A Plan to Shift Hydrogen Vehicles into High Gear

For fuel cell-powered transportation, the future hinges on investment in six key areas

As a transportation mode that uses the universe’s most abundant element, one that’s renewable and yields zero tailpipe emissions other than water, hydrogen-powered vehicles might seem like the most logical heir to the hydrocarbon-fueled vehicles that have dominated our roads for more than a century.

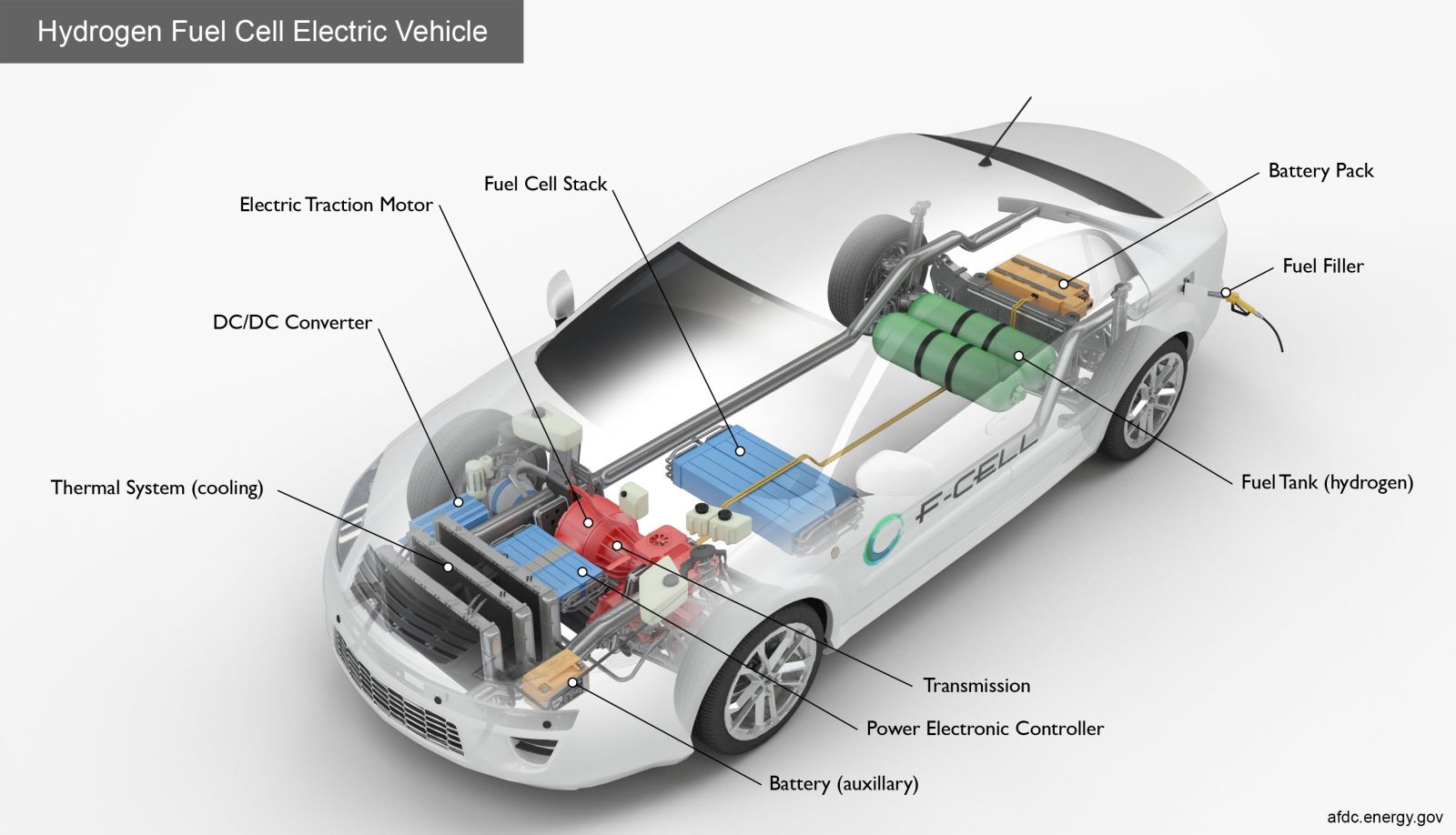

Instead, practical realities have intervened, accelerating the mainstream acceptance of battery-electric vehicles (EVs) while keeping hydrogen-powered vehicles at the margins of the transportation mix. And while hydrogen vehicles, which typically run on onboard fuel cells that convert hydrogen into electricity (although some use compressed hydrogen directly to power an internal-combustion engine) remain a promising option for a decarbonizing world, their entry into the mainstream has been hampered by a lack of supporting infrastructure, as well as the high cost of fuel and a dearth of actual vehicles that are cost-competitive for the fleet operators and consumers that would drive demand. A recent MIT analysis concluded, for example, that the lifetime cost of ownership for a hydrogen fuel cell car is roughly 40 percent higher than a comparable gasoline vehicle, and 10 percent more than an EV, largely due to the high cost of the hydrogen fuel itself.

image courtesy DOE

If hydrogen fuel cell vehicles (FCVs) are to fulfill the promise that many see in them, there will need to be massive investments to develop a supporting infrastructure (that today remains scarce outside of places like California), accompanied by a drop in the total cost of owning an FCV. Based on our experience with EVs, both are possible, but neither is going to happen overnight. So, where to start? Here are six areas where infrastructure investments can help FCVs find the next gear in terms of practicality and market acceptance:

1. Developing a true fuel production, distribution, and dispensing network.

Among the purported advantages of hydrogen as a transportation fuel is that it can be pumped into a vehicle faster than it takes an EV to recharge, and provide a longer driving range than an EV. However, absent the pipeline infrastructure to deliver hydrogen to a fueling station, the fuel needs to be produced onsite or trucked in. In the latter scenario, industrial-scale compressed gas companies and refineries would have to see a business case for producing hydrogen in large volumes for transportation purposes, and a class of distributors would need to emerge to deliver supplies to fueling outlets. The old chicken-or-the-egg conundrum certainly applies here: Without strong, consistent demand for hydrogen transportation fuel, it’s hard to envision anyone investing capital at the scale required to make this happen.

The most viable way forward could be for multiple companies to create business ecosystems where they share the risk and reward of building out fuel production and delivery infrastructure. Some of the world’s largest energy producers are taking such an approach with EV charging facilities that combine electricity generated from renewable sources with charging infrastructure, as well as retail and fleet services. That alone won’t likely be enough, however. Heavy government subsidies and incentives will be needed to make the economics work, at least initially.

2. Developing a fuel distribution network that serves multiple industries to lower costs.

The main industry targeted for hydrogen fuel power, after the cargo shipping industry, is the road transport industry (mainly tractor-trailers). But other industries also could benefit from a reliable, accessible hydrogen fuel network, including construction, stationary power generation, and even light vehicles. These stakeholders would provide the economies of scale and volume to make development of a hydrogen distribution network cost-effective.

3. Integrating digital infrastructure so data can be leveraged to make operations and supply chains more intelligent.

By fully integrating their digital infrastructure, critical data and real-time insight can flow unimpeded across the business. That level of data visibility should extend beyond company walls to supplier networks and business ecosystems, so everyone has the fresh data they need to be more responsive and on-point in their decision-making, better manage risk, and identify optimal pathways for developing and delivering products and services to market profitably, whether it’s vehicle components, entire vehicles, or fuel.

4. The ability to manage every hydrogen molecule.

Hydrogen isn’t an easy molecule to manage. Still, companies must be able to collect and analyze accurate data about the hydrogen molecule’s journey from production to end use. Artificial intelligence-driven analytics then can be applied to the data to gain insight into whether supplies are being handled most efficiently during each step of that journey, and to identify specific areas where additional efficiencies can be captured. Integral to all this is an accounting system that accommodates and reinforces a volumetric approach to handling hydrogen fuel, to provide full transparency into the cost and profit margin associated with each step in the molecule’s journey.

5. Intelligent asset management.

Companies involved in building out the infrastructure to support hydrogen vehicles must have a strong handle on both the hydrogen molecule itself, and the assets that produce, handle, transport, and deliver that molecule. Here’s where intelligent modeling and predictive analytics capabilities can play a vital role. They can give companies deeper insight into the most efficient, profitable, and sustainable ways to produce hydrogen, helping them weigh the tradeoffs in producing the various types of hydrogen (typically categorized as gray, blue, or green, depending on the process). They can help guide siting and configuration of fueling installations, and, using predictive analytics powered by AI, give operators deeper insight into how their assets are running, along with proactive suggestions regarding maintenance and repairs over the lifecycle of those assets. They can provide insight to inform how hydrogen is priced and how to manage price risk. They can even illuminate pathways for repurposing existing fueling station assets and infrastructure to accommodate hydrogen.

6. Skilled workers who understand how to apply the advanced intelligent capabilities and approaches that hydrogen will require.

All the data, analytics, and AI won’t amount to much unless companies also have the human expertise needed to use these types of capabilities, and apply the insight they produce to real-life operational and supply chain scenarios. Companies involved in hydrogen-powered transportation will need to invest heavily in training and upskilling/reskilling.

As much promise as hydrogen vehicles show, the investments required to steer them into the mainstream are indeed substantial. But as we’ve seen with EVs, barriers that once seemed insurmountable can be overcome with digitally enabled collaboration and innovation, along with a good dose of government support.

Craig Kindleman advises customer executive teams and leads priority shareholder value initiatives in the Oil Gas and Energy industry for SAP in North America. He has focused in areas of operations, asset management, marketing, and technology, having designed global initiatives for multi-national clients, specializing in high-impact business transformation projects. He focuses on SAP’s strategic growth areas of Emerging Energies, LNG, Hydrogen, CCUS, Renewable Fuels, Cloud Based Utilization, and AI.

Craig Kindleman advises customer executive teams and leads priority shareholder value initiatives in the Oil Gas and Energy industry for SAP in North America. He has focused in areas of operations, asset management, marketing, and technology, having designed global initiatives for multi-national clients, specializing in high-impact business transformation projects. He focuses on SAP’s strategic growth areas of Emerging Energies, LNG, Hydrogen, CCUS, Renewable Fuels, Cloud Based Utilization, and AI.

SAP | www.sap.com

Author: Craig Kindleman

Volume: 2025 March/April