OEMs Block Wind Turbine Optimization

Wind plant operators face many challenges: low energy prices, hefty maintenance costs, investor pressure, and tight-- if existent-- margins. And despite common knowledge throughout the industry that wind turbines commonly underperform, the original equipment manufacturers (OEMs) are often unwilling to admit the shortcomings of their products to help owners bridge a widening gap to profitability.

Stranglehold on Profitability

Stranglehold on Profitability

The OEM stranglehold on the wind industry comes in the form of Long Term and Full Service Agreements (LTSAs and FSAs) that block trusted third-party partners from working with plant operators and independent power producers (IPPs) to improve plant performance. OEMs often have multi-year agreements in place with operators that threaten warranty cancellation if equipment is altered or maintained by any third party. In addition, OEMs often hold back valuable data about turbine output from their owners and operators in the name of protecting valuable equipment still under warranty. The result? IPPs and operators end up struggling to make money at their wind plants. This problem is likely to worsen as more OEMs move towards expanding their service divisions, squeezing out independent service providers.

Additionally, the data shared by the OEM is often difficult to use. The wind energy industry lacks standardized SCADA data across OEMs and turbine models, forcing owners and solutions providers to put in an exceptional amount of effort to make data usable for their platforms. This takes away from time that could be applied towards actually making annual energy productions (AEP) improvements. In the end, industry buzz about big data and artificial intelligence (AI) falls short, as most effort is spent on data ingestion rather than putting data to work.

Scalable Solutions

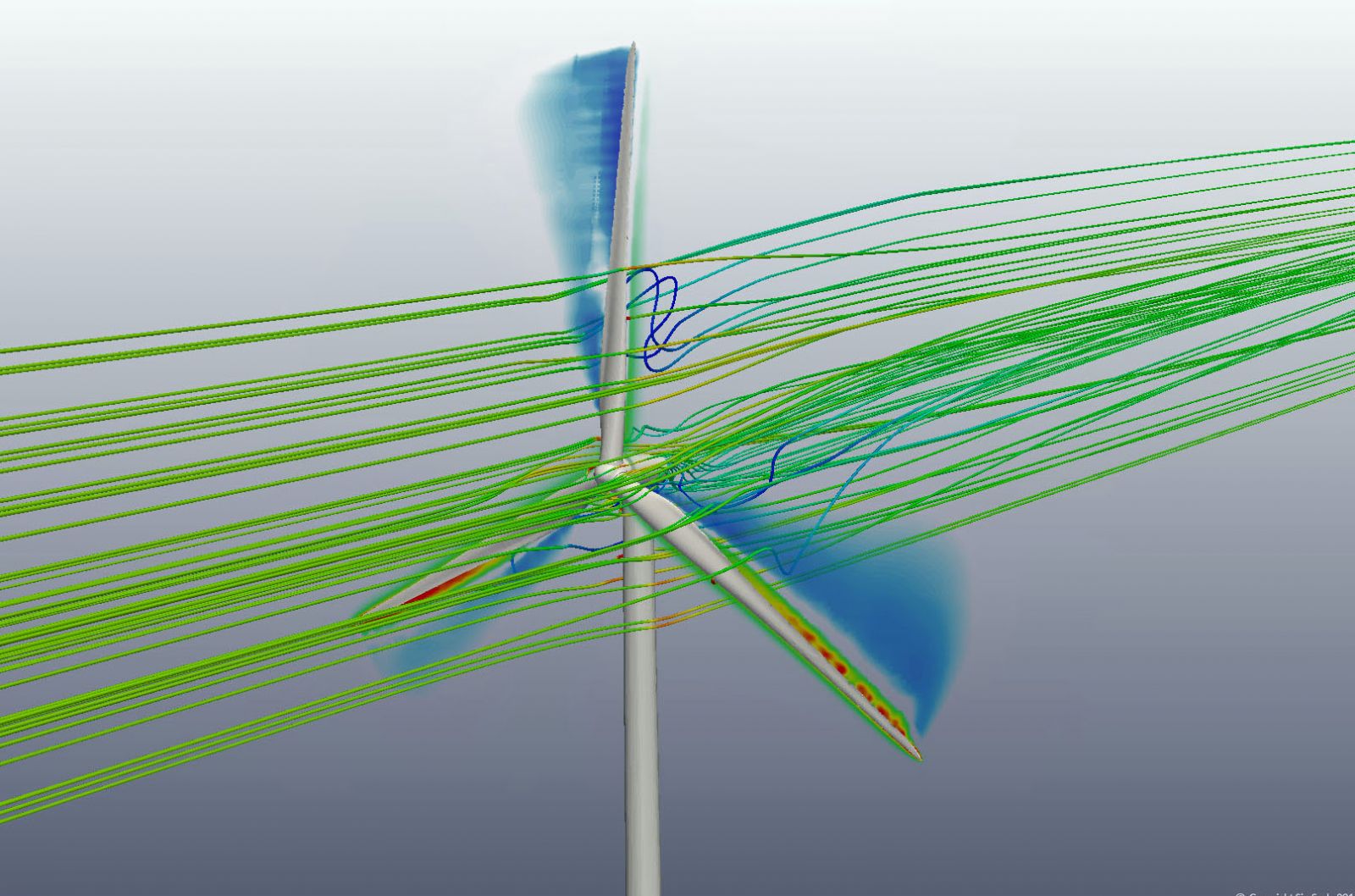

IPPs have long sought ways to improve their bottom lines by increasing energy production on existing equipment. Hardware solutions like light detection and ranging (LiDAR) systems, spinner anemometers, and wind measurement (MET) towers have provided operators with information about wind direction. However, these techniques are expensive; LiDAR systems can cost $100k per turbine. Others have proven ineffective, like MET towers, which are accurate only within a handful of degrees and are not effective on sites with varied topography. Data-based detection solutions have emerged as a scalable alternative to the expensive, difficult to install, and often unreliable hardware-based detection systems. To take advantage of these solutions, OEMs need to provide operators with access to their turbines' SCADA data.

Unlocking AEP Improvements

Despite the challenges, solution providers have worked with OEMs to improve AEP. With trusted third-party partners, wind plant operators can find incremental ways to increase AEP by 2-7 percent. For example, yaw misalignment, a common condition in which wind turbines do not face directly into the wind, is often undetectable to turbine operators. Yaw misalignment can be corrected through specialized applications that analyze SCADA data. Corrections to yaw can result in hundreds of additional MWs produced, in addition to increasing the expected lifetime of turbine systems. The key to unlocking these improvements is standardized, accessible data that is often already being collected by the OEM. By providing turbine owners with access to the SCADA data, operators and their trusted partners can improve energy production, profitability, and ability to attract investors for additional plants. In turn, free flowing data benefits the OEMs too, who will likely be called upon for new equipment as wind energy investment becomes more attractive.

Preparing for New Opportunities

While optimizing AEP at a single plant is a worthwhile endeavor on its own, the cumulative effect is even more compelling. Analyzing SCADA data across many wind plants will help spark innovative solutions for improving wind energy production around the globe. The time is right to focus on improving turbine data availability: the EU recently doubled down on its commitment to investing in wind energy, while the Biden administration has made bold promises to reduce the US's reliance on fossil fuels over the long and short terms. With aging infrastructure and investor attention on renewables, now is the time for the wind industry to improve data sharing and ultimately wind sector performance.

Blair Heavey is the Chief Executive Officer of WindESCo. He brings with him a long history of success in scaling up companies across a broad range of industries, including software, healthtech, fintech, and digital marketing. Blair is an undergraduate of Boston College with an MBA from Babson College's Olin Graduate School of Business. He has proven success in leading both startup and Fortune 100 teams to achieve outstanding results, including multiple acquisitions and IPOs valued in excess of two billion dollars

WindESCo | www.windesco.com

Author: Blair Heavey

Volume: 2021 March/April