Sinovoltaics Releases 2025 North America Solar Supply Chain Map and Directory

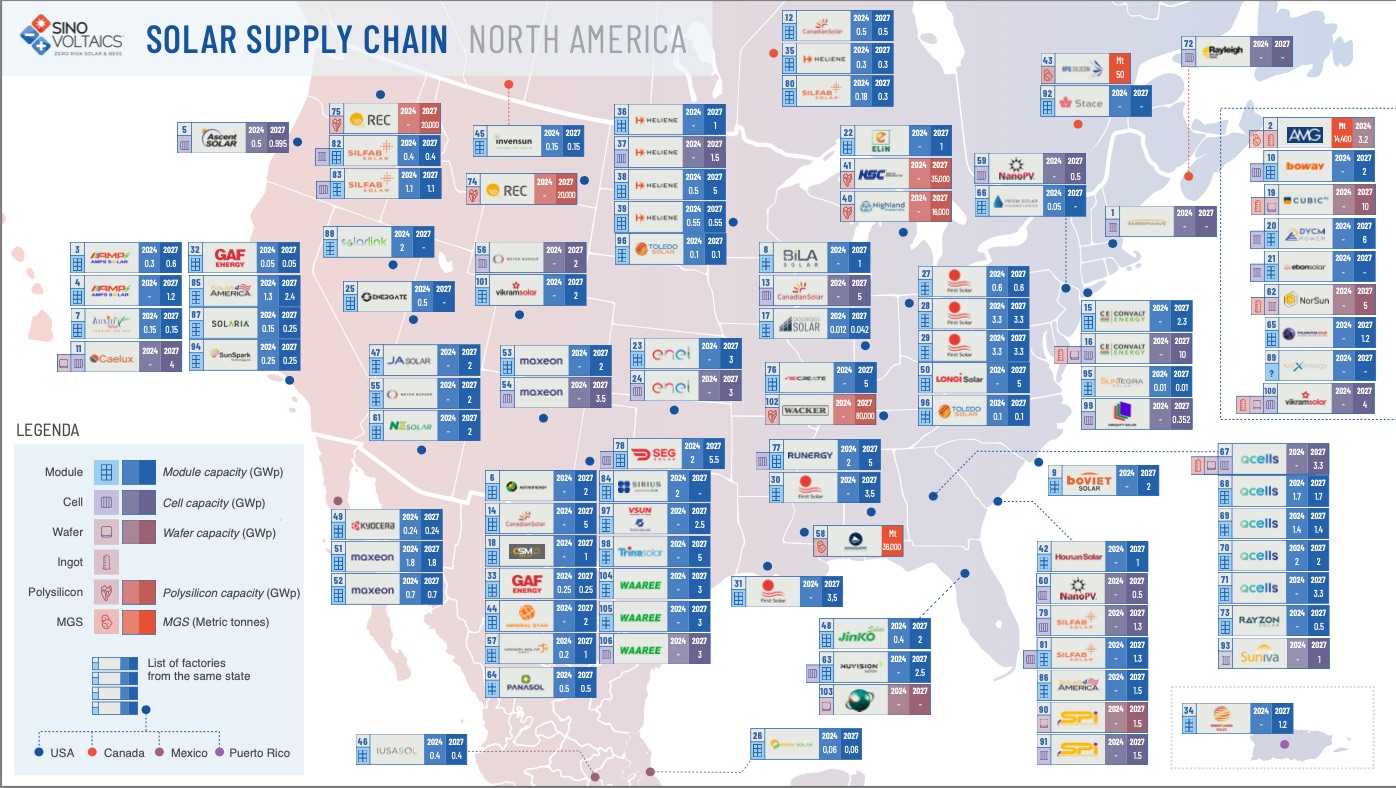

Sinovoltaics, a Dutch-German Battery Energy Storage (BESS) and solar photovoltaic (PV) technical compliance and quality assurance service firm, has released an updated North America Solar Supply Chain Map, Edition 1. The map and listings are based on the latest fourth quarter of 2024.

The complimentary infographic and data pages reveal the existing and future PV manufacturing facilities in the United States, Canada, and Mexico. In addition to showing existing and planned North American solar module assembly, cell, wafer, ingot, and polysilicon supply factories, the free PDF download also includes production capacity data, website, and contact information. At a glance, solar developers and PV procurement professionals will be able to see a comprehensive listing of North America’s PV supply factories and openings.

Since the last edition at the end of 2024, the updated directory includes:

- New factories added. Amps Solar, Boviet Solar, DYCM Power, Ebon Power, Imperial Star Solar, NuVison, EsFoundry, ReCreate, and Toyo/VSUN have been added.

- Capacity reductions. Meyer Burger has scrapped its plans for a 2 GW cell manufacturing site in Colorado.

- New Module Capacity Expansion Totals. A total of 31.92 GW of module production capacity is spread throughout Mexico, Canada, and the US. These manufacturers are now forecasting an expansion of 97.9 GW in the coming 3-6 years. If all facilities are completed, the total North American module production capacity will be 129.9 GW.

- Cell and Wafer Production Constraints. Although manufacturers are making great strides in increasing cell production from 8 GW to 64.9 GW by 2027/2030 and wafer production from 3.2 GW to 24.5 GW by 2027/2030, current cell capacity remains constrained for module manufacturers.

- Polysilicon Production Constraints. There is now a short list of polysilicon suppliers in North America: Hemlock Semiconductor, Wacker Mississippi Silicon, and Highland Materials, with an estimated total of 171,000 metric tons of production capacity,

With the Inflation Reduction Act (IRA) incentives now under review by the U.S. administration, the PV supply chain landscape may quickly change in 2025.

“Timely, accurate module purchasing insights are essential for the solar industry,” said Dricus de Rooij, co-founder and CEO of Sinovoltaics. “With updates every four months, solar developers gain access to dynamic, data-driven intelligence—empowering them to stay ahead of emerging PV suppliers and global manufacturing trends.”

This information is particularly useful for the IRA’s domestic content bonus tax credit requirements, which specify that a certain percentage of module components must be domestically manufactured. By understanding which factories are producing solar cells, wafers, and polysilicon, developers can prioritize suppliers with production capabilities that meet the domestic content criteria.

Available as a complimentary download, Sinovoltaics’ series of solar supply chain maps are also provided for Europe, Southeast Asia, and India and updated every four months. In addition, Sinovoltaics publishes an annual Mainland China Transformer Factory Map.

The Edition 1 2025 North America Solar Supply Chain Map is available for free download at: https://sinovoltaics.com/sinovoltaics-supply-chain-maps/

Sinovoltaics | https://sinovoltaics.com/

.png?r=1907)