Floating Wind Gains Momentum Amid Turbulence from US Market Withdrawal

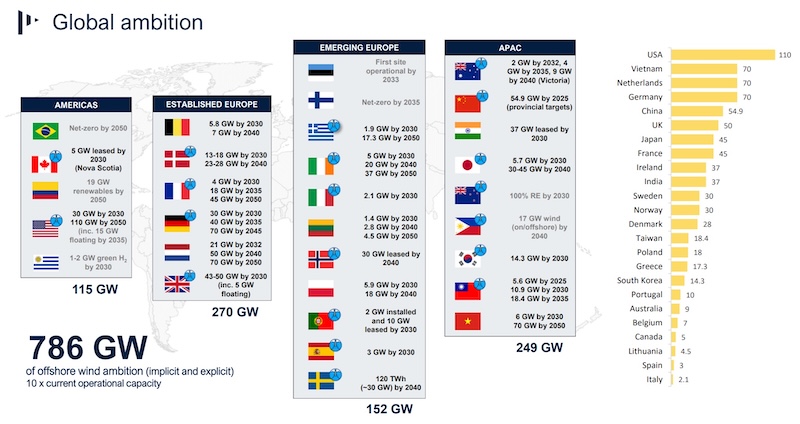

TGS, a global provider of energy data and intelligence, has published its latest Quarterly Market Overview Report, as part of the services offered by its 4C Offshore wind market intelligence membership. The report highlights the significant transformation for the offshore wind industry, caused by the United States’ shift in policy, forecasting a potential global installation shortfall of 26 GW by 2035 as a result.

The withdrawal of a major market like the U.S. has significant implications globally, with developers and members of the supply chain forced to rethink investment strategies. Another key topic shaping the industry is heightened security concerns across global supply chains, driving a strategic shift toward localized manufacturing.

Despite these challenges, floating offshore wind continues its upward trajectory, with new auction awards defying broader market uncertainty. The analysis from the report forecasts installations to grow from 0.5 GW today to 26.5 GW by 2035. The technology remains resilient, benefiting from ongoing innovation and governmental support, particularly in Europe and the Asia-Pacific region.

However, leading developer ambition overall shows signs of weakening due to increasing financial pressures and regulatory uncertainties, raising questions around who will lead the future offshore wind industry. The report reveals that up to 70 developers will begin construction on their first project by 2030, showing a new wave of smaller, often more local, players is ready to drive the industry forward.

In response to market demand for deeper insights, key features in this edition of the Quarterly Market Overview Report include:

- A comprehensive update on emerging technologies, including updated Offshore-Wind-to-Hydrogen analysis and a refreshed Floating Market Attractive Index

- An in-depth analysis of turbine manufacturers, including detailed market development analysis, demand forecasts to 2040, and OEM market share tracking

- A visual project progress chart showing movement since the start of 2024

- A new historical and forward-looking view on the number of developers reaching the construction phase

Accompanying the main report, 4C Offshore’s Project Opportunity Pipeline (POP) now includes a historical database of project transactions, complemented by new analytical charts. Additionally, a new project-specific CAPEX model is included, providing the industry with a granular view of capital expenditure assumptions across the offshore wind project lifecycle.

“We enter the second half of the 2020s at a turbulent time, with political uncertainty becoming ever more consequential,” commented Patrick Owen, lead author on the report, “and we are seeing some market shifts. As major developers’ ambitions waver, smaller and newer players are taking on greater roles in meeting national targets. Security risks also remain a hot topic. In this evolving landscape, having access to reliable intelligence is more important than ever.”

The latest Quarterly Market Overview Report delivers critical insights and comprehensive market analysis for industry stakeholders navigating an increasingly complex yet opportunity-rich offshore wind landscape. The report is available for subscribers to 4C Offshore market intelligence. For more information or to request a copy, visit 4COffshore.com.

TGS releases regular intelligence reports on a variety of offshore energy topics powered by 4C Offshore market intelligence. They also provide independent, expert cable consultancy services for offshore projects, including offshore wind, subsea power cables, telecommunications and pipelines.

TGS | www.tgs.com