Q1 2025 Solar Module Pricing Insights Report

Early Quarter Spike & Stabilization

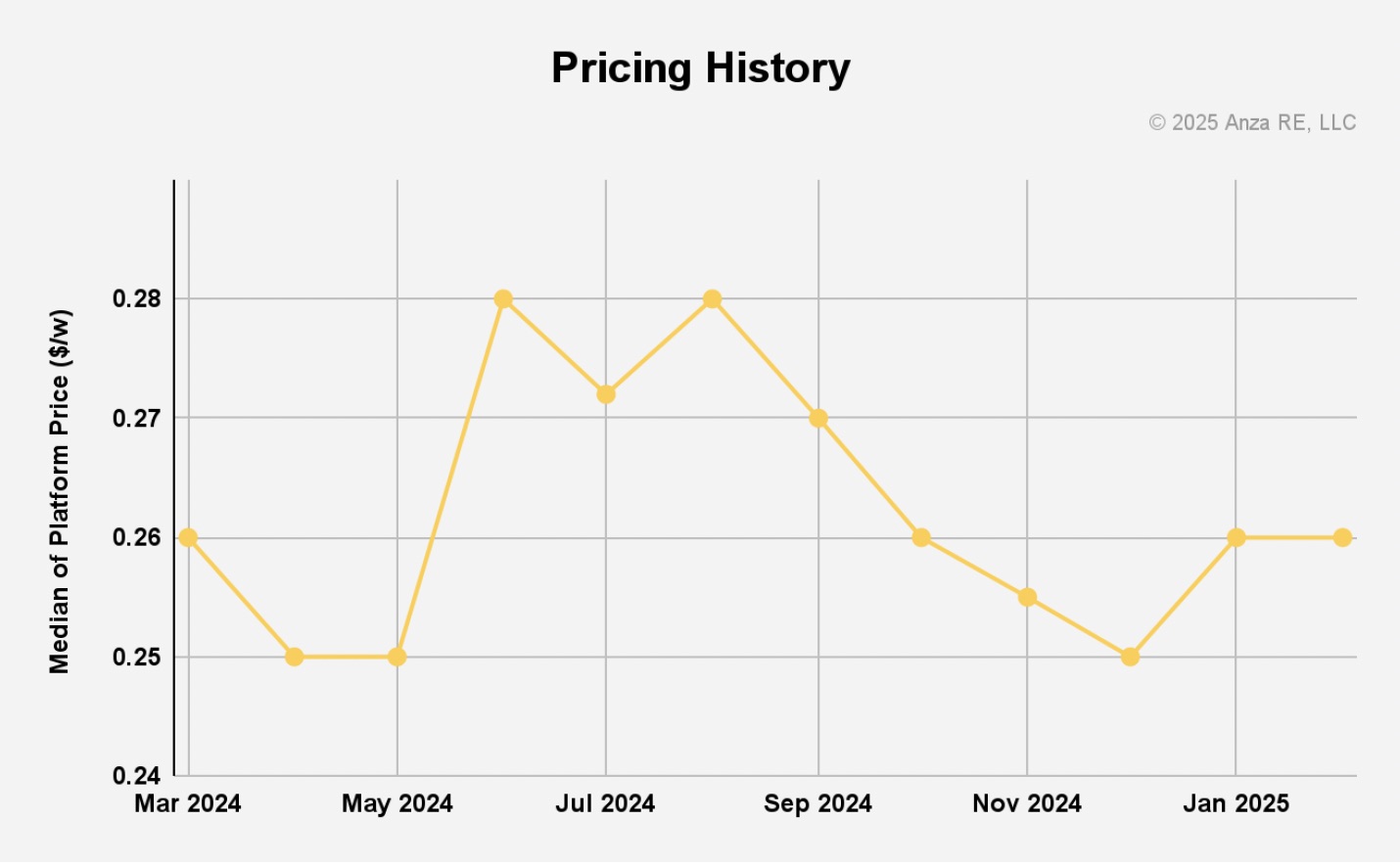

Our last quarterly report highlighted data through November 2024, when pricing steadily declined from the summer highs of 28 cents per watt. This report covering November through February notes that prices had dropped near record lows of 25 cents per watt in December. However, between December and January, prices experienced a 4% increase. This spike occurred as the market recalibrated its pricing in response to the new Trump-era tariff policies—forcing the market to reset its expectations after months of gradual declines. As uncertainty over future tariff adjustments and policy debates grew by February, prices appear to have leveled off. Despite a modest 2% increase since November, the market continues to navigate complex shifts driven by evolving trade policies and buyer caution.

It’s important to note that Section 201 tariffs are now fully integrated into our module pricing, reflecting standard industry practice; as a result, a separate chart on this impact isn’t included.

Module Technology Insights

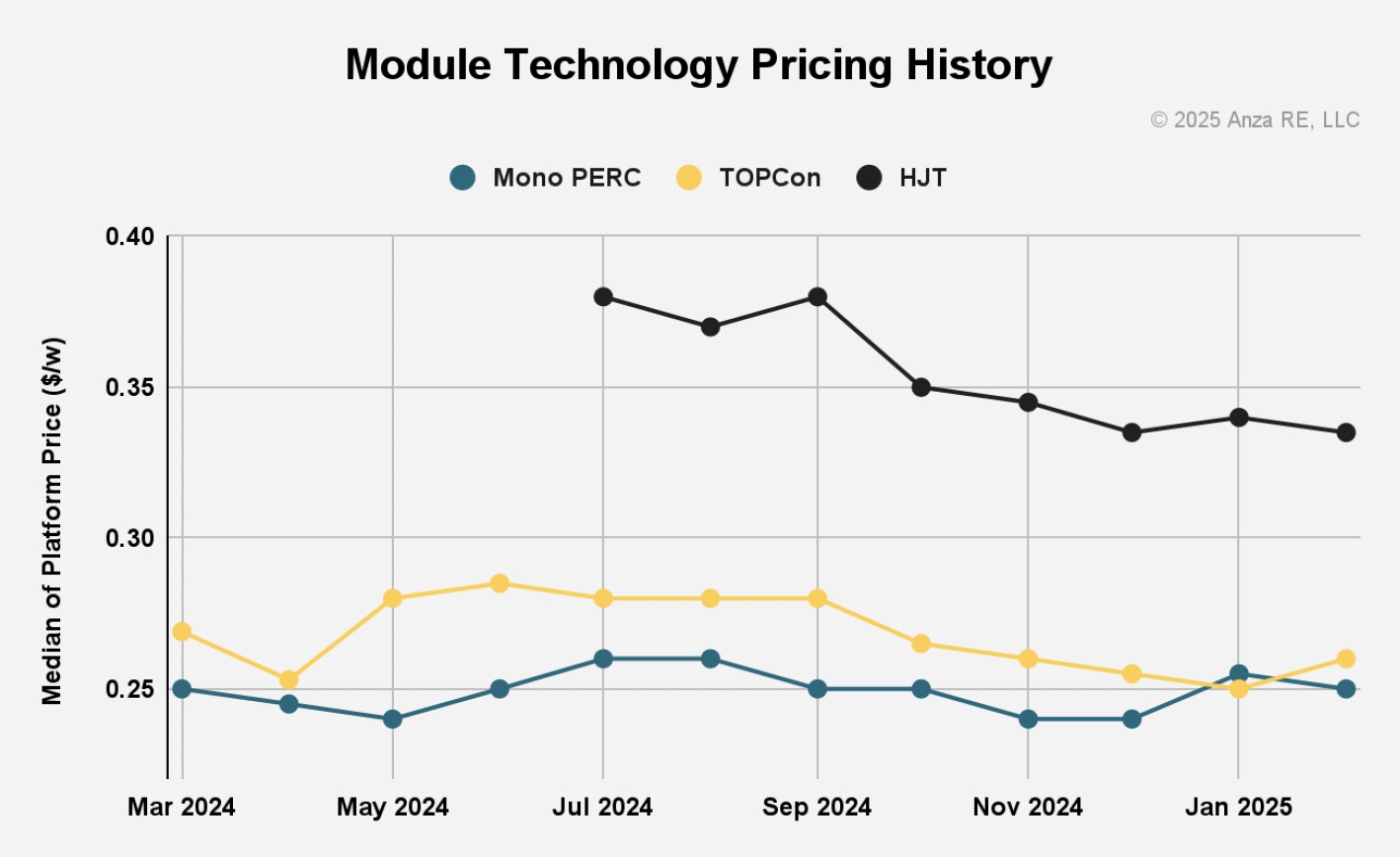

Mono PERC

Suppliers of Mono PERC technology have benefited from recent market shifts, particularly in light of the ongoing TOPCon patent litigation among several Tier-1 suppliers. Concerns over potential disruptions in TOPCon availability and the possibility of retroactive fines have driven some buyers to consider Mono PERC modules more favorably, pushing prices up to 25 cents per watt—a 4.2% increase since November. However, it is important to note that although domestic cell providers have reacted strongly to these litigation risks, many buyers still view the overall risk as low. As such, while litigation influences supplier dynamics and reduces domestic options, it should not be the sole factor guiding purchasing decisions.

TOPCon

Median TOPCon module pricing has remained steady at 26 cents per watt from November to February. Historically, TOPCon’s performance justified a price premium. Despite ongoing discussions around potential retroactive fines from litigation, many buyers continue to value TOPCon’s superior performance. Although market sentiment has shifted slightly—with pricing now aligning more closely with Mono PERC—the overall risk from litigation is seen as relatively low by most buyers. This suggests that while legal issues may factor into decision-making, they are not causing a widespread avoidance of TOPCon technology.

HJT

Heterojunction technology (HJT) module pricing has decreased by 2.9% since November, reflecting the price pressures of the more mature Mono PERC and TOPCon module technologies. HJT manufacturers are likely testing their pricing, finding the price point that matches the benefits of higher efficiency, lower temperature coefficients, and reduced performance loss in colder conditions offered by these modules.

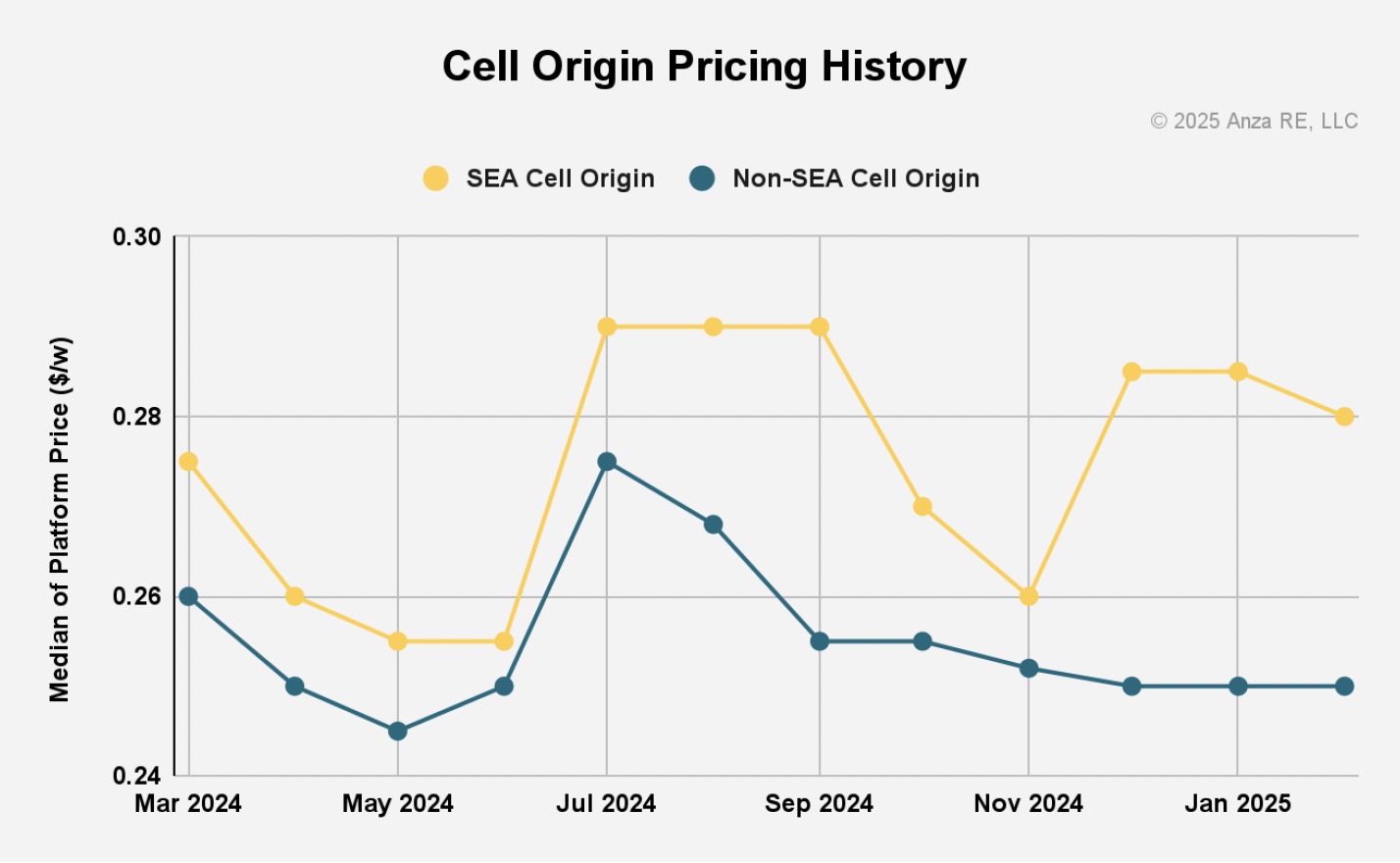

Cell Origin Impacts

Cell origin has emerged as a significant determinant of module pricing. Modules with cells sourced from designated tariff-affected countries in Southeast Asia (Cambodia, Malaysia, Thailand, and Vietnam) saw a sharp 7.7% price increase since November, driven by tariff implications that directly inflate procurement costs. Meanwhile, non-Southeast Asian cell modules experienced a 0.8% decrease in pricing, reflecting competitive pricing dynamics as buyers pivot toward sources less impacted by tariffs. This increased spread between Southeast Asian and non-Southeast Asian cell pricing highlights the sensitivity of market pricing to geopolitical trade policies, with buyers rethinking sourcing strategies to mitigate risks and strategically diversify.

The first quarter of 2025 highlights the complex interplay of policy, litigation, and technology evolution in the solar module market. While overall volatility remains moderate, the underlying dynamics illustrate significant strategic shifts: buyers responding rapidly to legal risks, manufacturers navigating tariff-induced uncertainties, and emerging technologies steadily gaining market traction. Understanding these nuanced forces is crucial for stakeholders aiming to optimize their development and procurement strategies.

The data in this report represents median DG list prices from over 35 module vendors participating in the Anza platform, which captures over 95% of the U.S. module supply. Contact our Anza team for deeper insights, including negotiated and transaction pricing for DG & utility-scale and extensive data on domestic content, tariff exposure, technical specifications, and supplier contract terms.

Talk to our team today to learn how Anza's comprehensive market data can inform your solar development and procurement strategy.

Anza Renewables | https://www.anzarenewables.com/

.png?r=4830)