Beyond Capacity? Offshore wind heavy lift fleet faces uncharted waters

The global goal for offshore wind capacity is an ambitious 234 GW by 2030*, but a significant gap exists between national targets and developer realities. With political, economic, and technological hurdles threatening progress, this article explores the impact of a globalizing market on installation performance.

Well-established players such as the UK and Germany are more confident in meeting respective goals of 50 and 30 GW, but it is yet to be seen how some emerging markets, such as Colombia or Australia, will fare. The middle ground sees two regions that have been ramping up bottom-fixed capacity since the early 2020s: APAC and North America. Through these two regions, the market begins to understand some of the crucial hurdles those emerging wind players face.

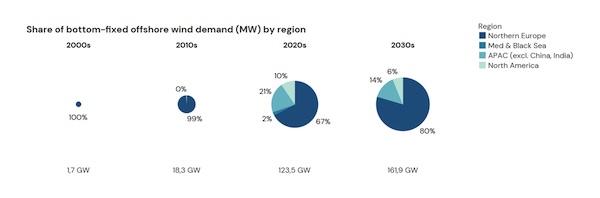

Chart: evolution of bottom fixed offshore wind demand by decade and region

As countries like the USA, Taiwan, Japan, and South Korea aggressively advance their offshore wind projects, the challenges surrounding heavy-lift installation vessels (which are designed to install foundations and turbines) have come to the fore. Heavy lift contractors must navigate evolving legislation, increased transit times, lack of infrastructure, complex marine spreads, diverse seabed compositions, and fluctuating weather patterns. Additionally, recurring events like whale breeding seasons can further constrain operational windows. These challenges necessitate meticulous planning to minimize disruption.

Legislative challenges

When examining legislative hurdles, the US Jones Act is at the top of the list; the Jones Act mandates using American-made, owned, and operated vessels for transporting goods between US ports. This regulation significantly complicates logistics for foreign heavy-lift vessels aiming to operate in the burgeoning US offshore wind sector.

But it is not the only legislation posing questions for developers. In Brazil, which is yet to have a full-fledged offshore wind market, regulations state minimum requirements of local content onboard.

Logistical hurdles

Infrastructure limitations further add to the operational challenges. Ports equipped to handle the specific needs of heavy lift vessels are sparse in emerging markets. Few ports can welcome heavy-lift jackups with sufficient quay length, space, and strength to receive batches of foundations and turbines. This requires alternative approaches, such as offshore feedering solutions with HLCs or barges, which increase complexity and cost.

Civil infrastructure can also present issues. The Great Belt Bridge, between the Danish islands of Zealand and Funen, blocks Baltic Sea entry to crane vessels with an air draft above 65 meters. This means yet more complex and costly solutions. For example, prior to turbine installation at Arcadis Ost 1, semisub Thialf underwent extensive modifications to its crane A-frame to allow it to lower the cranes, fold the A-frames, and use ballasting to create enough space to pass under the bridge.

Transit times and associated costs represent a logistical challenge, especially when components or vessels must travel from distant bases, such as heavy lift assets from Europe for projects in Asia or North America. The distance escalates costs and introduces complexities in supply chain management, decreasing effective vessel utilization on the worksite.

Environmental considerations

Environmental regulations (and expectations) dictate operational timelines, restricting activities to specific seasons to minimize the impact on local habitats and activities. This was apparent during the development of Saint Brieuc, where the installation campaign followed the rhythm of scallop fishing seasons, blocking offshore operations in October and November. The project itself was met with local resistance, with several occurrences of fishermen surrounding installation vessels on the worksite, breaching safety zones, and halting operations.

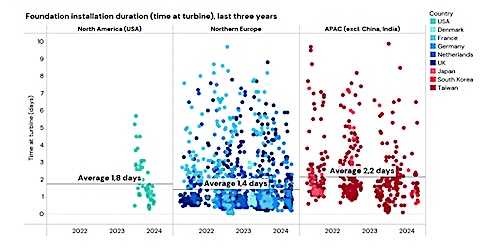

Beyond legislation and logistics, the environment of new regions poses its own questions to developers. The Baltic Sea presents a particularly challenging environment with its weak seabed, which is unsuitable for some of the jackup vessels traditionally used in offshore wind installations. This necessitates the deployment of more specialized floaters. In Taiwan, attempts to use XXL monopiles at the Yunlin project resulted in several slippages. It can be observed that Taiwan’s seabed composition is one of the factors that negatively impact operations performance, at 2.2 days per completed installation in APAC compared to 1.4 in Europe on average.

Chart: foundation installations completed over the last three years per region.

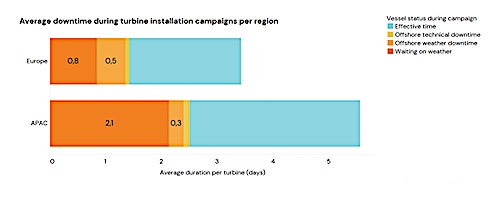

Beyond seabed considerations, typhoon risks in East Asia necessitate modifications to both planning and equipment. The need to operate within narrow weather windows adds pressure to project schedules, leading to downtime when the installation vessel is in port waiting for conditions to improve. In a turbine installation analysis of the last projects to reach COD in Taiwan and Europe, waiting on weather duration was found to be 152 percent higher in Taiwan, at 2.1 days per turbine versus 0.8.

Chart: Average duration per turbine in recent projects reaching COD in Taiwan and Europe

Regional adaptability

Regional markets use various strategies to cope with these challenges. By using the approaches of North America and East Asia as examples, we gain insights into how different regions adapt.

- North America: Local compliance adversely impacts installation costs

Protectionist policies like the US Jones Act limit growth. To navigate this regulatory landscape, the US has increased its investment in local WTIV construction, but not by enough. Charybdis, the first US-built WTIV, is expected to install an average of 50 turbines and foundations annually, but this is nowhere near meeting US capacity goals.

The forced reliance on local assets creates major hurdles when it comes to using foreign vessels instead, diverting time and money to operate the complex marine spreads used for feedering or shuttling from Canada.

Furthermore, while shipyards and designers have devised innovative designs to smooth the process, such as a U-shaped WTIV hull that can receive barges like a rack, these have yet to be built.

- East Asia: Leveraging local manufacturing strengths

East Asia, led by South Korea, Japan, and Taiwan, has capitalized on a strong shipbuilding industry. This strategy led to a robust fleet of vessels perfectly suited for diverse offshore wind projects. Benefits include reduced reliance on international shipping, minimized costs, and less impact from geopolitical issues that could affect foreign vessel deployment. Furthermore, well-developed regional ports located near existing maritime hubs provide readily scalable infrastructure and resources. Proximity to turbine and foundation manufacturers further lowers delivery times and expenses.

Unlike North America, East Asia is less focused on protectionist legislation, allowing for efficient shuttling methods with foreign assets. While facing challenges like harsh weather and difficult seabeds, which result in slightly lower installation performance than Europe, East Asia's strategic advantages position it for rapid growth in the offshore wind market.

Yvan Gelbart is Lead Analyst at Spinergie, a maritime technology company specializing in market intelligence, operational digitalization, and emission reduction.

Spinergie | www.spinergie.com

Author: Yvan Gelbart

Volume: 2024 July/August