processing. Today’s data centers are quite different. The exponential growth of data center development around the world needed to support the digital transformation, edge computing, and increased demand for cloud services, is astounding.

Nearly half of the estimated 11,000+ data centers worldwide1 are in the United States alone. For perspective, the International Data Corporation determined that 1.2 zettabytes of new data had been created globally in 2010 (1 zettabyte = 1 trillion gigabytes). In 2025, that data creation jumps to 175 zettabytes2. Just between 2018 and 2020, more data was created than in all human history before 20183.

For the renewable energy industry, data center development presents a goldmine of opportunity, and is an increasingly sought after area for renewable energy developers. In addition to the global energy demand, data centers consume large amounts of electricity, requiring reliable and stable power. Many of the tech companies operating data centers have also set ambitious sustainability targets. On the other side of power generation, governments and local authorities offer incentives for renewable energy development, making these partnerships mutually beneficial.

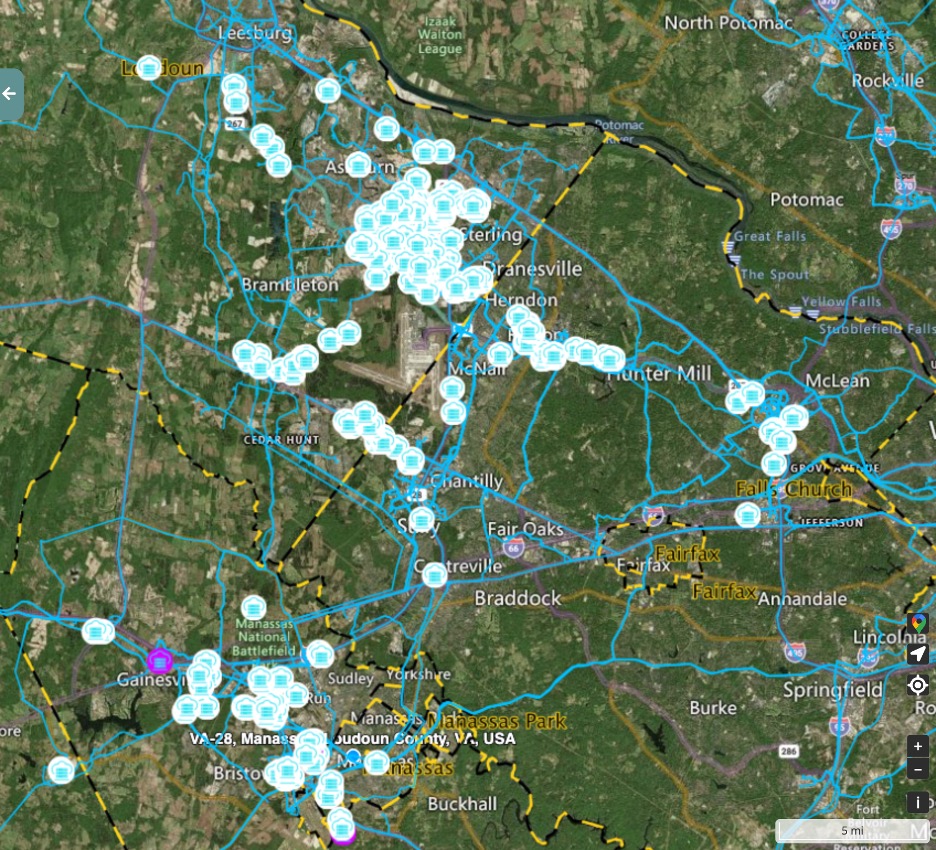

Data Center Activity in Northern Virginia as of Mid 2024.

As with any other renewable energy development, land suitability plays a critical role in the development of new data centers. Access to suitable land with robust infrastructure, reliable power supply, and favorable economic conditions is essential for their successful operation. Virginia, often referred to as the "Data Center Alley," has emerged as a major hub for data centers in the United States. In addition to numerous data centers, Virginia hosts colocation, hyperscale, and edge facilities. It is home to over 150 hyperscale data centers, representing 35 percent of all known hyperscale data centers worldwide. The current offtake capacity (the amount of power that data centers can draw from the grid to meet their operational needs) is substantial, particularly in Northern Virginia, where the robust infrastructure, reliable power supply, and favorable economic conditions are designed to support the high energy demands of numerous data centers. However, this rapid expansion has led to significant energy demands that challenge the available offtake capacity. Data centers in Northern Virginia already consume over 1,600 megawatts, with demand expected to double by 20354,5, and contribute to an anticipated 12 percent annual increase in peak electric load over the next 15 years. 6

Because the data center industry significantly boosts Virginia’s economy (generating $1.2 billion in tax revenue annually, including $1 billion for local municipalities and $174 million for the state7), state legislators have developed attractive incentives. The Virginia Economic Development Partnership (VEDP) offers a 6 percent Virginia retail sales and use tax exemption on IT equipment and enabling software. The upcoming Mega Data Center Incentive Program proposes extending these exemptions for up to 15 years on qualifying equipment; this program currently runs through 2035, and includes up to $140 million for site and infrastructure improvements, workforce development, and other project-related costs. Virginia’s Henrico County will allocate $60 million from data center revenues to its first Affordable Housing Trust Fund8, which aims to support housing affordability through grants to nonprofit and for-profit entities. The initiative follows the approval of a new data center campus by the Henrico County Board of Supervisors, reflecting Henrico’s effort to balance technological growth with community benefits, and addressing concerns about affordable housing and environmental impact.

There is also a growing emphasis on energy efficiency and sustainability, with data centers implementing measures to reduce their carbon footprint and increase the use of renewable energy sources like solar. Security and compliance with state and federal regulations remain paramount, ensuring that data centers maintain high standards of data protection and operational integrity.

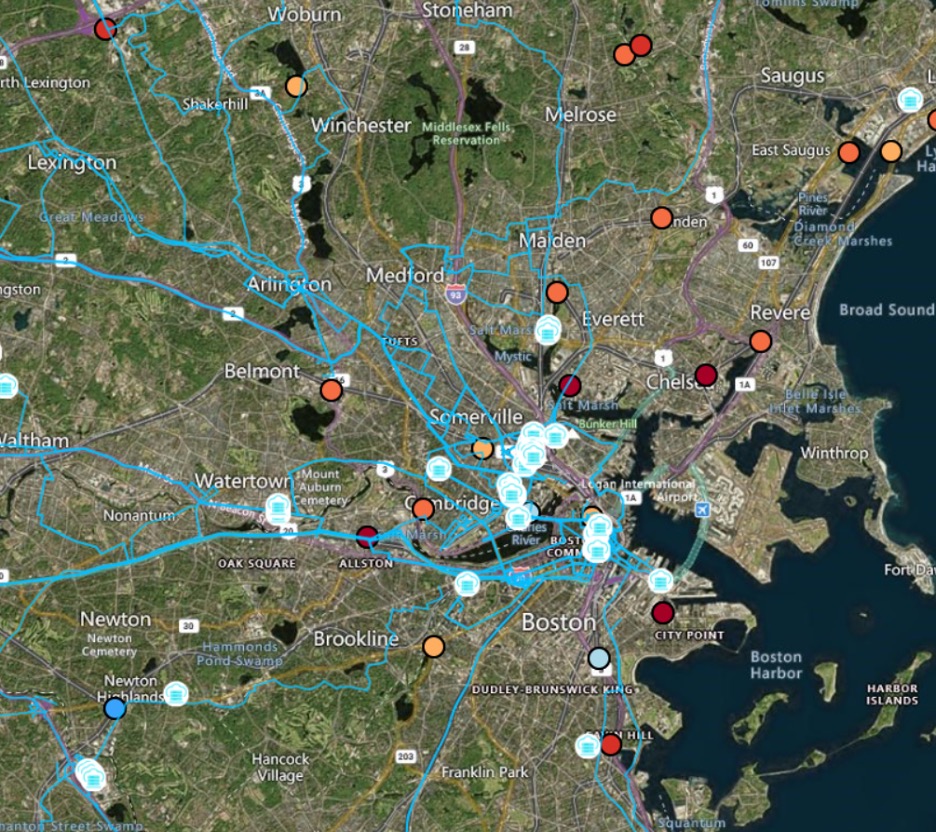

Data Centers, Fiber Optic Lines, and Mapped Offtake Capacity in Boston, Massachusetts.

Despite advancements, challenges related to infrastructure and connectivity need to be addressed. Ensuring a reliable power supply, effective cooling systems, and robust network connectivity are critical for the smooth operation of data centers. Projections indicate that the electricity demand for all of Virginia's data centers could reach 13.3 gigawatts by 2038, necessitating significant infrastructure upgrades and raising concerns about environmental sustainability9. The regulatory environment also plays a significant role in shaping the development and management of data centers; the state’s commitment to reducing carbon emissions and promoting renewable energy sources is critical in addressing the environmental impact of the growing industry. However, ample growth opportunities exist, with potential for further expansion of data centers and enhancement of offtake capacity to meet future demands.

Data Center Locations and Fiber Lines in Northern Virginia.

The trends and activities of data centers highlight their critical role in the digital economy and their significant economic impact, and are setting an example the rest of the world will undoubtedly follow. Accurate and efficient management of offtake capacity is essential for ensuring reliable operations and supporting future growth. In order to maintain a sustainable future for energy infrastructure, it is imperative for the energy industry to prioritize data accuracy and technological innovation.

Alessandra Millican is Managing Director and Ishan Bhattarai is an Energy Analyst at LandGate, a provider of data solutions for site selection, origination, development, and financing of US renewable energy and infrastructure projects.

Alessandra Millican is Managing Director and Ishan Bhattarai is an Energy Analyst at LandGate, a provider of data solutions for site selection, origination, development, and financing of US renewable energy and infrastructure projects.

LandGate | www.landgate.com

Sources:

1 “Data Centers Worldwide by Country 2024.” Statista, 2024, www.statista.com/statistics/1228433/data-centers-worldwide-by-country/.

2 Daigle, Brian. “Data Centers Around the World: A Quick Look.” United States International Trade Commission, May 2021.

3BusinessWire, “IDC Forecasts Revenues for Big Data will Reach $189.1 Billion This Year,” April 4, 2019.

4 Starner, Ron. “Data Centers: Grab Power While You Can: Electricity Is the New Gold in the Race to Build More Data Centers.” Site Selection, 2023, siteselection.com/issues/2023/nov/grab-power-while-you-can.cfm.

5 Miller, Rich. “The Cloud Needs More Land in Northern Virginia.” Data Center Frontier, Data Center Frontier, 14 Mar. 2022, www.datacenterfrontier.com/cloud/article/11427536/the-cloud-needs-more-land-in-northern-virginia.

6 https://www.novec.com/About_NOVEC/upload/NOVEC_AR-2023-compressed-2.pdf

7 Miller, Rich. “Virginia Updates Incentives to Land $35 Billion Data Center Buildout by AWS.” Data Center Frontier, Data Center Frontier, 23 Jan. 2023, www.datacenterfrontier.com/cloud/article/21545918/virginia-updates-incentives-to-land-35-billion-data-center-buildout-by-aws.

8 “Henrico to Create Trust to Enhance Access to Affordable Homeownership - Henrico County, Virginia.” Henrico County Virginia, 16 May 2024, henrico.gov/news/2024/05/henrico-to-create-trust-to-enhance-access-to-affordable-homeownership/.

9 “Dominion Planning to Power 15 More Data Centers in 2024 | Reuters.” Reuters, 2 May 2024, www.reuters.com/business/energy/dominion-energy-posts-lower-q1-profit-unfavorable-weather-2024-05-02/.

Author: Alessandra Millican and Ishan Bhattarai

Volume: 2024 September/October

.png?r=6416)

.jpg?r=3451)